Market Briefing For Thursday, March 1

Neurotic swings persist without any change in Fed policy (other than wishful thinking from Bulls who wistfully would like to return to a 'good news is bad news' reactive market). That crowd, as I've noted recently, actually hopes the US economy does not respond to fiscal stimulus of any type; because they need very low interest rates prevailing for their market approach to work. The party ended; and they've not sobered up.

One of the problems with that approach, which continues what I warned of as their 'let's fight the Fed' thinking, is that the market has discounted 'actual' spirited recovery to the extent that it's not just about rates (even if mostly so short-term). Now you will need actual growth (beyond those buybacks that have returned to a degree) in profits to justify these high levels the majority of most-concentrated fund holdings are orbiting near (FANG and more of course).

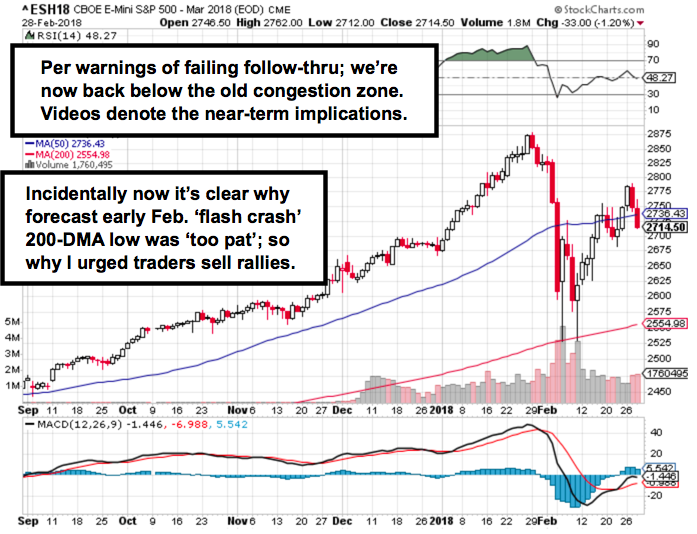

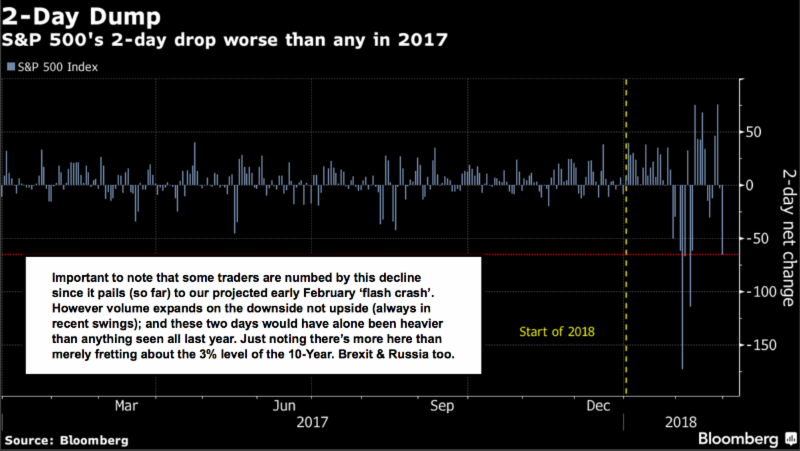

Remember; in January I called the move unsustainable as a parabola; a probably 'hard break' by early February; and a rebound that would be for trading not investing. Once we got it and the usual pundits trotted-out a slew of lists to buy (they still do it), it was time to contemplate my overall forecast, which was 'crack' the S&P, rebound with Oil and FANG leadership; then as complacency returns prepare for Round 2. Tomorrow we get Round 2 of the Fed Chair; but there's more afoot. I also saw NO reason for the Chairman to clarify and expected him to be right in line with other Fed heads on policy; as he very likely will be.

Beef Goulash or Shish-Kabob ?

So why are they 'fighting the Fed'? They are full-boat long. If you had an economic climate that allowed perpetual low interest rates; many money managers envision just continuing to levitate financial assets (like years prior to the Election). The catch is we already had that move; now we need profits beyond those already discounted, to advance prices; not a return to absurdly low interest rates.

So you have 'bad news Bulls' who pray for problems to hold rates down 'as if' the old game would revive. Spring rebounds and oscillations or not, the question is whether these cycles continue to 'orbit' high levels or just get hit. That's the difference between a beef-stew (rotation with little gain incidentally) or a shish-kabob, where the Bulls are simply skewered.

Bottom line: they can't have it both ways. The Fed Chairman's remarks were almost precisely not only the 'tone' I suspected he would take, that reiterated the monetary policy admonitions from various Fed-heads over recent months; but rebuffed the 'bearish bull' crowds, who are nervously holding their virtually full-boat long positions; and at a loss of what to do.

At the same time 'record margin' levels on the public side matter; but it's rarely noted ...these institutions and/or hedgers and/or funds, are using leverage to 'force' markets to conform to their need, rather than because they really believe they see value.

That is my opinion; but it's probably exactly what they're doing; as fund inflows alone can't account for the dramatic swings and efforts to hold a tenuous rally by the March S&P over the 'congestion zone' I technically observed at the 2750 level. As that level restrained prices until Friday's suspected sneaky break above it, leverage was employed to squeeze shorts. (And the leverage / borrowing-power the guys have is not retail levels at all; but far greater; hence they can't sustain the follow-through.)

I suspected that occurring because the resistance evolved into a slowly declining standard-deviation daily 'mean'. As that eased lower it became more visible to everyone for a few days, hence an invitation to take the market higher and run-in a ton of short-sellers. But not necessarily a full new leg-up. Hence it was an A-B-C rally; but not terribly sustainable as I had warned of both before it even happened, and thereafter. It's tricky.

In-sum: not realized by most investors, the professional traders have an ability to employ leverage or borrowing power nowhere near retail levels at all; but far greater. Leverage is also an 'Achilles Heel' during reversals, as they can't sustain 'too much' of a 'hit' (beyond, say, what we projected for early February), without that leverage being a real equity killer.

To wit: if they are leveraged 4 x 1 and you get a 10% decline as we did; they are seriously hurt. For normal investing, let's observe that anyone with 'passive investing' holdings that declined by more than 10% should consider that their manager (or holding) was leveraged. Many of those leveraged funds are at-risk of disaster if there were an overdue 20% hit.

Conclusion: there is really 'no such thing as passive investing'. Whatever you invested in managed by funds or systems; or a money manager; is not 'really' passive. Somebody has to make a decision (even if 'algo-based'). Therefore my advice to mostly all investors who 'think' they are using fee-based investments, is realize that it's only 'passive' to you; not passive to your money. Hence I believe everyone has to be 'active' watching 'passive' holdings. And if necessary reorient holdings, if they see hints of excess leverage. In my view this market is more dangerous; and will get so if this persists into the Spring. Hence in a perfect world there would be no debt now; of course, zero margin; with trading focused away from leveraged tactics.

Just wanted to invite readers here to join us this week. (And please realize that my technical videos and further charts are only available in the full service.) As I spoke at the NY Trader Expo; there is a $50. rebate on new Daily Briefing subscriptions this week only if you indicated the word 'Expo' in the feedback window when subscribing at our website.