Market Briefing For Thursday, September 3

|

S&P picks-up steam - despite 'nominal retreats by a couple key super-cap leaders. Behind the scenes, a lot of defensive action in small-caps, beyond biotech or former vaccine candidates. Since pressure from Washington, or even Bill Gates, emphasize most pharmas shouldn't anticipate more funding for such programs, it makes sense. The emphasis on expedited rapid testing and therapeutic treatments persists, even if a number of stocks of companies working in that area, are down and meandering. If anything, recognizing that many citizens won't be willing to try the earliest of vaccines is a point, as well as the efficacy not be terribly broad in some early tests. That's one reason many will be pleased that therapeutics become available 'if' they need help. This market is 'all about Covid', including the growing belief that we will emerge from this period of disruptions (to say the least), without a stock market decline anything of the sort we looked for early this year. Even though some states have the highest rate of positive cases occurring 'now', the proximity of viable vaccines arriving, and many discussing a 2021 comeback (not so much tourism or business travel, but 'better' as the year evolves), should provide a sort of 'floor' under the S&P, but not so high as to deny a reasonable shakeout, which is 'testy' in an Election year, but probable.

Executive summary:

In-sum: the average 'best-case' projections by most analysts for the S&P are below current levels, and the combination of FOMO and TINA lead the market to records in a 'superficial' manner, and our view that the S&P would not see a retreat to what I'd referred to as the March 23rd 'Inger Bottom' prevails. That's part of why I show June, when there was a 10% shakeout, and all it did was provoke more Fed expansionism, amid false hopes for an early economic opening to be successful, and it supports the idea that these recovery 'dynamics' are unusual.

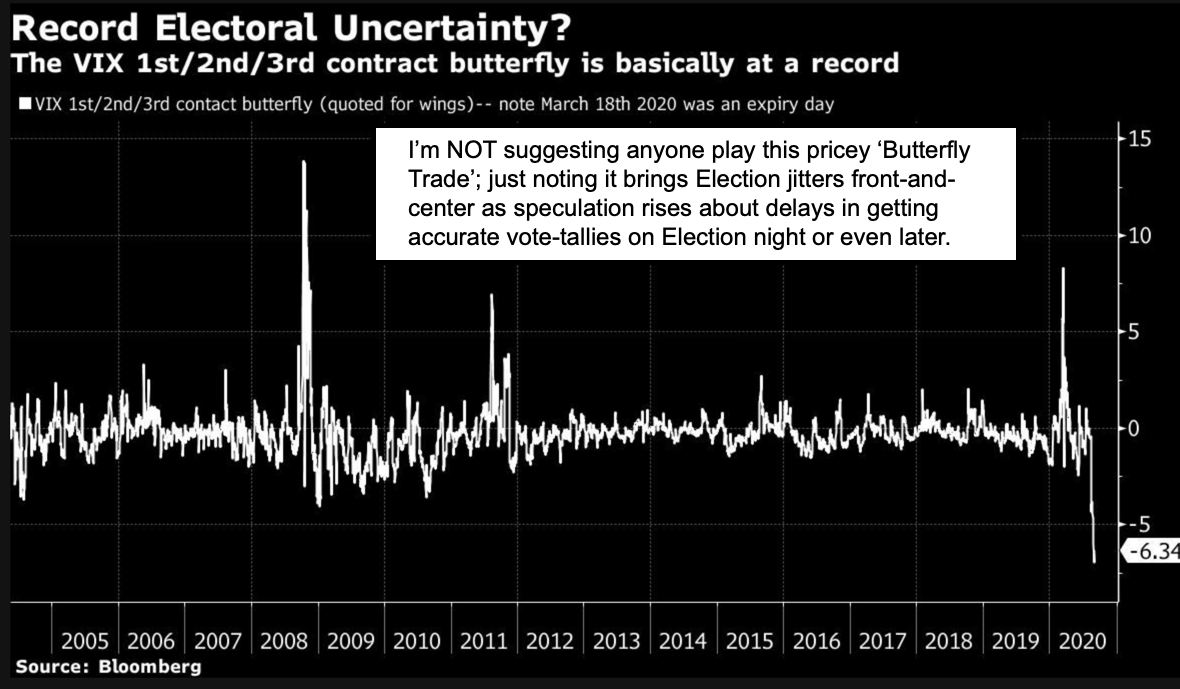

Bottom-line: all this is an upward S&P progression, with limited participation. There should be more rotation in the expensive stocks than there is, but it sort of shows the concern about 'when' those businesses recover, or in some cases 'whether' ever. The country outside of investors isn't obsessed with higher taxes on markets, though for sure the general market view out there is that if you get a Biden victory you get a market decline. However even that ultimately regroups and likely recovers (maybe in a broader way incidentally, as more favorable to big than small business some say). I see the Street's view clearly in a different pattern if Trump wins reelection, so maybe part of today's extension related to 'bookies' suggesting that. Of all of possibilities in this known/unknown political era, I suppose having an undecided election for weeks or longer might give us Pelosi. I have no perspective on the S&P under-performance existing during such a situation (hopefully that remark was somewhat in-jest). Conclusion: as constructive as we've been since calling the March lows, as well as for weeks questioning the 'concentrated leadership' of a handful of big-caps, this is a continuation pattern without extreme readings on the broad Oscillators, though with a indeterminable perspective about the pace of post-Covid revival, you have a narrow leadership that still dominates, even as more stocks try to wind-up their corrections I have noted ongoing outside of the senior Indexes. |