Market Briefing For Tuesday, May 25

Seasonal bias kicked-in, to the upside, ahead of Memorial Day, primarily it seems led by rotational rebounds in the usual suspects of momentum stocks, but also as Oil moved above 65 / bbl, suggesting rising global demand.

For the most part this rise conforms with our expectation of stable-to-firm Oil (OIL), and of course the economic benefit from global reopening is identified by the major institutions that more recently got bullish on Oil (we are since under 40 and we would not chase the upside even as we hold higher levels unfold).

Rising demand matters slightly, as almost all the major financial media ignore rising COVID case levels. Complacency prevails as those might be threatening to everything from Semiconductors (SMH), as Taiwan hurriedly locks-down again, or Japan, where Tokyo's hearing renewed calls to shut-down this Summer's Olympics entirely, rather than just do it without visitors or any spectators at all, aside the athletes and associated staff. (I suspect there's more than a health concern here, Japan will lose an even-larger fortune if the Olympics are held without spectators, versus concern about actual 'games' as well as important milestones for the athletes. Will they postpone it yet again?)

Executive Summary:

- Seasonal pre-holiday upside S&P tendencies kicked-in as expected.

- COVID is also kicking-in, especially in Asia, and can surface to impact markets, if global economics are again disrupted (think Taiwan).

- There's way too much complacency about COVID, it is only this evening that the State Department suddenly issued a warning NOT to travel to Japan, not simply for the Olympics, but in-general.

- This is a big deal, Japan is not India (which has a travel advisory), and Japan was very low in positivity, and look what can happen, perhaps the geniuses in Washington (and CDC Atlanta) already know the risks of this returning in the Fall, although fingers are crossed that we avoid that.

- So sure, there is too much complacency about COVID, even if the USA is lucky and doesn't catch what's spreading in Asia, and still wild in Brazil.

- By the way to combat these new variants 'properly', there will be need for both new vaccines (they call them 'boosters') and monoclonal antibodies, (or MAB's for short).

- I chatted with a physician who was involved in the clinical trials of Lilly's antibody which they nicknamed 'bambam', it did NOT work very well, but she is more optimistic that other antibodies will be more effective.

- Newer generation MAB's such as Merck (MRK), Sorrento (SRNE) and even Gilead (GILD) are working on, may have better success (of these Sorrento has more than one antibody, as such, and is more specialized in that field, last week they received approval to finally initiate recruiting clinical trials in Brazil.. based on results in the United States that we haven't even heard of yet).

- The 'global reopening' and now tonight's travel warning, can't hide fears in Japan that hosting their Olympics invites COVID if they allow 'any' visitors or spectators, and economically becomes a disaster if they don't, hence the pondering of whether to cancel.

- Shorting the market here is rather risky, even though after a Monday rally it is common to see consolidation before intraweek upside resumes.

- Tesla (TSLA) 'may' have hooked-up with Luminar (LAZR) at least for study, as a test car with California plates was spotted driving around West Palm Beach, Musk often says LiDar isn't necessary but here Tesla is researching just that (by the way we continue suspecting LightPath (LPTH) lenses in Luminar systems), as to Luminar stock it's been firmer for a couple days, likely on this.

- Aside Belarus horrendous 'state terrorism hijacking' of the Ryanair 737 (RYAOF) to Minsk, to have their KGB agents offload a young critic, there's not much global new news, and yes the EU should very sternly do something about it, and we hear is doing that right now, starting with flight restrictions, I do hope the pro-democracy editor / organizer is not tortured or killed by the last remaining dictator in Europe (unless you consider Russia as Europe).

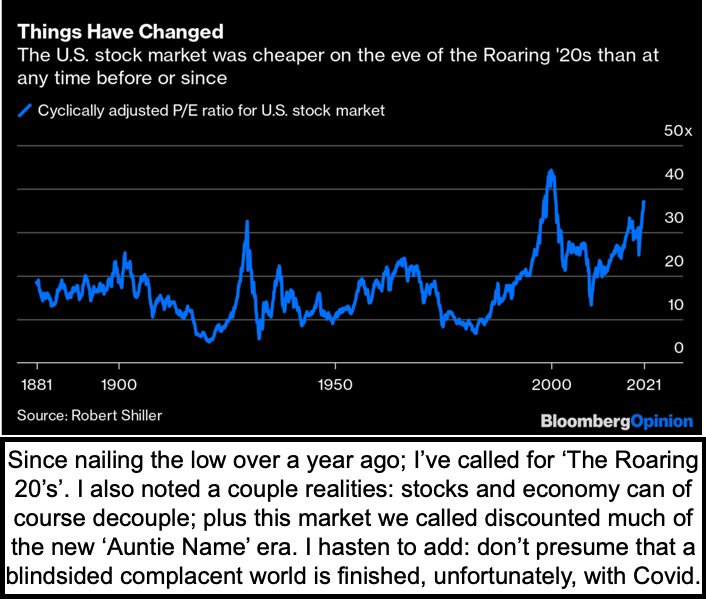

- CNBC made a deserved big deal over the Anniversary of Mark Haines death, by emphasizing the Haines Bottom over a decade ago.. that was on my March 10th Birthday and (regardless of chatting with Mark at that time), the 'occasion' is why I proclaimed March 20 'last year' as the Inger Bottom (now we hear technicians saying lower levels won't be seen, well that was my view on that day which was possibly a bit bolder than it is for a technician to say so now).

- A few days ago the SEC said Nasdaq can allow 'direct listing' smaller companies (as contrasted to only IPO's) to raise money, this is a big deal for many would-be public companies needing funding to accelerate, and a blow to those who Wall Street who like to promote investment banking all the way (sometimes weaseling their or clients way into a prized situation).

- This remains an expensive market, but as said: internal corrections and rotation have allowed it to work-off overbought readings in a 'rolling' way, give this some time to hold together (no massive advance) into early June if all goes according to plan.

Now, the COVID situation is not a sidelined issue, despite not really headlined globally now, other than 'as if' we are post-pandemic, which is barely a partial truth, and CDC knew awhile back they had to open up especially should it get nasty in the Fall and more stringent approaches are needed (the vaccines for sure had better work or they will simply blame the newest 'variants').

What is sidelined is the absurd denial that the virus wasn't engineered, as was somehow split into irrelevant political biases last year. My suspicion from the start (before it was named SARS-Cov2 or COVID-19 I dubbed it 'WuFlu' as you know), was that it most likely was an unintentional release from the Lab.

If it was associated with the horrible open-air markets, it might have included a worker from the Lab trying to sell an animal, but once I saw the assessment by both a Thai (US funded research) Lab and a Professor at Leicester Univ., in the UK, about the Genomic DNA Sequence including HIV strands (he knew that those strands suggested it was engineered, not from nature).. that sort of reinforced my take that this was indeed designed as a biological weapon.

So, last week we have a Chinese Professor in Beijing saying 'China won the great biological-war of 2020' against Europe and America'. I suspect you'll not hear from him again, as while it was 'pro-China supremacy', it goes against of course the CCP propaganda that nobody knows the origins of the virus.

This all matters to the stock market 'if' variants are reinvigorated this coming Fall, which would derail some of the economic expectations, at least in Asia, if not in Europe and America. While the belief is that the Pfizer (PFE) vaccine -others possibly, but it's been- tested against protecting against the early UK and later Indian variants (there are 4 Indian variants apparently), provides immunity 'to an adequate degree' (probably means victim gets sick but lives without radical interventions, frankly such as I had to survive). I'm not so sure I concur, as the report I saw from Tokyo (hence my Olympic comments) said they desperately need ventilators and more vaccines, and that's absolutely a 1st world country.

The markets will continue to do what greed and fear push them to do and the result will continue to be those jaggedy graphs wandering up and down.

And certainly the virus had a bit of help in developing, and probably it was fairly accidental that it got out at that time, not part of the plan.

My solution would be an airtight border closing right away. If all of the fools in various positions in various countries had acted as they should have, probably most of the deaths could have been prevented. But stupidity prevailed and so did the spreading among all. And it does not appear that stupidity can be "fixed."

While I agree, wouldn't shutting down the borders have not only stranded many Americans in foreign countries? It also would have devastated our economy even further and prevented the import/export of goods.

Certainly shutting the border would have stranded a few INFECTED carriers outside some place. And certainly it would have had some economic impact. BUT it would probably have been far less than what we can see has happened instead. Putting out a small fire is always easier than waiting until the whole city has burned.