Market Briefing For Wednesday, Aug. 11

Derailing this market is a common topic, since the S&P continued just barely grinding-out repeated record highs. The irony is that the underlying market isn't off the tracks, but has been equivalent to a passenger train ride on rough tracks used by freights. (Experienced that in recent year on otherwise-deluxe Toronto-Montreal service, as tracks are shared.. same here in the U.S. often. Many 'better' fast trains in Europe have seamless and dedicated tracks.)

So the point is the ride has been rough outside of the S&P Index (SPY), even today was a rotation to a degree, as Oils & Banks somewhat offset the heavy 'tech' sectors, as momentum leaders (FANG+) generally did not kick-in at all. Most spent the session on the defense.

So the question of derailing isn't as precise as looking at the S&P, as it would have been down if not for the much-maligned Oil stocks (USO), that I continue liking in a relative fashion and required to participate for this year's extension.

That leads to sustainability. The market risk quotient hasn't changed. Late last week Goldman Sachs elevated their S&P target, today David Kostin (yes, he's with Goldman Sachs) talked of a 6% gain for S&P this year, so that got some headlines. Guess what, as best I can tell, it's the same as last week's call. Of course given that so many on Wall St. will tag-along with whatever Goldman says (and that helps them in multiple ways), it's no surprise they reiterate the same call. It didn't have much effect, nothing did in today's calmer markets.

In fact I for one don't deny the S&P can advance, I just think vulnerability's greater this time of year, not just because of seasonality, and not because of technical indicators (they are generally neutral, not flat-out extreme like some contend), but because of 'discounted growth' at-risk given COVID-driven economics. But the very short-term work tends to point to higher not lower price for now (that's not likely going to unfold unless the big-cap techs kick back into the action).

The Infrastructure Bill passed the Senate, a bit of feisty wrangling then it goes through the House gauntlet. All-in-all will indeed provide the growth spurt we'd like to see in this country over the next 3-5 years. It's the next 3 months more concerning at the moment, hence the focus on COVID. And shame on those in positions of power who both covered-up the origins of the virus, as well as the various ways to mitigate it.

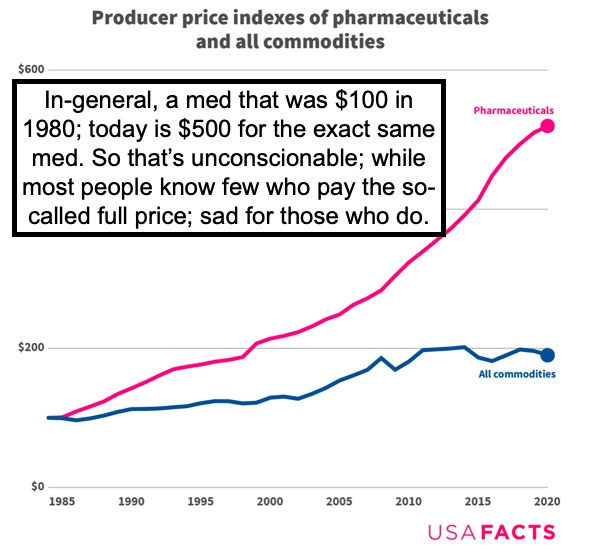

We talk plenty about pills or monoclonal antibody solutions, but there's more. Just today an Israeli company I mentioned at least once, reported a notable 93% recovery success on 90 patients with severe ARDS in Greek hospitals, where their trial takes place. It doesn't even make news in the United States, which is consumed with vaccine discussions. I understand it of course, with school starting, but if one gets sick one needs to be aware of a few things, like monoclonal antibodies, heart-lung machines, CD24 (the Israeli treatment), Stem-cell trials and more. As a society we can't surrender to the COVID 'beast', which seems to be the unenlightened calls for 'living with the virus'.

Since COVID isn't going away (certainly not globally) the stock market as well as economic recovery extension depend heavily on stopping COVID. I believe a thought from one of our members (probably a doctor), saying that this virus is unlike anything the world has ever seen before, allowing it to occupy hosts, even the fully-vaccinated give it new and more deadly ways to evolve. (That's also further supportive of my contention for 18 months that it's a bio-weapon.)

The financial press is focused on politics, infrastructure and direct listings...it's sort of everything but the market itself. We never departed from analyzing the daily action, and the irony is that someone new might think so, given neutrality I've expressed. Well, that's an assessment, and it is very neutral.

Remember in-general the post mid-July idea was limited upside potential and greater downside risk at anytime going forward. There's been no change with that viewpoint, because it remains the correct assessment of this behavior. It's as-if everyone is afraid to make a move, which can also mean complacency, a danger if 'the other shoe drops'. (That would relate to the Fed, but not yet.)

Wednesday can see more upside, but grinding and not particularly exciting. If traders can spark some new interest in the overdone big-cap then maybe.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as charts and analyses. You can subscribe for more