Market Briefing For Wednesday, Dec. 1

Stickier inflation dilutes the discretionary spending capability of consumers, and that is problematic based on both Fed policy, known unknowns that relate to the renewed 'possibly' profligate expansion of another COVID wave, and that all runs into the winding-down of tax-selling season for a stressful 2021.

Today Chairman Powell himself formerly retired the word 'transitory' used too long to describe inflation. For months I've said it was 'enduring' with really no way to 'claw back' wage increases and a majority of other real cost increases. I believe inflation will prevail even if the Omicron variant spreading returns the other word to focus on: 'stagflation'. This is a persistent unresolved issue.

It is also an impetuous situation for the Fed (who didn't use the active window early this year during fairly swift growth to initiate more tapering), and for our society as a whole, which isn't keen to hear what may be premature warnings from the same 'experts' that were tardy alerting Americans to COVID last year. An orderly and 'flexible' approach to monetary policy is what's needed, rather than the spinning of intentional tapering to fit the backdrop, worrisome or not.

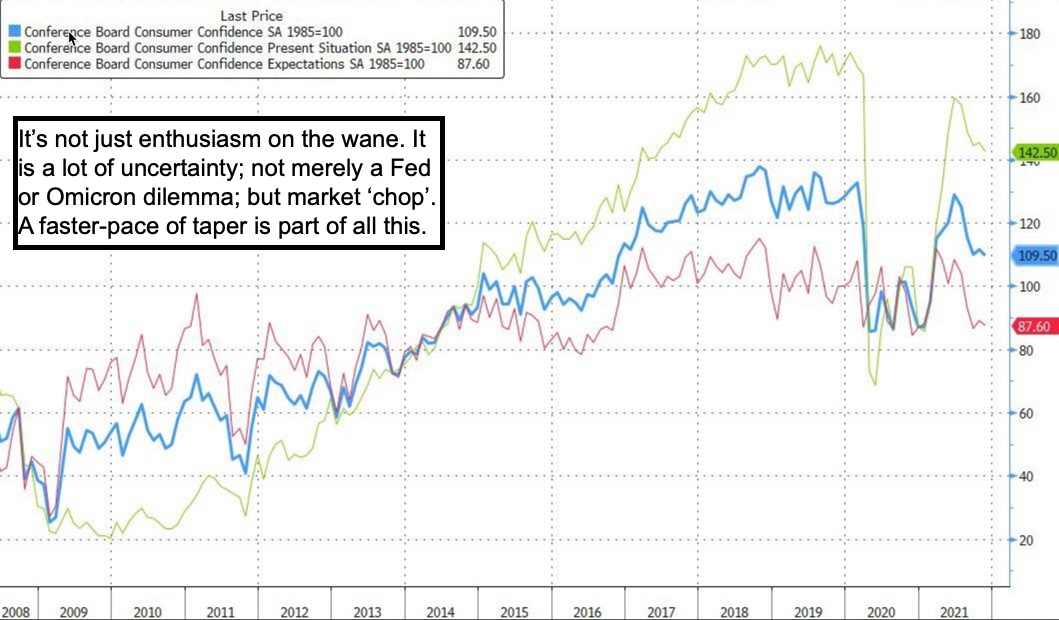

Confidence is a mixed-bag as people legitimately wonder whether incomes or spending power will both go in opposite (and undesirable) directions. That's a function of human nature only to a degree. How so? Because a confluence of events (Fed 'testy' hawkishness rationalized by anything related to COVID rise or decline.. because they spin the implications as discussed last night), meets the known unknown of whether Omicron 'really' is going to be widespread.

As always, the market doesn't like uncertainty, and all this lacks any clarity for sure. It creamed the Oil market too, hurt travel bookings, and makes everyone revisit anxiety of months earlier, even if some media pretend it's some game. I only can see that point of view for behaving 'as if' the old approaches are best as they also acknowledge new treatment modalities are pretty clearly needed (OIL).

All of it evokes the angst we suspected last night, and you saw in today's S&P slide. The decline was pretty broad and seemed to be generally defensive as was patently obvious it would be from Monday's hint Chairman Powell gave. I suspect there will be a solid reversal (perhaps with margin-call chop involved in the morning), and we might finish Wednesday in the green for the S&P.

For much of Tuesday Apple (AAPL) was the only major stock 'in the green', so maybe it offers less uncertainty that so many others. Less shopping traffic even isn't a plus for the Googles or Amazons of the world, although a dreaded return to being stuck at home due to Omicron, would be. Let me take a look at why Apple won't be boring as some think next year, or how it relates to more than the (so far merely speculated) Apple Car, whether or not involving Canoo (GOEV).

Apple is Rockley Photonics' (RKLY) largest customer. Few are talking about Rockley as a lot of initial SPAC / IPO holders were stuck at more than double the price as it came public several months ago. We're in it in the 6-7 area, and expect the shares to lift after the tax-loss or frustration pressure comes off (many looked for more than EKG and Blood/Oxygen levels in Apple Watch 7 and departed the shares of Rockley when it wasn't there). In essence that's great because it gave the half-price opportunity, and remember, stocks that are promising are one of the few things in life that people don't like when available 'on-sale'.

As Rockley's said that the new 'beyond LED' sensors are being refined with human trials 'now' and that they increased from 4 to 6 the largest consumer or (electronic wearables) firms in the world out of the top 10, well that's basically an endorsement of what they're working on, now cooperating with CalTech by the way. It's believed that Apple and Medtronic are both key partners too.

A difference between newer sensors and the ones typically used today is that higher wavelengths (IR!) are utilized in addition to the visible spectrum ones. The miniature Spectrometer-on-chip is apparently capable of capturing info on 'sugar' (glucose), blood oxygen, hydration, heart rate, heart rate variability, core body temperature, breath rate, blood pressure, hydration, and more.

So exciting times are clearly ahead in the wearable tech space, and our 'bet' just is as simple as it states: gradual accumulation, recognizing they will have to go to the well once or twice since their SPAC didn't raise expected funds as I already discussed being a mistake (but that mistake created the low price for new entries and our speculation on next year), and now we look forward to a series of gradual rumors related to what Apple Watch 8 will bring. Others may arrive first (depends), but that will be the big factor 'if' they have gear ready. If it was known 'for sure' this stock would be double-digits now. Hence a gamble but one based on logic, developed technology and a team with track-record.

(MRNA)

Bottom-line:

We've had the 'red warning flags' out for a couple of weeks now, and the 'continuation' pattern evolved. That included projected but insufficient rebounds on Monday and a long-overdue further break promulgated by Fed's tease remarks yesterday, expanded upon today. While the Fed Chairman is in a sense 'softening-up' the market to prepare it for tighter policies anticipated, it is still ridiculous that they not only waited until a weak time in markets, but in the throes of uncertainty regarding the impact of Omicron.

That he 'spun' that as he did simply tells me the Fed was moving to snugness come hell or high water, and will do so whether the new COVID variant is tame or not. If it is not tame, the Fed will be hard-pressed to respond appropriately.

This market action (and known unknowns) remind everyone that everything is still fluid and remains hostage to COVID (even the Fed isn't as free as they say to modify policy given the uncertainty that looms for the moment). For some stocks, that's dangerous, for others it's a chance to absorb stock 'on-sale'.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more