Market Briefing For Tuesday, April 28

(Again, working-towards a dip; perhaps after month-end, not yet.)

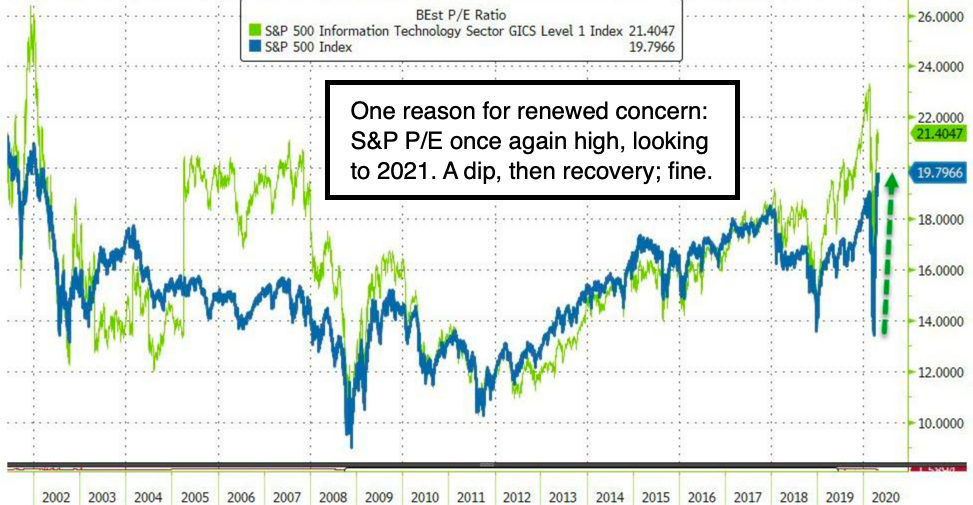

Anticipating better days (for the patients and the market), we ventured very dramatically to the long-side just over a month ago (yes the lows), and we do know that every sector of S&P has firmed (again on Monday), and it (backed by the Fed) continues grinding higher (nearly exhausted or not), within the target range we've had now for well over a month. That's a 'band' or zone I've referred to as between the 50-DMA and 200-DMA, and we're in it.

So it means shorting isn't very logical here, letting it stretch as it can should set-up a subsequent retrenching, but ideally not all the way to March lows, where the gloom & doom crowd were trying to panic investors into selling, which promulgated my declaring what I smiled and called what I thought in the near future would prove to be 'The Inger Bottom', as indeed it did.

There are many tiny and speculative stocks trying to both capitalize and of course help with the fight against the coronavirus itself and saving lives if it strikes someone in a serious way. I've highlighted a couple; and prefer to not try singling-out which (if any) actually deliver a useful drug or device.

So I'll add one or two to issues to monitor, staring with Pluristem (PSTI) but I hesitate to suggest chasing any of these. This one has secured large 50 million Euro funding; in a partnership with a Berlin University; and in just a handful of patients tested in Israel and one in New York, claims full faster recovery for severe cases on ventilators. As to U.S. speculative issues, like Athersys (ATHX), or Australia's Mesoblast (MESO), the latter was tested this month with Mt. Sinai Hospital in New York. And as faras the 'internal UV light', product exists yet. The tiny stock is Aytu Bioscience, and again while their team at Cedars has a Patent, the device doesn't exist as far as I know, but proves the point President Trump was onto something that does have at least potential.

Modalities for reopening the economy, as well as known and new potential testing and treatment possibilities are varied, but matter. Of course money flowing into speculative Covid-related stocks will flow-out as the sector is 'culled' as some move forward to broader use, but most don't.

And the broader NYSE and NASDAQ as well as the S&P, absolutely need to know how all this goes, because it comes back to not only opening with a guarded sense of responsibility, but also 'taking death off the table' as a prospect, beyond those who may have serious comorbidities or at risk in a sense with anything that comes along depending on their situations. It's all clearly Fed-backed, and even ignoring the pressure from OIL, for now.

(This oil chart refers to over trends; not to front-month devastations.)

As far as speculative stocks go, most are not well suited for investors. There are so many speculative candidates, plus it's well-known that most biotech or device stocks fail, while those that work do so well, by benefiting from take-out partners or similar if at all.

Daily action - extends the move, and I suspect the significant skepticism (I even have thought this market is moving toward a rest but not big reversal) is actually what keeps it alive. So may be an understanding that there's at last a better-coordinated 'plan' (posted in the first section) to fight Covid.

Meanwhile, be careful with rank speculation; view S&P extensions here as 'tentative'. barring revelations of 'what really works' and of course 'is all the antibody immunity exist' for real, in those who test positive for antibodies; or does that depend also on what 'strain' of Covid-19 one might become expose too. That part is sort of like flu; where vaccines are often partially protective because there are lots of variants in flu shots; so perhaps a similar concern prevails.

So we're getting to the other side of the 'first' peak; trying to avoid another, while not even at a base (in many parts of the Country) warranting opening although stages are being determined. What stores or businesses find their demise before this is all over (ideally it will be with regard to in forefronts of our minds, but that perception, of daily activities without a care, is years off it seems for now).

For the stock market, we might even make new S&P highs, of course with setbacks along the way, given the Fed remaining behind all of this; with a lot of investors and managers regretting that they liquidated near the lows; and chasing the upside. While this may indeed have proven to be what I'd ideally looked-for, both 'The Crash from Jan/Feb highs' (The Inger Top) and 'max-fear panic capitulation' ('The Inger Bottom') in March, the dynamics of all this are still very fluid.

While medical (thus commercial) outcomes are of course at the forefront, everyone wants to get back to work and daily life in a safe comfortable way and that is key to stocks. But the broader assessment has to be aware of it in a global and monetary context, as well as geopolitical, energy and other concerns that might seem to be of less primacy (they are since everyone is grappling with Covid-19 globally), so we continue eyeing those too.

For now the trend is extended, but remains higher.