Market Briefing For Tuesday, Apr. 27

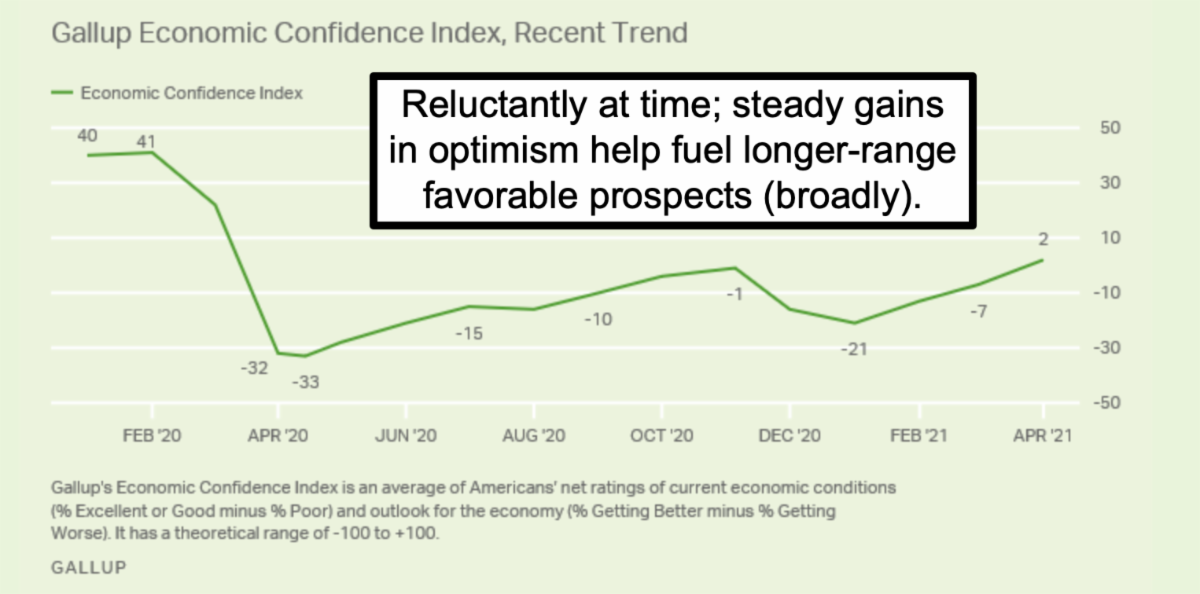

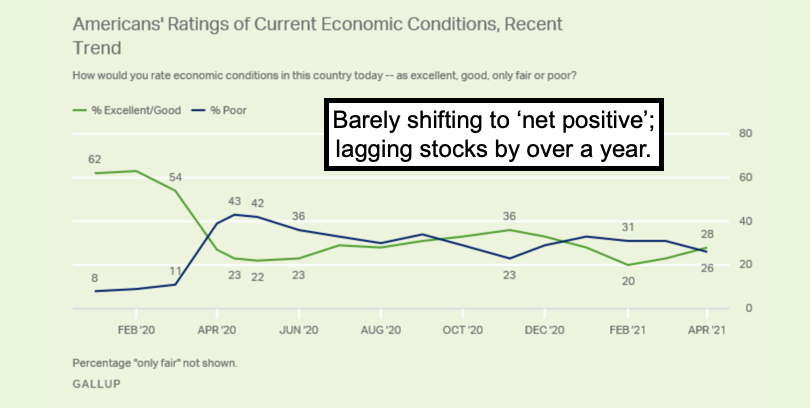

American optimism about the economy's direction is now slowly improving, a year after our targeted S&P turnaround in late March 2020. For the first time since, Gallup's Economic Confidence Index has displayed a positive score. Its important for longer-term growth and stocks too, if it is 'The Roaring 20's'.

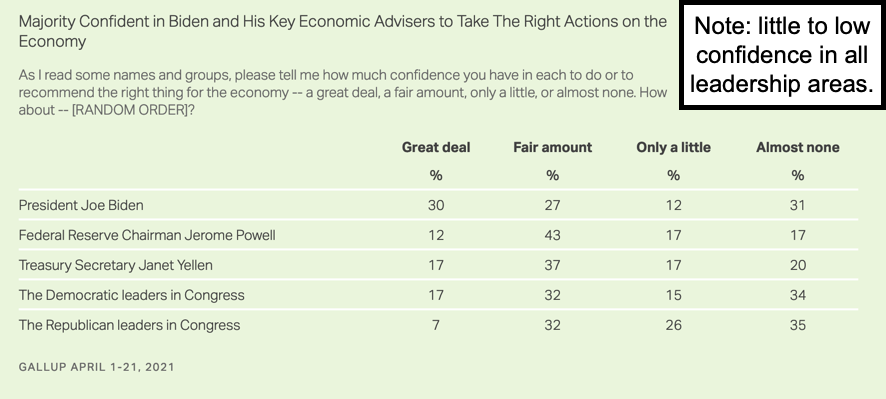

There are conditions or caveats for sure: dramatic economic stimulus actions taken in the past year offset much of economic damage from the coronavirus. This also set-the-stage for 2021 to be a strong year of economic growth, very much to the dismay of concerns related to longer-term debt encumbrance.

Sure, growth predictions rest on assumptions the coronavirus will be largely under control this year, at least here in the USA, if not abroad (heaven forbid anyone looks at India, where they thought they were somehow dodging worst case alternatives, then the medical house of cards collapsed on them...at one point France and the UK were in dire straits too, but meandered through it).

So, as more Americans get vaccinated, the spread of COVID-19 ideally keeps to a minimal level (as we see in over half the states now), more businesses in almost every city will be relieved, public places re-open and do accommodate larger numbers of customers. Wearing masks outdoors will be recognized as very unnecessary, and the MIT study will be sobering about social distancing (in-itself enabling arguments for denser restaurant seating).

Such developments 'could' unleash a surge of pent-up consumer demand as the public has largely avoided traveling or attending events with large crowds for over a year. And that can validate some equity gains already seen. What's needed of course is 'broadening out' of participation as more sectors emerge from the funk and restrictive era. What started as 'COVID fatigue' morphs into a realistic (sort of cautious) embrace of more 'normalcy' the world longs for.

Executive Summary:

- Contrary views, as a BofA analyst waxes bullish going forward, while the Chief strategist at Goldman Sachs issues a warning (my view is both may be reasonably right, if we get a larger correction within overall uptrend).

- Excess savings and global liquidity will contribute to ultimate progress for stocks, regardless of speed-bumps likely inevitable in the weeks ahead,

- Adherence to COVID guidelines in the United States is collapsing steadily, now an MIT Study has been released that finds 'little if any benefit' from a 6' social distancing dictum, in Europe it can be 1 or 2 meters by the way.

- MIT now says 6' is the same at 60' (?), what matters (and I concur) more is 'ventilation', density of a crowd or gathering, and 'to' wear masks.

- Shifting to EV, the EPA just gave California permission to set standards of emissions (beyond what they already had for years) giving the state more flexibility on 'tailpipe' (or not in the case of full EV) emissions.

- Internationally, a number of new (and stylish EV cars were impressive at the large Shanghai Auto Show in China), the NIO ET3 sort of stood-out (NIO).

- Media and fans 'tried' to position Tesla (TSLA) as a bit better than most others.., it's really broader global competition that matters in the years ahead, with consumers trending to newer styling and innovation, although charging as well as software support isn't as advanced as the competition, yet.

- China also unveiled 3 new warships today, all are new classes, and a first in terms of simultaneous introduction (helicopter carrier, destroyer, and a nuclear submarine), certainly all is intended to intimidate Taiwan.

- There are wider ruminations that a crisis between China and Taiwan could be in the cards this year, and if so (given US support if not formal alignment), that's a real challenge for both and could be a rather notable 'speed bump'.

Overall there's more in this busy week, with a Fed Meeting and then President Biden's Joint-Session Address to the Nation. And there's Mother's Day too!

Of course the bull/bear debates will persist, and that's reasonable because it's really more a 'market of stocks' these days, than a broad inclusive advance, a factor that contributes to the confusion for those not accepting bifurcation. So, in a sense both are correct, the market is due for an S&P / NASDAQ shake-up at the same time many stocks already corrected. The timing for exhaustion and a shakeout does coincide with what I've leaned-toward for a long time, as that was vulnerability in the late April and parts of May time frame (SPY, QQQ). Stay tuned.