Market Briefing For Thursday, June 6

The investment 'realm' holds many challenging alternatives that most of today's analysts and pundits are debating, or hold divergent opinions about. A lot of chatter, and yet 'none' know reliably, how the evolving and pending contingencies impacting almost every area will evolve.

That's why you hear 'defaults' to either 'all is fixed with a trade deal' (that's in fact not what would happen, which is why cash raising on rallies was really a justified approach on the Spring distributional rallies); or the disputes fail to get resolved, and we find (for instance) China hell-bent to predominate in Asia (they are) and thus the view we're better off 'not' to make a deal.

Most markets 'do' want a deal; and a deal actually helps China stabilize and move forward to advance their agenda faster (notice they completed illegal militarization of several islands in the South China Sea that they had agreed not to militarize in previous meetings, but now it's a fait-accompli).

There is global deflation ongoing; as the race to the bottom in rates persists. I generally agree with the President's trade policies; and hope he restrains a modicum of the confrontational nature of discussions; where it's appropriate (in the case of Mexico the message is conveyed; now work it out) and not if it's not. Acting in the best interests of America remains foremost; while we're also navigating the high-wire act of maintaining relationships with allies.

Most analysts debate greater growth, focus on superficial issues like jobs (at this point that's moot as really obscured the sluggish economy for a year or so); or (more enlightening) talk about low liquidity or a potential credit crisis.

In stocks the spreads are wider; and the concentration remains leveraged or aggressive trader play in the narrow universe of stocks that move. In a way the volatility reflects the limited liquidity in the market. Moving markets fairly rapidly (sizable moves down or up within hours) is a liquidity crisis too.

Geopolitical events aside trade & tariff issues have been largely eclipsed. A story surfacing late today may change that a bit. As you likely know, Jared Kushner has been a bit embarrassed by his efforts to befriend Bin Salman in Saudi Arabia; primarily due to the subsequent Khashoggi journalist murder.

It's increasingly evident either that the Saudis dishonored their promises to the United States (for the increased military support and more); or (if one is to take the view of CNN who broke this story) that the Administration knew a lot more. Politically Trump's opponents will want to color it thusly regardless. We aren't going to try judging that; but think you should know this.

In a '60 Minutes' interview in 2018, Bin Salman has made clear that should Iran obtain a nuclear weapon, Saudi would work to do the same. Saudis are among the biggest buyers of US weapons, but are barred from purchasing ballistic missiles from the US under regulations set forth by the 1987 Missile Technology Control Regime. That's a multi-country pact aimed at preventing the sale of rockets capable of carrying weapons of mass destruction. China, not a signatory to that pact, has been periodically selling missiles to KSA.

It is now being alleged Intelligence believes Saudi Arabia has significantly escalated its ballistic missile program with the help of China; a development that threatens decades of efforts to limit Mid-East missile proliferation.

Now the political part (CNN emphasizes, we don't know) alleges the Trump administration did not initially disclose its knowledge of this development to key members of Congress. The previously unreported classified intelligence indicates Saudi Arabia recently expanded both its missile infrastructure and technology through recent purchases from China. We mention it simply as a concern (we don't trust KSA, and never did; and will not forgive involvement in 9-11, nor should any civilized person) regarding regional stability. Just as a 'for-instance', CNN leaking this story (for obvious agendas) might just get Tehran to use it to justify their own efforts to ramp-up missile forces; plus it's already 'bad enough' with Hamas 'thanking' Iran for enabling their attacks on Israel with 'rockets provided by Iran' as Hamas last week proclaimed. So let us just be aware there is more going on than Fed or trade-related issues.

In-sum: the cavalcade of alternative market patterns being debated, are too reflective of angina (uncertainly) about what's likely to actually occur. That's a frenzy that can't be assured by bull or bear alike; and enhances neutrality, or even a Summer trading-range prospect, as I suggested last night.

These can be terrific to anticipate and actually swing in opposing thrusts for traders; while being inconclusive for investors, who won't find a 'Holy Grail' answer, almost regardless of some of the news headlines that emerge.

That, at the same time, can be healthy in a sense; as it removes enthusiasm while stirring some nervousness; and that eliminates overbought conditions in so many stocks (especially FANG & MAGA types), which join the majority of more pedestrian (if you will) Industrial and general stocks already softer.

Bottom line: this can be a variation on last year's 'rinse & repeat' behavior; and interestingly can set-up a favorable pattern for the market either later in the year, or upon resolution of a couple of the pending issues. More likely a series of swings that again do not resolve the serious macro prospects very quickly; and do set-up an investment-grade opportunity 'down the road' a bit as we'll assess (in a perfect world by the 4th Quarter things get interesting).

This certainly could change quicker; given the nature of the challenges; and at-minimum those scenarios will impact trading moves for the S&P and even more dramatically for the NDX (Nasdaq 100) or Semiconductors (SOX). If anything, once again Oil may point-the-way; but for now it's on defense.

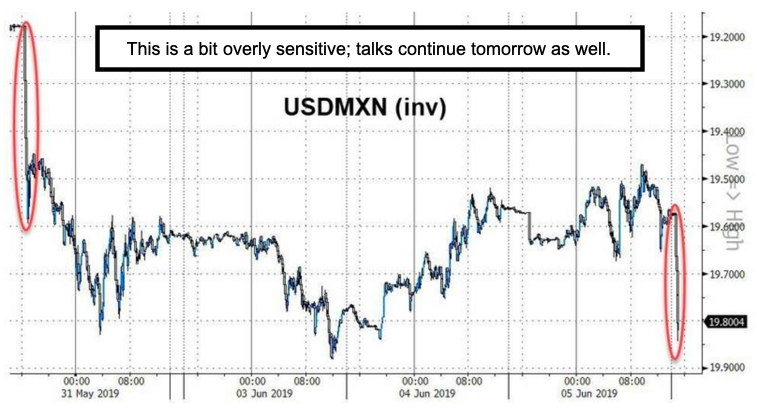

This evening President Trump says 'there is not enough progress on what Mexico can/will do yet'; so this remains in-the-mix for the moment.