Market Briefing For Tuesday, Feb. 19

Multiple amalgams sustain this market - denying even mildly reasonable pullbacks (to the extent overly defensive institutions) many keep awaiting. It is reminiscent of the post Trump-victory rally, when again few believed that a combination of lower taxes, regulatory reform, and capital repatriation would actually happen, or propel the market to new history highs, as it did.

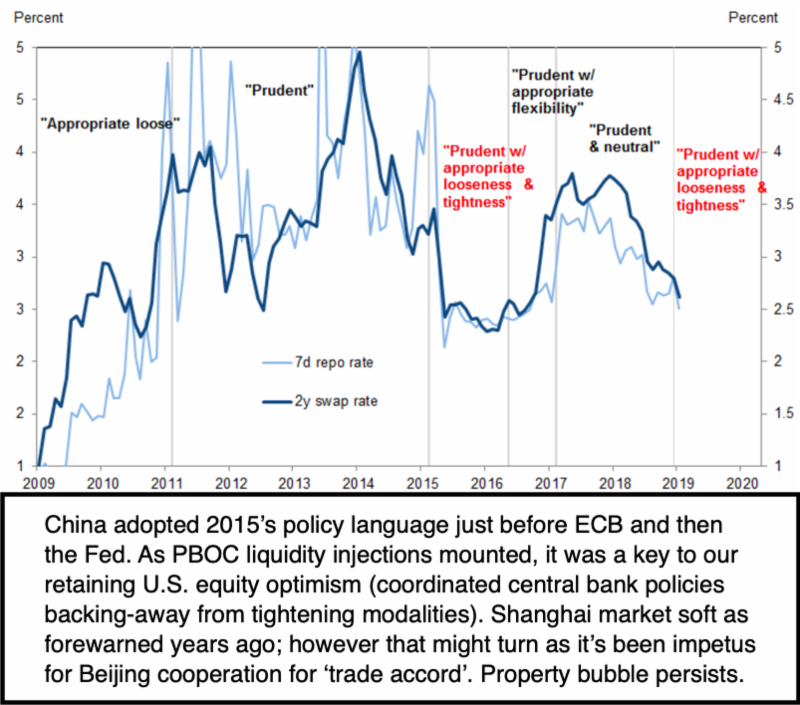

Now that's not to say the 'Bull in the China Shoppe' of the moment rockets to the Moon. In fact, the backdrop is such that too much actual strength in the economy (such as President Trump proclaims, but in reality is generally regionalized and not as all-encompassing as we wish it were)... that would actually empower the Fed to revert to a more overt restrictive policy than of course they will mildly follow, with regard to the Balance Sheet, while talking a far milder tone, as we described for over a month now.

While the Monday holiday commemorates historic Presidents (so isn't about the current one despite kidding he probably thinks it is); in a sense Trump is tackling (as I've observed for two years) many of the thorniest challenges as the United States has found itself in over the last couple decades, and that's of course related to 'Trade and the deconstruction of American industry'.

It's not easy to resolve; but the failure of prior Administrations or Congress, a topic I've addressed for over 40 years even while mostly bullish during the many years (aside spiky ones begging for corrections or worse), to tackle it with persistence and commitment... this addressing of what matters for the American people... largely offsets the quirky persona everyone has trouble coming-to-grips with.

It's possible, if our Founding Fathers were still here (not just commemorated on a holiday), they might say so long as unnecessary foreign entanglements are avoided, and we reconstruct our Industry and ability to retain success to have the ability to enhance healthcare and educational levels.. well that's a significant (and essential) accomplishment. It's not easy because everything was neglected (or mildly resisted) for decades.

So in that climate, of course China was shell-shocked that we responded in a way that strives to be fair; maintain supply-chains; open-up entry to not just our businesses, but without the partnership arrangements (sometimes fine, but not in all instances) that hamstrung competitive postures in Asia.

(Of course that requirement actually isn't 'communism' per-se; but relates to an arrangement the Communist Party never got over from its inception; that relates to how the British would take Chinese partners in Shanghai business ventures, but would always have a 'say'. Semi-colonialist holdover reactions that actually had nothing to the with the US, but an earlier British presence. I have not studied this; just recall it mentioned when I did a documentary from Taipei many years ago.) So we're helping China mature; and limiting their efforts not just at educating engineers and so on here, but what was clearly becoming an effort to control American companies; mostly in technology.

Lest I deflect from the 'bullet-point' status summary; let's update it a bit:

- Markets quite pleased with the 'trade progress' shifting back to the U.S.;

- Market not phased by the 'Emergency' declaration regarding the Wall;

- Too many 'Bearish' technicians looking at the obvious: technical levels of the 200-Day Moving Average for the S&P, 'assuming' it must repel;

- Similarly technicians have overlooked the New York Composite strength or NASDAQ, which had previously surpassed comparable levels;

- Rebounds in technology and Oil are what's needed to punch the overall market higher, even though no doubt the S&P is increasingly extended;

- Sure 'has potential' to actually make 'all-time' highs 'if' the China deal is actually strong enough; and it may not be entirely 'priced-in';

- Hence awhile ago we retreated on the 'sell the news' idea (for more than a very short-term hiccup) given that most hedgers are taking that stance but they're not heavily long; thus actually need a pullback for buying;

- That's the gist of what I've talked about; yes there's been lots of selling on the way down and the way up since December; but that means they are already out and thus 'not' potential sellers, but eventually buyers;

- Flip-side arguments exist (like if tariffs actually went into effects, but that is not the main focus for the moment); but opportunities selectively exist and not the myopic pre-China-deal reticence in 'Retail' and so on;

- Dialogue may shift a bit to Europe (and Brexit), so that wild card remains but there's a prospect PM May manages to forestall decisions there;

- We remain open-minded to a varying pattern; but the beauty of this is a lot of correction (and vanquishing of those uber-bulls of last year who of course freaked in the 4th Quarter) is behind; and speculative appetites actually increase while 'usual' cheer-leaders are torn between praying for pullbacks, and not wanting to capitulate into upside strength;

- Individual stocks (in ETF's or not) have been interesting; not exciting in most of the old FANG+ types; but stabilization in laggards like AT&T or washed-out small-caps like LightPath (LPTH) or speculation in next-generation stocks like Ceragon (CRNT) Networks;

- Our general focus is as usual on the S&P and sectors; and of course we may all retain 'core' holdings in major Oils and Techs for years; with last Fall's targeted purge to S&P 2300-2400 providing a good point to add to or initiate positions;

- Friday was February Expiration and may have impacted a few stocks; that might see relief in the new week; overall action was broadly firm;

- The coming week (providing no new zingers) should see a compressed intraweek rally given that there are only 4 trading days.

In sum: the rally is daunting primarily to the overweight managers (in cash, not pounds haha) and they are perplexed by how to address strong markets in this environment (at least most are).

Individual investor shifting to not just cash but ETF's, or heavily going into cash as Merrill and others reported, may not reflect deserting markets as is presumed by those making a point of that. But rather may relate to regaining control of their funds and portfolios (ie: self-directed investments). Perhaps it reflects realization how 'hand-holding' kept them in through 2018's serious distribution that (some of us thought) was obvious, but denied by so many.

(The above table reflects some notable 2018 institutional CRNT shifts.)

~

The upshot of this ideally will be that instead of the 'recession' being ahead, as many contend, it may be about to end around the time it's confirmed; as I have suggested for just over a year. Now if we recover 'too quickly', then the Fed has 'legitimate' rationale to be tougher; otherwise slower progress tends to be more favorable for the market, with less upward pressure on rates.

Bottom line: this upward phase indicated for the S&P from pre-Christmas liquidation waves is getting stretched, but isn't necessarily toast yet.