Market Briefing For Thursday, Jun. 10

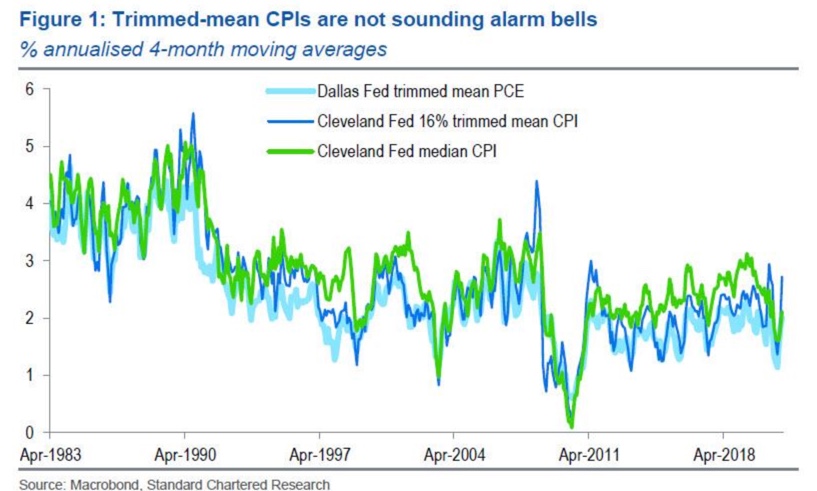

Transitory or enduring is the great debate about inflation, but realistically it's not entirely dependent on tomorrow's CPI number, aside the initial reaction that will be explained away by either bull or bear. Real yields in the US remain at incredibly low levels, and would not be where they are if not for Fed buying.

Essentially I'm arguing that this is all financially engineered, that tapering will mean more to the market (or lack of it) than the pace of inflation, though it for sure is here. While certain commodity prices will come down (I've noted that), it's the presumption that Fed is way offsides and will have to do something in the fullness of time, which is something the market is more concerned about.

I'm generally thinking a mixed CPI when you break it down, ultimately there is no was wages will regress, and hence they can't be transitory. Hard goods not much change, and commodities probably see the edge come off a bit.

Margin pressure becomes an issue for the S&P 'if' increased costs aren't able to be passed-on to customers (or end-users) hence pricing-power matters in a sense more than whether they 'massage' the CPI enough to support transitory arguments. We're not being dogmatic, just emphasizing that the liquidity flood has triggered inflation, no matter how you cut it. (Even my dentist today had a new fee, the 'appointment fee' on top of the normal routine cleaning. Reminds me of a hotel with a 'resort fee' which is offends customers.)

But that's how life is now, and I'm sure wage inflation is not so transitory, so regardless of CPI in this report it's really working higher. Now Government is so concerned to give the 'illusion' that their frenetic spending didn't trigger any lasting inflation is primarily aimed at one factor: Social Security.

In just a few months Social Security payments for 2022 will be finalized, and that's for the most part based on changes in the CPI. That's why Government plays a game of saying car prices are lower if they include safety accessories that in the past were optional, or a new computer or iPhone has more memory without an additional cost, versus the preceding model. It's an indirect way of manipulating CPI. Consumers are going to get to a higher aggregate inflation pace later this year, and that regardless of the games played with CPI.

The market is unlikely to be 'supercharged' for now, and the feeble behavior's a sign of exhaustion. However, I suspect the bulls will try again on Thursday, with the outcome perhaps dependent on Oil prices (OIL, BNO), besides the CPI release. It was the CPI concern that generally kept traders fairly sidelined, so I'll give it credence for that rather than having a mediocre 'hump day'.

This is an excerpt from Gene Inger's Daily Briefing, which is distributed nightly and typically includes one or two videos as well as charts and analysis. You can subscribe more

Transitory means not permanent, it does not mean "short term. Life is transitory.

My point here is that "transitory" is a very carefully selected weasel-word that is intended to obscure the truth. So while this last blast of intentional inflation will not last "forever", it will be doing it's damage for a long time.