|

So maybe an 'event' or post-Election market purge here (allowing for rebound intraweek and more dependent on Stimulus or not, more than the Debate), in a sense contributes to 'global synchronized economic resurgence' looming in 2021, with decks cleared. There's too much controversy to define it closer.

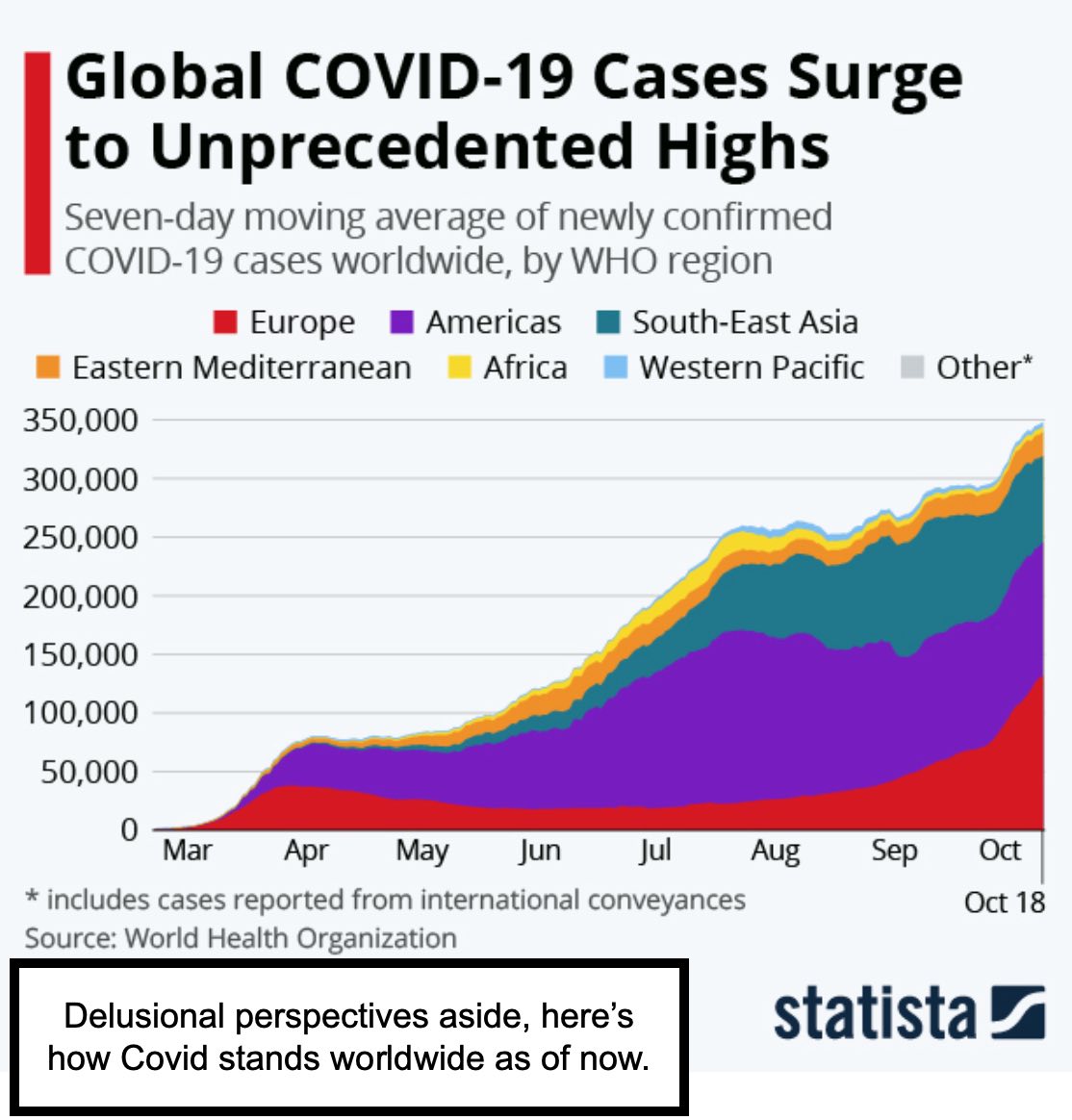

But of course it's still a bit early to have confidence in global resurgence (we can't know the pace of mass produced vaccines, we can't know precisely how the rest of the world resolves, and we can't know how China plays by rules as this evolves). By the way that's tougher, if not impossible, without reasonable resolution to the pandemic. As we're not there yet, and even rapid testing and opening things up won't embolden many people to mingle and really engage in commerce as normal. It will take a vaccine as is simply not available, but for which people have confidence in on top of it, to get things percolating at a level to justify meaningfully higher equity valuations.

So in the meantime this is more than frustration with early vaccines, it's more than frustration with the slowpoke speed of safe 'antibody therapeutics' being tested fully, much less available, and it's more than frustration with politics as the posturing by both sides (and the allegations and innuendos) aren't exactly taking the high roads. I doubt this will change, and suspect the coming WSJ article (following the NY Post's.. same ownership) will only aggravate 'angst'.

It seems that most people either voted or know their voting prospects by now, it also seems that the risk might not even be just the Election, but the possible slow process of tallying the outcome, and who knows, maybe even beyond is adjudication (if you recall Bush/Gore, we've been there before).

|