Market Briefing For Thursday, Jan. 14

For nearly a yearsince projecting a similarly-timed S&P shakeout, for a late January/early February time-frame, so many market influencers 'evolved' shall we say. As we got into last January I escalated warnings to a 'crash alert', as I heard first hand from investors who had been to China, or had relatives there, and that information came partially from attendees at my Florida Money Show presentation (the last in-person event). I'm updating this for those who are apparently frustrated that the market hasn't collapsed I guess, because I rightly advocated 'against' shorting for quite some time, now.

My point is when I hear chartists comparing this year with last year and entirely do omit the backdrop of COVID. Though it lingers, the prospect of emergence may limit the downside of the next shakeout, to nothing like what we got last year.

Executive Summary:

- The stock market continues relatively sanguine during not just my illness (not yet defined), but as suspected not heavily moved by political unrest.

- The President, via an email to Fox News, called for an orderly transition to the new Administration, and requested no violence or vandalism.

- Nevertheless the House moved forward with Impeachment, and with 10 Republicans voting 'yay', it passed, however no Senate action is expected.,

- If we can calmly get through the next week, the influence on the market may well wane, but we'll still be looking for a shakeout in the S&P.

- Because the market (and corporations) are 'somewhat' adjusted to these pandemic business conditions, there is rotation from pricey super-caps to the infrastructure (or similarly under-priced sectors affirming a forecast of several months ago.

- It take lots of 'heavy lifting' from the broad market to offset big-cap 'sag' if that really arrives, however so far that area is holding together, thus helps the S&P to 'hang-around' in the low 3800's around our maximum target or measure for this overall phase of technical action.

- Ironically the increased demand for computers and cellphones has helped the backdrop even as growth outperforms value.

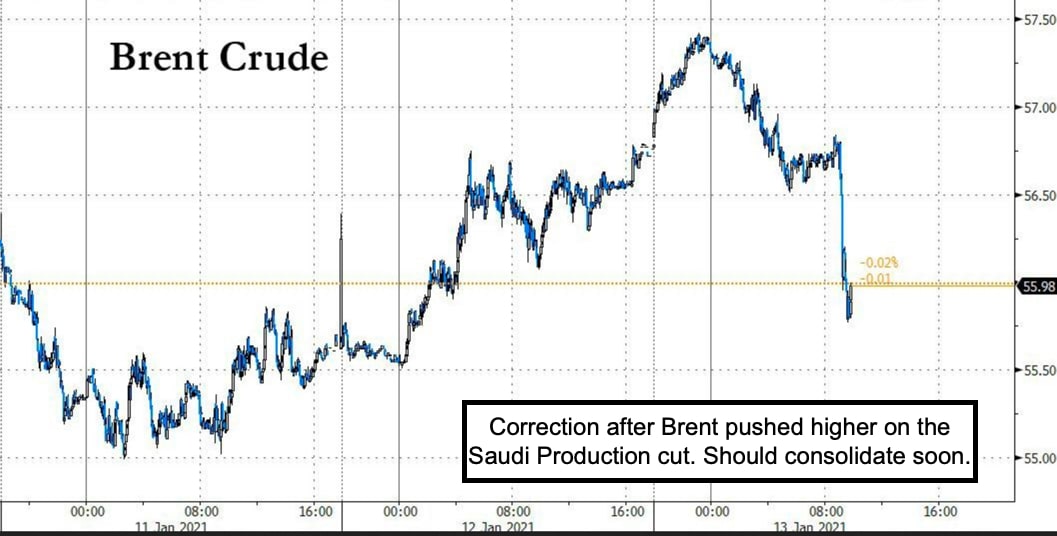

- The Energy Sector continues acting well, but many of today's new upside call hopefully are correct, but the optimal entry was when Oil (OIL) was in the mid-30's and everybody hated it (I called for 45 but higher if geopolitics, in this case Saudi production cuts) occurred, optimistically simply hold.

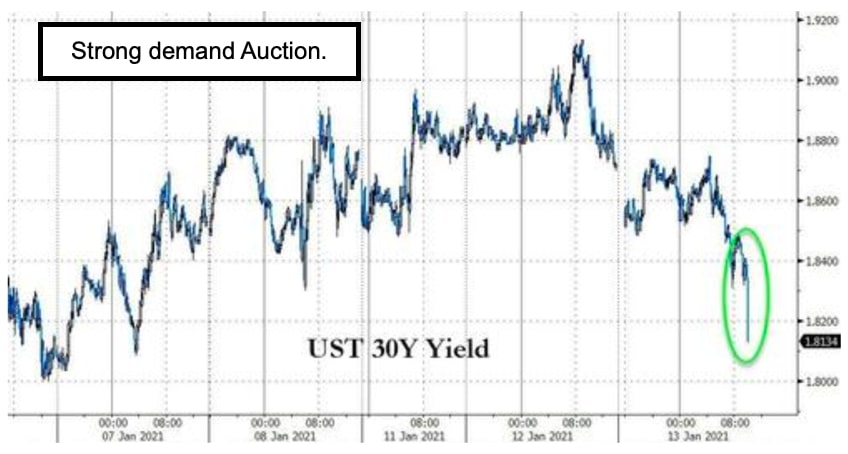

- One other key forecast is starting to take form, that's a rebound in the US Dollar, while the 10-year also continues to firm a bit (SPTL).

- On the COVID front, there's one big story: the J&J (JNJ) single shot vaccine that in Phase 1/2 preliminary data looks great, more comment later.

- Well maybe there is second story: Ohio researchers said today they've discovered two new variants of the coronavirus, one of which has become the dominant strain in Columbus.

- And I suppose Moderna's (MRNA) CEO saying we may never get rid of COVID fits in with arguments for Inovio's upcoming DNA vaccine, maybe superior as it allows boosting and cumulative better immunity without toxicity (maybe a new group in Washington will expedite that a bit?).

- The new strain prevalent in Columbus appears to spread more easily, and this new strain has the same genetic backbone as earlier cases, but it has three mutations that represent a significant evolution, and that's a concern pending testing to see how the existing vaccines do with it.

- Little LightPath (LPTH) also had a 15% rally which settle into about 12%, and on no news, which is more interesting (I'll also touch on more below).

- And I suspected the market would be mostly neutral this week amidst the chaos leading to the plug being pulled on Donald Trump, who of course is taking no personal responsibility for what happened (he encouraged it).

- For now, policies have not impacted the stock market, which I suppose investors hope just hangs onto next week's post-Inauguration behavior.

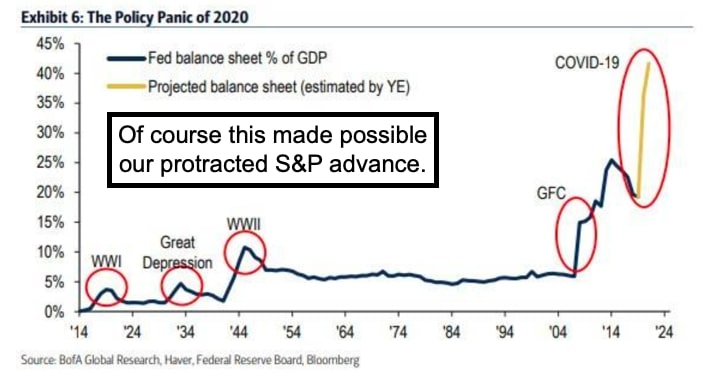

There's no way we would have dropped as much as the S&P (SPX) did if it were not for COVID, and the shifting fortunes and sector focus that resulted from pandemic. In fact, with money poured (excessively) into vaccines and not treatments but with the Fed statement underpinning Stimulus and a 'Fed Put' going forward, we not only nailed the March 23rd (Inger Bottom) low, but warned against the bearish case made by many prominent analysts, but all so far were 'off-base'.

Now we're going to get a correction, but ideally it will hold, and I suppose you could say I've been a 'centrist' on the market, not just politics. On the market it has been a realization that Fed policy must remain stable, that expectations of big spending later this year will help, and that the pandemic will be addressed a lot more aggressively, but without shutting-down the economy. It's touch for sure, but ideally will be contained as the sector rotation won't deny retreat, but temper it. Plus it's not a shock to the system.

Finally the President called more formerly (but not a National Address) for the maintenance of peace and sanity, and perhaps the images of National Guard, with weapons issued, itself becomes a deterrent to radical militia actions etc. I am still stunned that some Trump supporters do not grasp the significance of the SCOTUS decision on the Election, which is the final word.

The Business Community broadly responds, but in some cases too severely it seems, in terms of seemingly-playing to their own bases. More factions, and if this means insufficient alarm, or to the contrary, segmenting the Country even more in fragmented segments, that a topic for the future if people don't chill. It is entirely related to the assault on the Capital (or on SCOTUS given decision had already been taken).

How the response was to the thieving riotous vermin last summer isn't really a comparable gauge (it is likely a continuing concern), however bemoaning a softball treatment of those groups (BLM or others) is a totally different matter.

Ironically though, those events did more damage to our business or big cities than anything here Trump has done, which impacts the Nation's principles lots more than the underlying tensions within the political environment.

In-sum: politicians grapple with 'how to come together' or remain largely split. Nevertheless 10 Republicans voted with the House Majority for Impeachment, at the same time it is presumed the Senate won't convict in a future Trial.

Now this market, contrary to what some say, remains married to 'stimulus' and to progress against COVID, as those are the primary issues for the moment. In fact our basic high level S&P neutrality call this week reflects much on-hold.

Where do you think $LPTH is headed?