Market Briefing For Thursday, Sept. 24

Rapid sobriety returned - with a vengeance, just slightly before expected anyway in the course of 'evolution' of the S&P decline, and this time the selling was broader in a sense (with a reason I'll suggest) than merely being led by the 'super-caps'.

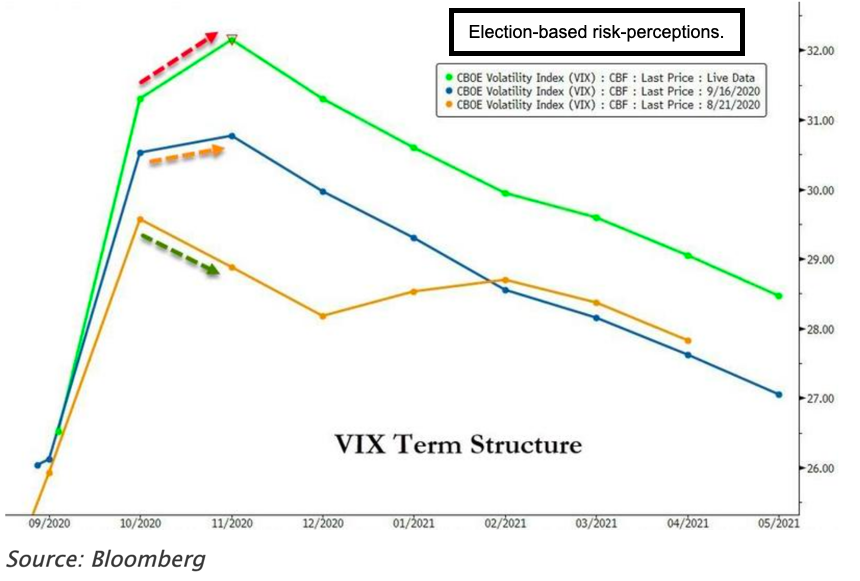

They, for sure, also cratered somewhat and that would be as outlined for weeks since we identified not merely the probability of correction, but a specific blow-off peak that I described as an 'S&P overshoot' as the key senior index exceeded a then-rising-tops pattern (above the 'standard deviation' envelope or 'band') typical of a top. (VIX)

Executive summary:

- Market break today was just hours (at most) ahead of expectations, within context of our projected 3rd leg down, with a break, intraweek rebound, then lower.

- The decline was broader than the S&P, primarily because of Oil (OIL) breaking down in the wake of the California decision, and realization of 'zero emission' implications on a broad variety of industries, and not just in the 'Golden State'.

- Though media isn't reporting it (as far as I know), we learned that at least one of the largest brokerages is 'soon' going to increased margin requirements, rather specifically because of concerns about volatility associated with the Elections.

- We totally agree with such defensive stances, and may help insulate the firms (and their clients whether they like it or not) from some of the potential risks.

- I also believe today's report of Citigroup (C) shuttering its retail options business (as relates to 'order flow' from most discount brokerages), is a big deal, and some of that has been how the industry coped with zeroed-out trading commissions,

- Presumptions (with we have shared about S&P prospects) that resumptions of downtrends was probable, tended to provoke selling without waiting for 'proof' or more evidence, especially after the higher margin trend became evidenced).

- There is no change in our measured downside range, however we do not tend to ever require the market to telegraph a 'percentage' of S&P decline, but rather do listen to the messages of the market regarding distribution (January / early Feb. and again mid-Summer forward, including the period of super-cap excesses).

- Alternatively the same might be said about watching for accumulation zones or capitulation points (sometimes hinted at by Fed stances such as in March), like our March 23rd low, or the correction call over a month ago, as well as specific overshoot for the S&P at the time.

- The downside is a work-in-progress and not seen as a bottoming zone for now.

Inherent in all this was clear realization that the 'run of the mine' stocks were peaking months ago, typically in June, while some of the COVID-19 plays tended to make their tops in July or August. One reason for their continued interest relates to being stocks that reflect 'needs' of people (actually of all humanity), as contrasted to 'wants' people have, which relates to almost everything beyond bare necessities for daily living.

All this takes me to 'why' the broad list got clipped today more than typical along with the FANG / super-cap types, and there are probably several reasons. The primary is a growing realization of probably market irregularity the closer we get to Election Day as well as the nastier the below-the-belt political types and supporters become, with a fear (usually not correct in either extreme) that going one way or the other spells sort of a doom for society, for finances, or importantly, for the stock market. It's not so but there are variations, with the preferences of Wall Street fairly evident as discussed.

In this case there's one more thing: leverage. I've pointed-out often how professionals (appropriate term at times, but often using similar algorithmic methodologies tending to magnify moves up or down) .. how professionals use greater leverage than what's available to the retail investor. However, the retail investor has been attributed as the primary factor lifting either very low-priced stocks or particularly the late stages of the 'super-cap' rally (hence stocks like Apple (AAPL) and Tesla (TSLA) finding buyers and rationales by a few analysts for chasing price 'after' they split, which made no sense at all, but it was expected, because of the 'perception' of affordability, which again reflected naivete.

In this case, the leverage issue comes home to roost (or is about to). Lots of people have ploughed money into overpriced speculative names and done so in the riskiest of approaches at times, using margin. Whether it's higher leverage from hedge funds as they disagreed with us back in late March about the capitulation and buying time, of course chased the upside and contributed to the false breakouts above recent highs.

Those hedge funds typically are leveraged or they're the parties writing options trying to generate extra income from those holdings, or both. The retail public occasionally will write options, but mostly tends to be on the buy side of Puts & Calls, which really is not often the winning side (which seeks reasonable revenue not home-run goals).

So where does that leave us? The first of probably several institutional firms started their notification to clients of a progressive increase in 'margin requirements' starting later this month and continuing until the Election. Just hearing about this shook stock prices, especially in those played by the so-called Robinhood gambling crowd, along with the hedge funds who were playing for our projected rebound and jumped-out in a New York minute once the story came-out about Interactive Brokers being first to say they will increase both initial and maintenance margin requirements mostly in October ahead of the toxic (my word not theirs) Election volatility.

They are basically protecting themselves, not clients, but phrasing it as a way to tone down client aggressiveness in this political environment. I agree and do not concur at all about the financial media crowing about using the dip for buying. Depends on what sectors or perspective I suppose, and there will be exceptions to volatile shakes (that will include winners vs. losers in the COVID-play arena too of course). But I contended all along in recent months, not just days, that margin leverage should be avoided.

Bottom-line: this is not a range-bound market as media pundits concluded. It's really a heavy market generally, led by the super-caps, but assisted by higher margins that are coming (where applicable, and will vary between major firms). That more than anything, is what led the market lower in today's afternoon trade.

Also, the California decision to mandate all new cars being 'emissions free' by 2035 is a factor, and it's not one that Washington can easily overrule. Because California has a history of pace-setting in pollution and environmentally-friendly rules, car makers of course learned decades ago not to build cars for 49 states, but for 50 states. (There was a time when there were cars made for California standards above Federal auto requirements, but economics preordained that manufacturers make cars to comply of course with California guidelines.)

In this case it impacts much more (including today the break in Oil stocks, but not so much Oil), because it hence telegraphs that most cars will have to be zero-emission increasingly over the next 14 years, and that means EV or hydrogen or any hybrid but zero emission is the point.

In-sum: trends that were persistent cracked too (even home builders), which also has me thinking it relates to the warnings to get off of leverage or margin. I have believed that this period of duress and shakiness ahead of Elections was pretty evident for at least a few weeks and more so more recently, so I'm surprised anyone was favorable to the extent of being leveraged.

Also, the prolongation of the COVID-19 situation also is an unfortunate but predictable series of secondary outbreaks, schools and so on. All that, including Europe suffering similarly, tends to reinforce the argument of mediocre economic gains nearer-term.