|

Executive Summary:

- Dr. Scott Atlas has resigned his post after the controversial 'rebellious' approaches to dealing with COVID as a Presidential Advisor.

- Vice President Pence is talking-up vaccines tonight, being distributed by Dec. 14, which is fine, but among those who 'do' wish to get it, most won't have it available, so we'll see how organized this is going to be.

- Near-term big-picture catalysts are somewhat consumed, that's been our ongoing belief about S&P in this 'overshoot-zone' as I've termed it.

- First of all this is normal behavior so they use strength in Apple (AAPL) and such (or upgrades based on nothing much) to hold the Indexes fairly stable.

- Political uncertainties are factors, but not significantly definable for stock market purposes 'yet', because both parties contemplate more spending.

- Yes we are in a situation where the 'poor get poorer' due to no stimulus, in that regard it not about blame, but perhaps shame, for those struggling.

- Contradictory views continuously clash whether it's about viable vaccines or whether antibody therapeutics is really where money should have been funded more significantly earlier (and now belatedly it comes along).

- There are only a couple companies out there with 'scalable' therapeutics, and that's why we have focused on Sorrento (if they get FDA approvals).

- In that regard Friday's Defense Department 'contract' via DARPA was the trigger to ignite a move in SRNE ahead of an institutional presentation.

- A DARPA division focused on 'chemical and biological defense' suggests the Pentagon knows more about how well these approaches work as well as how important 'treatment' and prophylactics are for our military forces.

- Coming ahead of pending FDA actions, this suggests the Defense Dept. knows more than any of us trying to analyse the stock, and takes it very seriously, since it is unusual to see the DOD moving ahead of the FDA.

- Again more behind the scenes than we know, but 'countermeasures' to a biological attack being the core of the DOD focus tells you a lot as well as revives speculation (not directly relevant) as to the 'design' of COVID.

- Sorrento (SRNE) at this point seems to be the only MAB (monoclonal antibody) of a type that could be 'scaled' sufficiently to protect hundreds of thousands of troops and civilians economically and rapidly, unlike vaccines.

- Though a few will try to say they are a variation on vaccines, that's not the case, as they can be protective and also treat 'already infected' patients, a role that the current vaccine candidates don't equivalently provide.

- Sorrento needs approvals of tests or IND's, long anticipated, meanwhile with nothing yet peer-reviewed or FDA approved as far as the COVID drugs or tests, it remains controversial and speculative, but rising.

- We may be in the early stages of a major economic cyclical recovery, but the big stocks have generally discounted lots of this, which is partially why we focus on both growth and speculation that isn't extremely expensive.

- Just because Indexes are at high levels doesn't mean overt bearishness will pay off, although yes there will be crosscurrents in December.

- Although we've had so many swings already that tax considerations may not be as prominent a consideration as they were a couple months back.

- Treasury yields are not going up that much so for now monetary policy is not an inhibitor, although stocks can certainly swing.

- Friction in OPEC+ is part of what's afoot, and might relate geopolitically to the concern about possible hostile actions increasing not merely related to Iran's so-called reprisal threats about the nuclear scientist's death,

- The OPEC stress at tomorrow's meeting might reflect the Saudi-Iranian tensions increasingly, and that (rather than the Iran-Israel animosity) may well be at the core of this, also Russia wants Oil prices high and thus Oil production cuts to remain in-place, this may come to a head this week.

- Zoom Video (ZM) made their numbers and got hit heavily after the Bell, sort of a good example of how the current 'work/stay home' stocks are pricey or overworked so to say, with regard to price (selling news isn't surprising so when a stock drops with good forward guidance realize it's profit-taking).

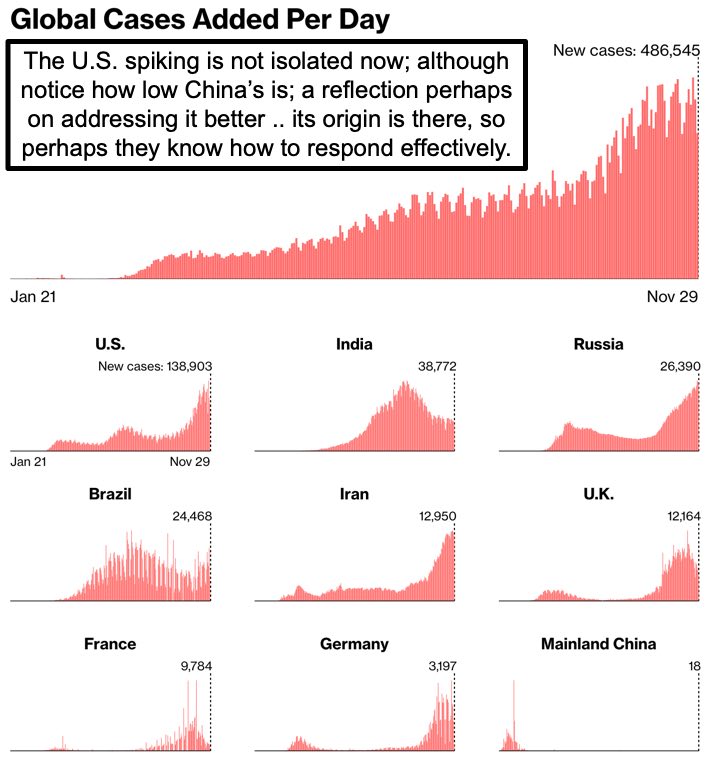

- Coronavirus cases continue soaring across the Country, and this is totally unsettling, and should be.

- The WHO contradicted itself again, saying lock-downs are not a solution, and then saying countries should not allow people to 'congregate',

- The foregoing is the dilemma of our time, how to bridge this gap to better medications and vaccines, versus not tanking the economy further, and of course most especially as relates to small business and poorer folks that at the start of this often perceived themselves as middle class workers.

- Savings rates 'now' are very high, but obviously many people didn't live at all with recommended cushions of savings, and those that did are running out if they are still not working, and there's no new help from Washington.

|

|

Certainly this plague is a huge disruption of almost everything in the world. It does give the appearance of w well designed weapon, and with that thought, who is, or was, the intended target? It seems more like the hand-grenade with the hundred yard kill radius.

And the big vaccine / antibody concern is that no matter what, any cure will take a long time to reach everybody. The production and inoculation process is not fast, and certainly there will be protesters slowing things as they can. Some companies will make fortunes, and others will not.