Market Briefing For Tuesday, Sept. 29

Markets remain hostage - to both COVID-19 'further waves' and vaccine/therapeutic developments, while politics looms as a further uncertainty as we all fully recognize.

At the same time, too much bearishness yields the ability catch bears 'off-guard', and the hope of a better 'reopening' story tends to help stocks like the airlines or even oil. To a lesser extent the market is hostage to the 'stimulus' story, with a deal possible at the same time acrimony persists between the parties involved in negotiating it.

We've called upon both Parties to get serious, moving forward to help stabilize softer sectors of our economy, as well as struggling people, with resolve to do this despite harsh politics, or even low prospects of a bill passing both Houses of Congress.

Executive Summary:

- The old-saw 'sell Rosh Hashana and buy Yom Kippur' worked well this year, but it's coincidental as we thought last week would see a post-Expiration shakeout.

- Bobbing-and-weaving makes sense over the next few weeks, especially since the Election results likely will not be clear or definitive on Election Night.

- However, the Wall St. opinion is NOT as negative on a Biden victory as some say, because while upper-income taxes would increase, but borrowing for economic / domestic growth, and rejoining the TPP (excluding China), might play well.

- In a nutshell this boils-down to a Biden and Dem sweep more likely to stimulate a broader segment of small business, versus tax cuts before favoring big business, if that should be the case in November (and how long the Election really takes).

- Stocks would have to contend with higher 'marginal' rates, so the Biden plan isn't much better than Trump's, and a year hence lands the nation about the same (in a growth phase we suspect to be our version of post-pandemic 'roaring 20's).

- Revelations that tensions are flaring with Russia backing Armenia and the Turkish (NATO member!) siding with Azerbaijan opens 'conflict concerns', firming oil (OIL).

- Restrictions on semiconductor sales to Chinese companies is a bigger deal than all the TikTok talk (unless you're a millennial I suppose), and likely TikToc stays around, with the Court ruling compelling more negotiations.

- Market movement should forge a bit higher and ignore the theatrics surrounding everything from Trump's taxes to the flip-side rumors, trying to suggest Biden not Trump had curried Russia's favors (I'm unsure about believing any of it).

- The Debate could be sensitive or not, and markets may square a bit late Tuesday based just on anxiety about what might unfold or not.

In-sum: the prospects would be comic-opera-like if not for how serious they might be, depending on what is 'real', and what are smokescreens intended to deflect 'stuff'.

Near-term many technicians and analysts have been too bearish, preoccupied by the very real 'depression-like' conditions in many areas, and outlooks about debt, election uncertainty, the flu-season scaring everyone, and so on. That's 'in' the market per our view, at least for the first phases down for the S&P, while market internals broadly did decline since mid-Summer, hence odds of a catastrophe really weren't present aside a horrible existential 'black swan', which we don't see handwriting on the wall for now.

Again, with this rebound having a bit more to go, we'd expect tempering into midweek as a likely possibility while everyone tosses-around accusations and promises made tomorrow night. Hopefully will be some decorum (hah.. wishful thinking).

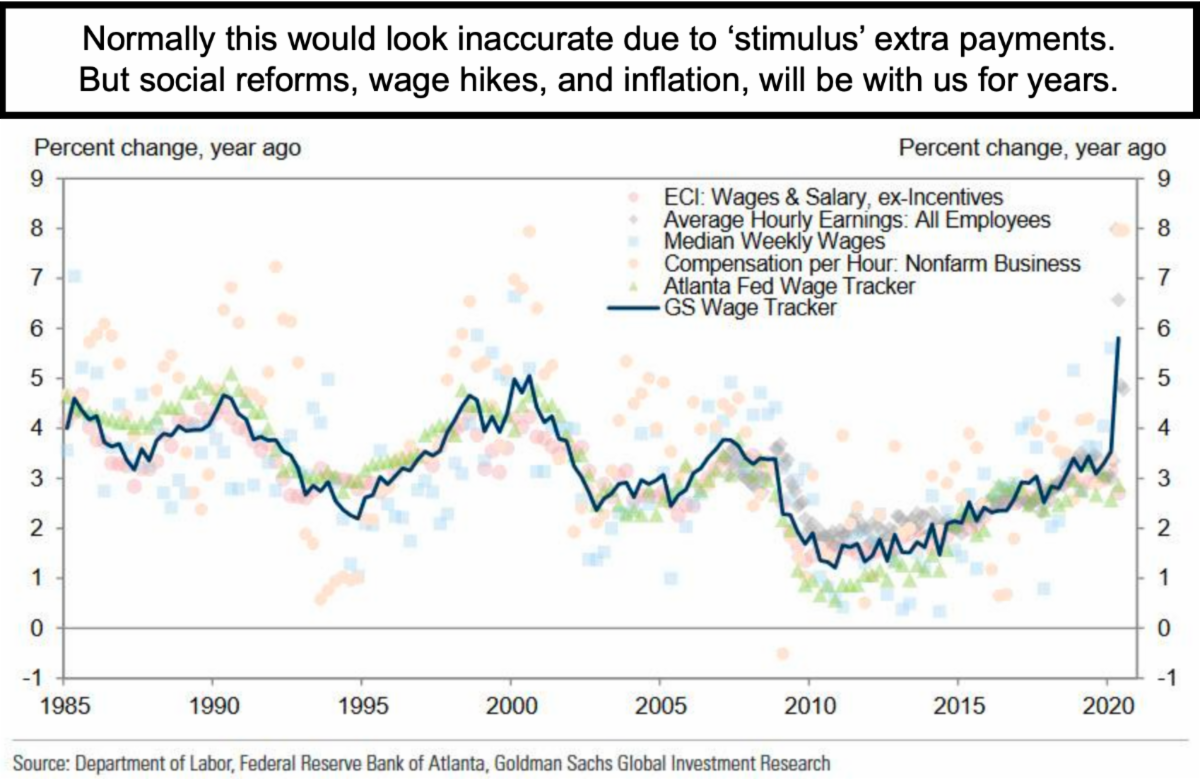

In addition to "all of those things that will be with us for years" there is one more thing, not mentioned. But it will not be like the stereotypical monkey on our back, it will be more like an ELEPHANT ON OUR BACK. That is the classic problem with debt, which is that it needs to be paid off some day.