Market Briefing For Tuesday, Oct. 6

Executive summary:

- The President's status remains debatable given he's on the steroid treatment, we have no idea about Trump's cognitive functions related to his decision to return to The White House this evening, even though it 'might' speak well, more to his zeal for getting back on the campaign trail, than concern for everyone around him.

- With all due respect, and so many staff and Republicans already under siege, or claiming there's 'hysteria' around this, it's hard to emotionally rationalize this while certainly glad to see him getting better.

- Several strong supporters of the President, are, to put it mildly, aghast at today's basically self-discharge, while as you know I hoped he'd be well by late Monday (especially as that tends to support the benefit of 'antibody' therapy), but steroids can also induce both delusional thinking and a temporary 'high', so who knows.

- Meanwhile it's all surreal and not a political statement to say that The President is a 'super-spreader', that's from an observation ascribed to doctors acquiescing to his desire while they 'said' they are cautiously optimistic about his prognosis (we are optimistic too, however mostly everyone feels this is premature), so given the stock market rally was assisted by his decision, he needs to actually do well.

- The President has not had a negative test (not possible this soon), the outbreak at the White House is continuing, making day-to-day challenges running America tough, notice his personal physician referred to 'getting through to next Monday' before breathing a 'deep sigh of relief'.

- Any indication that he has to return to Walter Reed might briefly shake markets, unless of course he is 'cured' by virtue of the hoped-for speed of antibody drugs, meanwhile the next few days will be very tricky and not just political theatrics, he is ambulatory, showing physical strength, that's great and hopefully sustainable.

- As recovery is ahead, not behind, true stabilized health can't occur this fast, even with effective antibodies, although if by 'miracle' it does, generally the best claim I heard about Sorrento's (SRNE) is 4-5 days, then get a negative COVID test a week or so later, confirm with a second test days later, so this is 'warp speed' to be sure.

- So, imagine the enthusiasm for Sorrento's antibodies that might follow along, if this works, because what they have coming at a lower cost and lower dose has a lower cost level too, hence they'll need immediate funding or a big partner.

- If successful it infers Government shouldn't have thrown huge money primarily at big-pharma companies, Regeneron (REGN) got $450 million (and commitment for initial distribution, even though it's an ungainly huge IV compared to what's coming).

- Sorrento issued a Press Release (unheard of on a Sunday evening) announcing a web special R&D Presentation (ideally Oct. 13th) outlining their progress, the timeline, research as is ongoing (good, everyone wants them to sort this out), it doesn't go unnoticed that media talks about every pharma but Sorrento it seems.

- And that's actually good, if SRNE drives the narrative after the Temple University and/or the Brazil 'antibody' trials.. well the public will suddenly wake-up to a new player, since it's mostly market traders aware of Sorrento so far, that's what has us sticking around despite viewing them as promotional initially, then speculative as they partnered with lots of others.

- Of course they still don't have significant revenue-generating products, so that's a reason there is a risk/reward quotient and it's inappropriate for those not grasping the risk involved, but for those that are, and without adding to existing positions, I did suggest on an intraday comment we'd make it 'Speculative Pick of the Year', for 2021, which is not to suggest it will workout, but that if it does the gain has an unusual upside potential.

- They 'may' soon announce something new called STI-2030, which may be a 'pill' (or oral solution) for COVID, that could be almost a 'holy grail' solution (let's limit a tendency to get excited, as this is not confirmed information, just being ruminated about a product for next year), I understand these kind of stocks trigger angina.

- Meanwhile we'll focus on this year's health crisis, as we have all year since first mentions of 'WuFlu' (we called it that before China pushed the COVID name thru their friends at WHO) in January, and Sorrento's ongoing posturing along with others, to stabilize patients emerging from disease as well as may be possible.

- The long-term course and side-effects are poorly understood, that's why it's not so wise for people recovering to try immediately going back to work and so on, and there is reinfection risk too, something for White House staff to remember, and again arguably right message 'after negative tests', not prematurely.

Meanwhile . .

- Russia has incredibly high COVID cases, suggesting no help so far from their vaunted vaccine, but cases among those inoculated are not separated yet, and Russia's Director of Vaccines has offered to help the USA with theirs.

- While this occurs, President Putin is totally isolated, runs Russia by video only, and has not stepped into a press or other public gathering in months, and has limited the ability of all staff to have physical contact with him, regardless of COVID status, that may be overreacting, but then again, the alternative isn't desirable.

- France is on increased lock-down, and basically this is clearly not just the U.S., the word from Paris is early closing times and basically a 10 pm curfew, Madrid has an even tougher situation, as do many other countries.

- Interest rates are slightly firmer, it's a plus in an indirect (better business) sense.

- Governor Cuomo overrode Mayor DeBlasio about closing NYC businesses.

- 2nd wave of COVID concerns are giving markets and people second thoughts of course, although everyone's suffering COVID fatigue and wants solutions fast.

- All this leaves the Election process in purgatory, although the polls continue in Biden/Harris's favor, with a number of variables as we all recognize, while there is a report suggesting a WSJ/NBC poll over-sampled Democrats (as in 2016?).

- Oil (OIL) prices are stable primarily due to approaching 'twin' storms (one in the Gulf now, the other on its heels approaching Western Cuba), both patterns now point to an approach to Louisiana over the course of a week or so (oil platforms),

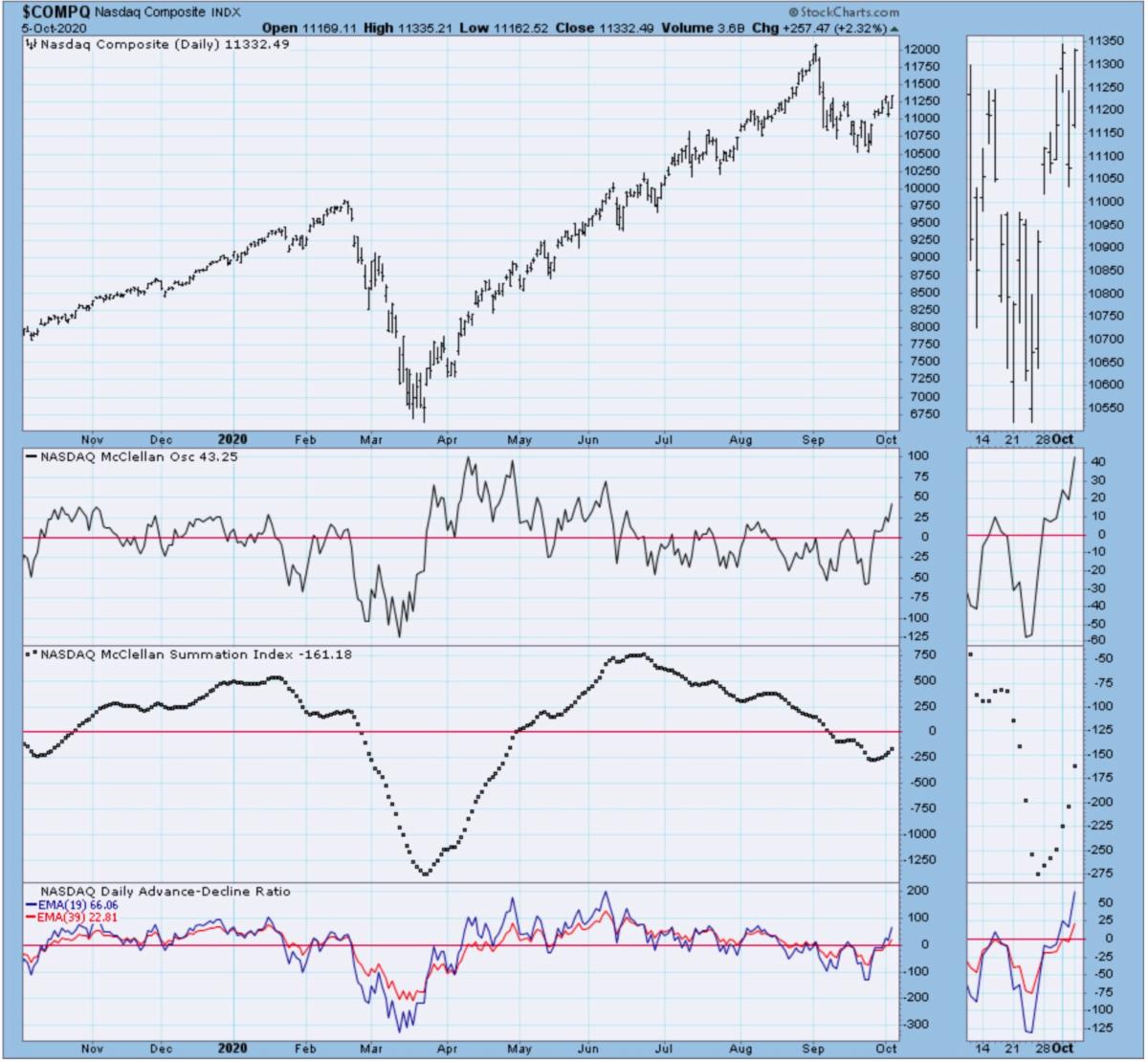

- The high level range for the S&P (SPY) persists, and one should not get 'too bearish', given prospects for a gigantic decline are not favorable, though shakeout risk is always there especially in October.

- Near-term news-sensitivity remains and the S&P might calm down a bit, although at the moment (especially if we get the stimulus), there's no big shakeout yet.

An example of why I think cruise lines are not a valid rebound candidate sector; even though the majors will survive with dramatically fewer ships. This brought memories a bit; as over the years I've been on the two 'former world's largest' RCL ships (at left)..

In-sum: the market did extraordinarily well Monday, but many stocks eased-off their best earlier gains, which is normal, given traders rarely chase out-of-the-box rallies on a Monday, but wait for some retrenching before they'll enter. In this case debate about what happens next tended to center on 'to move or not to move' (the President), as the question for Officials, and contributed to the afternoon's mild choppy action.

Now, not only will the President risk shedding viral particles, but a majority of working level staff (and Secret Service Agents) on-top of his personal assistant and WH Press Secretary, already are infected with COVID, are tense as scuttlebutt suggest they were opposed to the idea of POTUS returning to The White House so quickly. They too do have personal concerns, and are generally closed-lips about how they're feeling.

We think (as I've suggested for several months on occasion), clear the place out and totally sanitize the White House, replace (finally) the older HVAC systems, and move to yet another office space or even to Camp David (or Lago Mar in Florida), but they decided, Trump is back in the Residence, and we'll just have to see what happens...

About the president: The virus affects some far more than others, and those in less wonderful financial conditions often fare far worse. Likewise those who receive less than the maximum possible medical attention. So the statement that it was not so bad is totally a fool's bleating, and about the dumbest possible utterance that could be made.

Meanwhile, life in the rest of the world continues while nature and unrest work on their next challenge.