Market Briefing For Tuesday, June 1

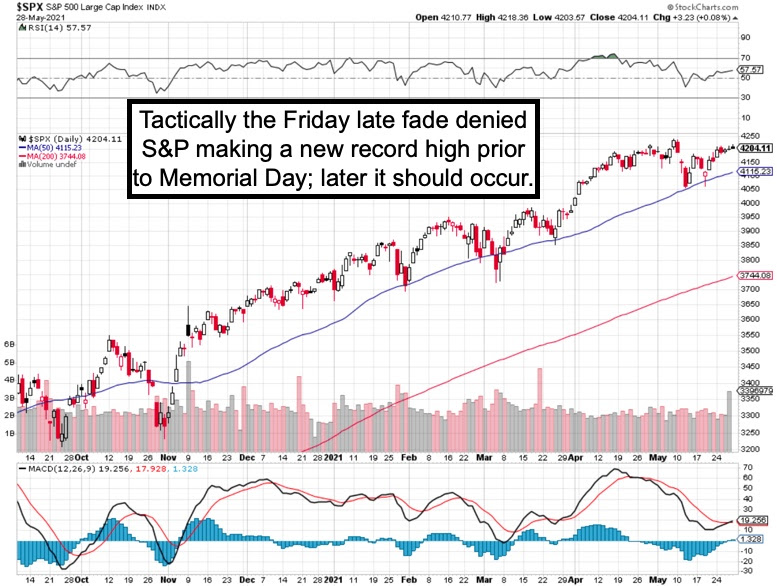

Factors remain lined up for solid economic growth ahead; however I tend to think a period of moderated market behavior will be experienced after most likely a record S&P high. The 'memorial' for the Bulls interestingly has already been written by the serious 20-50% drops in so many big momentum stocks of the 'past' rally with its roots from our March 23rd low of last year.

So that's a hint that of what I expect might be a rough Summer; later indeed preceding a new upward phase, within context of the cyclical upswing from last year's indicated low. In other words; look for the Index to have a dip within an uptrend while those stocks that corrected (again rotation) might do better.

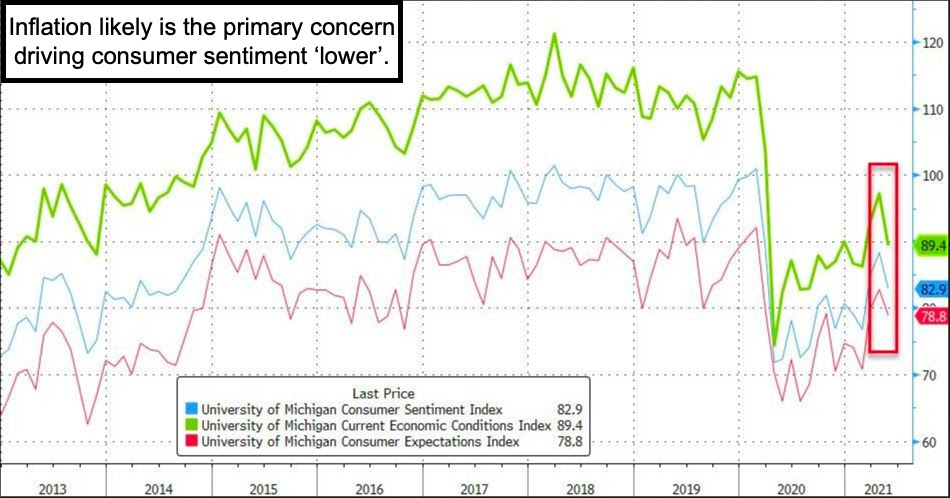

Nearby we have FOMC prospects of more 'tapering chatter' in June; although the idea that they (and we) shouldn't be concerned about inflation is absurd; a departure from dutifully following the official line that 'inflation is transitory'..

I've outlined why certain commodities can retreat; but the wage-price express is a bit tougher to overcome; as you'll not get workers to except retreats from an ongoing race to higher wages. I'll not complain about giving living wages to workers; but to imagine this won't be passed on via higher consumer and / or industrial customers is naive.

Now that doesn't mean the growth has to contract a lot (comparatively unlikely to exceed what we had in the year's first parts); but does mean stocks till high in price generally have discounted favorable forward guidance; while so many of last year's (work/study/stay home) pandemic gainers already corrected. So sure perhaps some of these can rebound; but perhaps range-bound at best.

In the last couple months I've shared an 'exodus' of lots of stock by insiders in the biggest well-known momentum stocks (or similar); as well as 'high wealth' clientele a couple institutions have acknowledged (BofA and Goldman entirely irrespective of their market outlooks). Those who built excess cash both rotate holdings and might even return to some of those internally corrected.

However, while inflation, the FOMC and Covid concerns (especially in Asia) at this point are merely speculative catalysts to tame the markets. Concurrently I note that these 'concerns' have not troubled the Treasury market; talk about a 'tapering' and so on hasn't budged rates significantly higher. But complacency is not a strategy here; as there are other reasons (capital flight for-instance) to keep an eye on the 10-year.

(I was pleased to hear media discussion of the longevity of antibodies in post-Covid patients; although it remains unclear whether also getting vaccine helps in people who 'already' have antibody levels higher than vaccines produce. At least they are finally exploring this topic; as well as the role of MAB's ahead.)

As they say it's a 'sugar-induced higher' and that is fine but sustainability may be assumed by so many because the wealth-effect of asset gains (real estate is not irrelevant in this realm) has stoked the 'comfort level' of most families at the moment. It's pretty clear what will happen when it all moderates for those not just chasing high-level equity Indexes; but also pricey homes.

(I mentioned this island's militarization earlier in the week; here's a look at it. We also have Russia expanding it's regional presence on the other side via heavier bombers being deployed to their air base in Syria above Lebanon.)

One more thing . . . I've now read quotes from Dr. Fauci years ago about his funding of 'gain of function' research. And apparently this was performed thru an intermediary (Peter Daszak) who helped set that up in Wuhan in 2017. As I recall more recently, he was in the so-called investigation group authorized to go to China to 'investigate', while 'real' investigative epidemiologists were fully denied access to China. As 79 Dr. Fauci doesn't need the grief; but he denied it all; and Weekend Australian will expose all of this .. well now.

The idea is we could have learned about 'gain of function' without any of the risks that they know existed by doing the lab/bat work the way it was handled. Huge scandal. Can that affect the market? Well in 2017 Fauci did not brief President Trump or Sec'y. Pompao; and didn't step forward in January 2020 when he inherently 'had to know' what was funded and where it took place (a picture of Daszak and the bat lady is featured in Australia's coverage). By the way 'translate' gain of function; and I get: CCP/PLA bioweapon research.

I suspect Bitcoin's crash is more pertinent to the market; both are indirect. But as the late Paul Harvey would say on radio; after the commercial when he did give 'background'; 'now you know the rest of the story'. In this case maybe the opening act of what should be the biggest research scandal in history. If such secret (not disclosed to oversight) funding along with China did this; there's no wonder a cover-up of silence went on for so many months.

Overall...we do need people spending money if we expect a full-fledged huge recovery to persist; as our projected (for over a year now) 'Roaring 20's' shall proceed. Part of this involves an internal correction and rotation. This process has been ongoing most of this year, with the upside (still) led by Oils & Banks as I outlined from the start essential, for the S&P to remain firm in 2021.

The conventional view, and we don't disagree but for different reasons, is that the market 'needs a rest'. Fine; but our view has been that we've had a rest in so many formerly hot or active stocks; as rotation has kept the S&P alive. So, in my call for grinding to a new record, albeit temporary (might as well say it's 'transitory' since that's the word of the month, albeit related to inflation lol).. in that call I suggested grinding moves by generally enough traction to get it and see behavior in early-mid June. Probably great hesitation ahead of FOMC.

But first let's take a gander at Bitcoin; with enthusiasts likely be relegated to Gander (Newfoundland, just kidding). I look back and actually made several 'calls' on this which generally understood the pattern, if distrustful of the entire case for it that some were making; since I believed it was more capital flight to stay under the radar, than legitimate; so surprised some major banks recently bought into it (who sold to them, the Chinese triads?). Remember my warning of 'leverage' in Asia which is far higher than here; and hedge leverage here in violation of the intent of the reform regulations following the 'Epic Debacle'. So heads may roll this lower; or tails may see another desperate rebound first.

One of the strategies going on now; might just be hedge fund lightening-up to avoid the fate of that 'family fund that blew-up'; and a bit of caution ahead of a fairly well-watched FOMC meeting coming up in June. Not time for heroics by the bulls; and not a clear sailing time for the bears either. It's not foggy like on Cape Cod; but likely to move up a bit (massive secular tailwinds in most tech key stocks); as managers are loaded with, and supporting heaviest holdings.

Much discussion about nearing a peak is valid for the S&P and maybe NDX of course; but the internal peak was months ago. I've described this frequently. It has been a reason 'not to fight the Fed' and not to excessively short Indexes. I realize there were individual short-selling opportunities in Covid or momentum stocks; but my focus has been on not fighting the S&P's thrust to another high which has sort of been a grinding meandering move. Not exciting, but correct.

If there was anything noteworthy in Friday's market; it was the President's new Budget; which would make Capital Gains taxes retroactively effective to April. The idea is this would inhibit sales later this year if rates are officially higher. It might not be terribly relevant; as I've thought a lot of the 'high net worth' sales this year were done in anticipation of the higher tax rates.

Speaking of rates, the US Postal Service is raising the price of a 1st Class stamp to $.58; for the limited use conventional snail-mail still has. They do a great job with Priority Mail; sometimes faster than UPS, but not FedEx.

The most stable sector for now remains Oil in particular; with Banks smart to avoid Bitcoin doing okay as well for the moment. The Budget proposal to make Capital Gains changes retroactive to April takes some of the pressure away from future declines; and as I noted some prior selling was just for that reason in hopes it wouldn't be retroactive (and it isn't to the year's start).

By the way, at the end of last year I talked about profit-taking in February and a rough period of rotation and adjustment to the preceding 'Roaring 20's gains we looked for since late March of last year. I also mentioned resumption of the 'Roaring 20's' in late 2021 (and likely heading into 2022); and that's likely still the outlook, barring serious economic or geopolitical disruptions. But for now..

Let's honor those who have served our Country (especially citizens making the ultimate sacrifice); realizing this is Memorial Day. Even though it's a celebration by all of us who survived the Chinese virus/ biowar/ pandemic as well. I especially honor our fallen soldiers and those who were lost on September 11th. So many victims were heroes too.