Market Briefing For Tuesday, Sept. 15

A favorable backdrop - for a 'Hail Mary' rebound was looked-for this week, and the backgrounds M&A news (and more) definitely supported the bounce as well. That's a factor in creating this move 'to the degree' that it provides sufficient cushion for Bulls to work with even if it proves to be transitory.

Aside the political risks that are extremely variable (or just uncertainty) there's overly bullish views that 'bear markets are prohibited by the new generation' (nonsense), but if you factor in Fed policy, you get an argument of it being delaying.

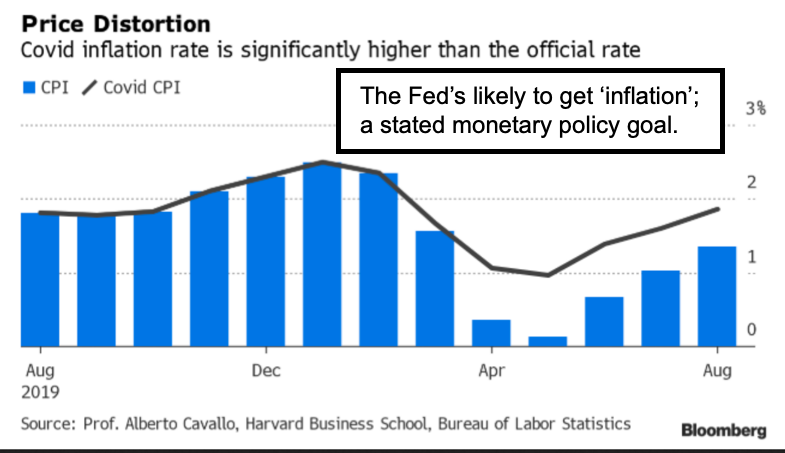

What that's going to result in will be higher inflation sooner rather than later, with the Fed frozen into inaction for a longer period. Yes I know I view their goal to repay debt with depreciated Dollars, but I also note their mandate is (or was) 'price stability' not the opposite as these policies thrust a lot of conservative investors (including pension funds) into taking more aggressive equity risks than they might otherwise. Many large pensions are underfunded because they have impossibly high actuarial requirements, so they scout around for what they're permitted to venture into. Risky business.

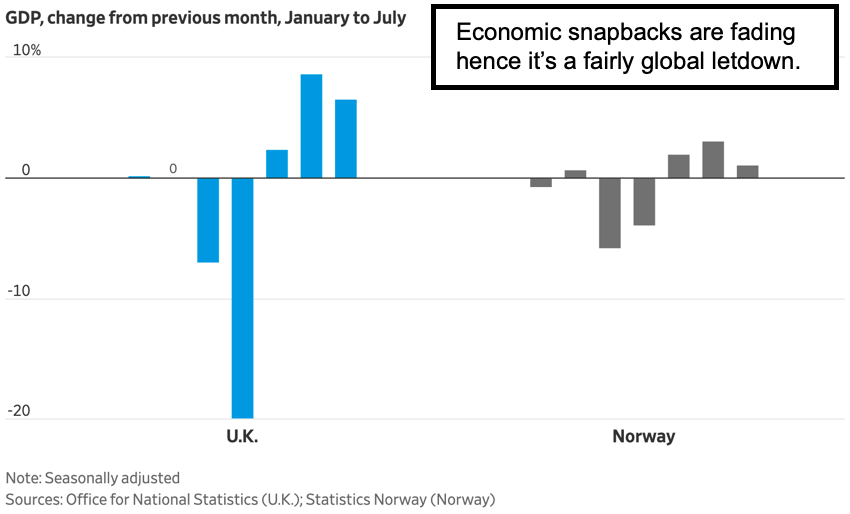

(Lots of this 'letdown' has to do with COVID's latest surge, most media minimizes it, perhaps to make the U.S. look even worse, but in many ways this again is global.)

Executive Summary:

- As part of the 'process' we expected an intraweek rebound, it got kicked-off to start with, given the M&A News (especially Nvidia (NVDA) buying ARM Holding (ARMH) which is actually incredible, but won't impact Apple's (AAPL) licensed rights).

- Antitrust or British regulators might question this 40 Billion Softbank (SFTBY) sale, ARM is perhaps the premier technology company in the UK, so no matter how bullish some pundits are on Nvidia, if you don't own it I personally wouldn't chase just on the idea of a selling wave 'if' regulators frown on this transaction.

- Speaking of Apple, their Presentation Tuesday will likely mention Apple silicon as well as a 'bundle' of services, not just iPhone, iPad, Watch, Apple TV news.

- The TikTok deal isn't entirely clear, as moving to Oracle (ORCL) servers isn't really totally secure unless unspecified aspects of the deal make it so.

- Merck (mrk) took a stake in Seattle Genetics (SGEN), and Gilead (GILD) is buying Immunomedics (IMMU), clearly this is a biotech (and cancer not just COVID) M&A season, interesting deals in which one is either in a stock 'before' the deal or really just watch the 'show', in this case interest in what 'may' unfold for a small speculations increases.

- Among stocks we cover, controversial Sorrento Technologies (SRNE) was interesting, with a breakout from the recent base, helped not just by the biotech firmness, but by Agreement with Mayo Clinic, for moving to commercialize Mayo's 'believed' leading-edge (antibody) cancer treatments (in trials apparently in Rochester),

- This Agreement, coming after licensing deals with Columbia Univ., and working with Mt. Sinai plus a global COVID (outside China) drug license, leaves them more legitimized by virtue of this additional arrangement with Mayo Clinic.

- SRNE partnering with renowned medical & research institutions & buying control or investments in other companies mostly with their stock and little cash, implies others know the significance of Sorrento's antibody portfolio (and presumably) are eager to join Sorrento or have them do the marketing and/or packaging products along with their portfolio pipeline (I know, nothing commercialized 'yet').

- Implication is that if they merely get a single FDA go-ahead (much less multiple) it could zoom shares, that's maybe an obvious reason for shorts to be scared.

- For traders that's an interesting posture, given much skepticism after it already had shaken-out (reflected by a huge percentage of the 'float' sold-short), so I'm pretty sure part of today's nearly 20% gain was a bit of a short-squeeze (no idea how much of today's 47 million shares volume were related to short-covering).

- I'll share my experience with the first echocardiogram in nearly two years, superb apparently, so much so that the technician repeated it 3 times to verify how much younger I'm getting presumably (ha), and I share in-hope the info. is helpful.

- I'll await the Doctor's reading of it, but does seem like Vascepa (proven in the Evaporate Trial to reduce plaque) definitely does, so again I encourage anyone with lipid or similar issues to look-into Vascepa (I take it for 2 years now, it was approved for cardiovascular and stroke risk-reduction in November 2019).

- Only problem for its pharma-maker Amarin (AMRN) is the generic versions coming, they don't have wider-label approval, but many insurance plans will likely substitute the generic for brand-name as far as what they will cover.

- Amarin markets are better protected (for years) in Canada and Europe, but smaller share here, with one of the Indian generics launching soon in the U.S., that limits U.S. market share 'in-theory', as it's too soon to know how insurance company 2021 'formularies, will treat generic vs. brand-name in this case.

- Out-of-the-money Calls are still very high premiums in the Options Markets, an indication of froth and speculation, but not necessarily just individuals, as we've learned from the Softbank story, there are various false signals from assuming certain implications by seeing higher open-interest in an option contract.

- Super-cap big stocks remain over-owned as a proportion of many portfolios, and despite some analysts proclaiming their 'worth', they know they're insufficiently diversified in many aspects.

- S&P technicals worked-out well, with perceptions not that much different, but the ability of this rebound firming some of the 'lesser stocks, helps, as does 'cushion' that's established above the 'last ditch' (short-term) support as as noted.

Politics & geopolitics:

- The President fell-back upon denying climate change again, which invited and got a back and forth going between him and Biden and some California fires.

- That isn't a plus for his campaign, as probably most Americans would prefer just embracing reality, even if it means just saying we're out of the Paris Accord just because it favored China and India having delays in 'pollution compliance'.

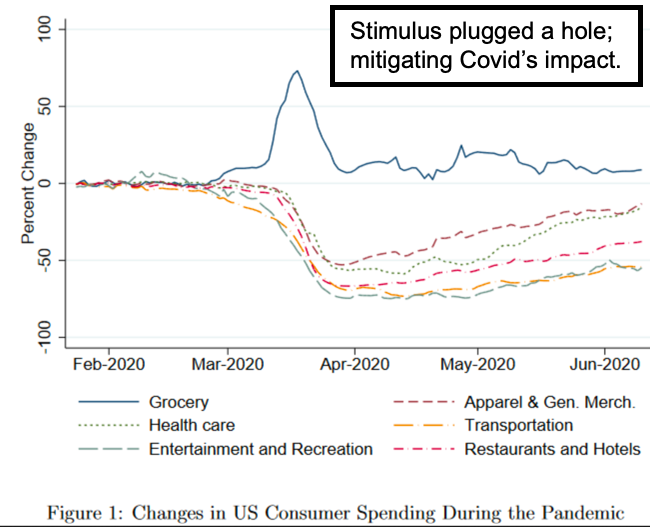

- If there is an economic stimulus plan coming, that would indeed help the overall economy, and especially those struggling after previous 'dike-plugging' stimulus programs ended, or are fading rapidly, this issue should be more bipartisan.

- Market volatility associated with global and domestic politics requires being a bit defensive, and allowing for another 'probe' of the technical support after this life, especially as relates to the 'super-cap' stocks.

- China has begun human testing of a COVID-19 vaccine that's sprayed in the nose rather than injected, and if effective the US should embrace vaccines or tests that were developed wherever, if they work (for-instance Sorrento has a drug licensed from a Chinese pharma, but will be produced in the US for use if approved).

- Tensions with Iran may ramp-up in a way, seems that Lana Marks the 66 year old US Ambassador to South Africa's life has been threatened, with Iran's Embassy in Pretoria involved in an assassination plot.

- YouTube's taken down a video interview with Dr. Scott Atlas, the controversial 'wanna-be' Fauci at The White House, saying the comments were not factual nor adhering to community standards (a White House adviser out of line, no way..but seriously, the real issue here is again censorship, as a fair number agree with him, and who is to make YouTube the arbiter of 'what's true' about the pandemic).

- One more thing: Aleksei Navalny (the Putin opposition) emerged from medically induced coma at Berlin's Charité hospital. A senior German security official, who was briefed on his condition, says Mr. Navalny seemed mentally sharp.. and he wants to go back to Russia (well how sharp can he be if he wants to go back?).

Other noteworthy items:

- GM (GM) has some tail-risk from the Nikola (NKLA) allegations (of a faked EV truck demo), now that the SEC is looking into it, it's more of an embarrassment, either that 'or' GM can show proper due diligence before agreeing to a 10% investment.

- Nikola admits the video was faked, at this point everyone is reacting and doesn't know how much further-along Nikola itself is, and given their efforts in Germany, they may or may not have made significant progress since the video was made.

- It's not uncommon to show non-fully-functioning vehicles, but the impression as a hydrogen-powered truck was clearly improper, whether the deal falls apart, 'or' if Nikola manages to validate their technology, remains to be seen.

- I actually showed a diagram of the hydrogen system Panasonic (PCRFY) displayed at IFA in Berlin last September, noting 'conceivably' great range (hence truck appeal) but not likely widely deployed (things evolve, hydrogen vs. EV is debatable).

- We have an FOMC Meeting starting, and that could limit further gains just a bit

- Hurricane Sally is about to slam into Mobile Bay (with the right quadrant hitting the Florida panhandle in the morning), all this contributes to the reconstruction boom of 2021-2023, but also denotes need to revise construction codes,

- What was called 'Dade County' codes refers to the Miami area being first to really introduce strong construction codes, like impact glass, concrete block structure, and strapping all roofs while prohibiting gable roof designs, it was incredible that a couple big housing developers continue so skirt these regulations, as exposed by Hurricane Andrew ripping off 2nd floors, as some builders made of wood frame (I mention this because some places, Florida too, they still get away with that).

In-sum: market fragility remains, but buttressed a bit by a slight broadening as we get more upside participation, largely driven by an uptick in M&A activity or speculation.