Market Briefing For Tuesday, Nov. 5

Skepticism reigns supreme as the S&P surges to record highs. All the increasingly dubious pundits and outright bearish technicians miss something a bit surprising: the bifurcated nature of this market, which if viewed thusly shows the difference between dormant Industrial stocks, versus the FANG type expensive 'grand dames', as clearly defined as a political poll about candidates or impeachment prospects.

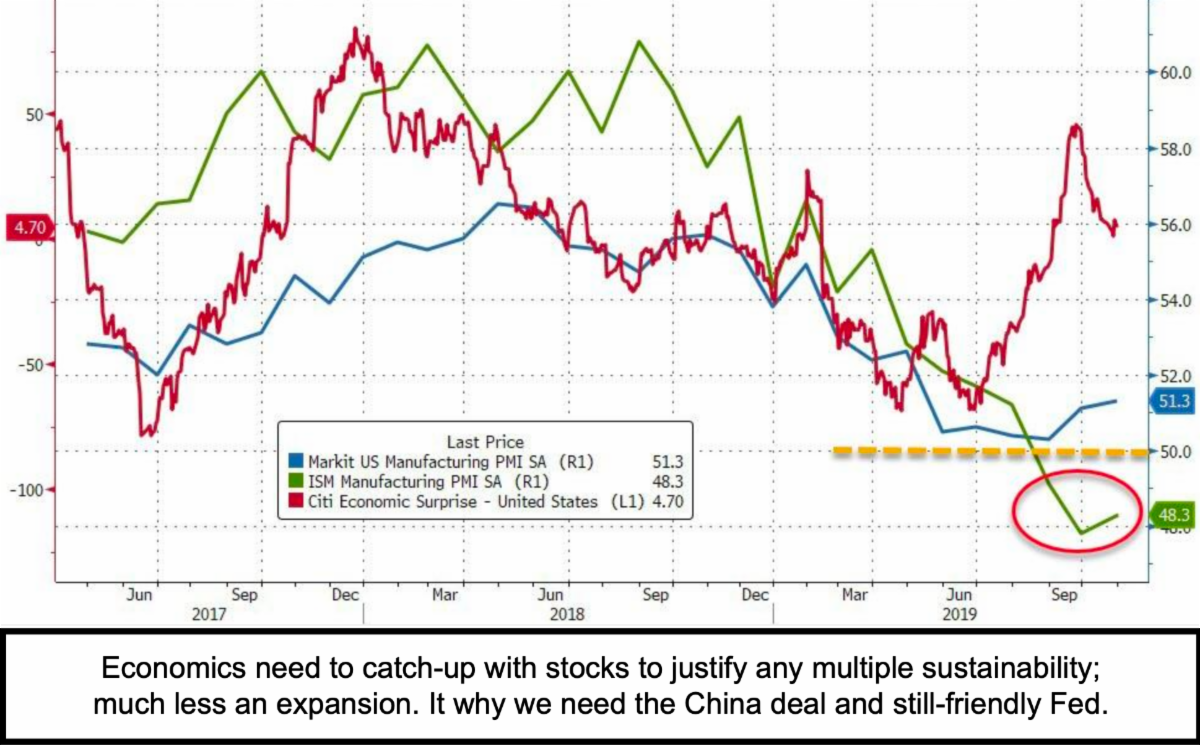

What's somewhat odd about it is that neither the S&P's cap-weighted or structural split, or US political divisiveness, really (at least so far) is impacting equity prospects. What does matter here is getting a deal with China; seemingly illusive, while we do see it coming together 'this' month based on Navarro's comments Saturday morning as well. So for now the question is whether post-news-spike selling occurs.

That's of course the question. It may depend largely on whether or not the uber-strong S&P has by that time corrected again, or just just languishing at high levels, since it is a bit unrealistic to expect it to surge forward at this angle-of-attack for a long time, once the benefits of short-covering scrambles subside a bit.

In sum: while the Bears or even some very skeptical normally flexible managers, have been shorting and fighting the Fed and this market all year (and continue doing so); the S&P has worked higher as outlined.

Yes, it may have limited potential near-term; but the TINA (there is no alternative to stocks) viewpoint dominates, dragging capital into higher price levels, which require a (dubious) multiple expansion to justify as profitability continues to diverge from prices.

However markets can do that as a discounting mechanism. It's exactly why in 2016 my contention was 'to the Moon if Trump wins'; regardless of anyone's political biases (to wit even if you hated Donald and loved Hillary, we suggested separating your politics from investment moves).

That worked out superbly then; as did our rolling correction approach following the January spike of 2018, and the crash alert of September; and then the probable 'cycle-low' forecast on the expected implosions that culminated (aided by that insane Fed hike that month) just before last Christmas. Even while calling a couple corrections or shakeouts as well as rebounds this year, we have repeated argued against shorting (aside a few particular stocks or fading them, and that usually worked), because we have said 'no catastrophe' is coming.

Bottom line: we may get a pullback 'soon' but any first dip should not be significant, unless it was a complete collapse of China talks (as that is unlikely incidentally).