Market Briefing For Tuesday, May 4

Catalysts to move markets are widely debated, but nobody has handles on 'what' if anything is going to break the market. Well, inflation is here, it's not a transitory short-term factor by the way, but the default view remains that Fed policy will remain expansive. We can (and will) identify a couple catalysts.

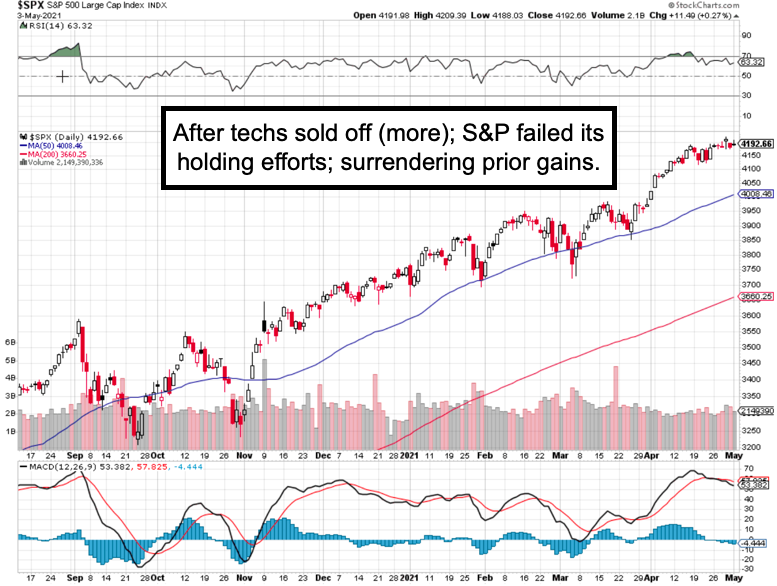

The upside of economic activity accelerating as COVID retreats makes sense, of course, but markets can have cyclical moves within secular trends, and that is the allowance for a shakeout that's more visible in the Senior Averages.

As I have outlined for months, we've been in a 'synchronized global recovery', and that growth contributes to the demand issues involved everything from of course steel and copper (JJC), to corn (CORN) and chicken (the chicken issue affected by a fire at one plant), while the Semiconductor 'shortages' is another story.

There isn't exactly a Semiconductor shortage due to rising demand. Rather it was a shortage ignited by Taiwan Semiconductor (TSM) closing production due to the customer cancellations related to COVID. And then when demand soared a few months later (including motor vehicles), they weren't ready and are now in the gearing-up stage to fulfill demand. (TSM's CEO emphasized that on CBS '60 Minutes' last night, in a clear discussion of influences involved. He also did mention they're building a new 'fab' in Phoenix, near Intel's home, and putting more money into their Austin Texas facility, as well as a new Taiwan line.)

Overall they dwarf the competition, and although not emphasized, Apple has a lot to do with this. Apple's own iPhone (and now the new M1 chips) licensed from ARMS, and make by Taiwan Semiconductor. The supply chain systems are long enough that it will take most of the rest of this year for auto makers or similar to obtain adequate supplies. That's not the case for Apple (AAPL), because of their order flow to TSM remaining steady.

Analysts this time of year will start to say 'oh orders were trimmed by 10%' or something like that. They omit that Apple does that every year as demand for current model products wanes a bit as they're shifting to the next-generation chip and model iPhone. This year that may be less of a factor since the TSM chips are Apple's design in their new iPad Pro too, with the next iPhone likely an 'X' year (modest ramp). If there's anything important on iPhone 13, it will likely be the next-generation Qualcomm processor which is SOC (system on a chip) and will have even lower battery power demands, allowing either a lighter phone or longer battery life (probably Apple's choice will be the latter).

If there's an issue surrounding Apple that should be more worrisome, it just might be the litigation that started in Federal Court in Oakland. On the surface this is about the 30% / 15% split between Epic and Apple. Implications are huge 'if' Apple loses, as much of their modern-day revenue relates to the App store and not just the money they take in, but the appeal of the Apps beyond the assumption that everything is available on Android systems too. Anyway if Apple 'is' ruled a monopoly, the biggest-cap S&P stock has an issue.

Executive summary:

- Inexplicable bantering about when 'the' decline arrives persist, while most stocks (even some techs more recently) have been correcting internally.

- We can identify catalysts able to impact the market: one would be arrival of persistent inflation that does more than lift prices temporarily (once you raise wages for instance, do you think workers will accept reductions?).

- Another of course would be the unthinkable (which means we should be thinking of) invasion of Taiwan by China, which I've repeatedly expressed concern about.

- Such an invasion would put the majority of semiconductor production very clearly under Chinese control (they would try not to destroy the plants as they too are huge customers of TSM), and that's problematic.

- Also Chinese influence in Hong Kong is increasing, and that can have an unknown level of disruption to finances in Asia, but this is a variable.

- While it will get lots of 'press', the Apple vs. Epic litigation matters, and it is likely a reason why Apple has been slightly neutral/defensive lately.

- Speaking of variables, there is crypto, and while I won't embrace Warren Buffet's (it's junk) view exactly, I do agree that nobody truly understands a lot of the intricacies of crypto, and chasers will get burned again in time.

- If there's a collapse of Bitcoin etc., the impact on 'Server' demand would be huge, since so much of today's computer processor (not small chips in question above) demand relates to the insane ' crypto mining' industry.

- So a lot of the big-tech stocks could be hurt when/if this happens, and just as occurred the last time Bitcoin collapsed, few recognized the fallout into the broader computer / server / cloud storage space.

- To simplify these (and I add one at the top): COVID resurgence, inflation, Bitcoin plunge, and Chinese invasion of Taiwan are catalysts we see.

- Is it possible everything consolidates and none of these happen, sure, in fact some are essential, especially maintaining Sino/US relationships.

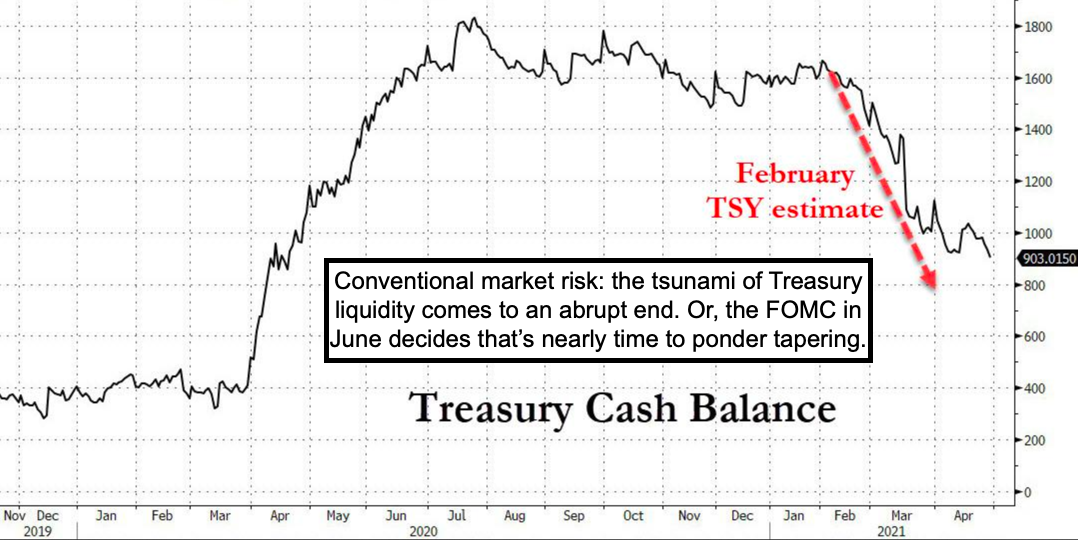

- And of course the biggest risk of all: that the FOMC decides to 'taper' the pace unlimited liquidity, although that would sure be politically incorrect.

- Meanwhile the stock market digests and rotates with many stocks having become darlings during the pandemic, clearly on the defensive now for a period of weeks or months, not really waiting for a broad breakdown.