Market Briefing For Thursday, Feb. 7

'Priced for Perfection' is a common refrain for the market's status now, in the wake of our projected run-up from the indicated December V-bottom. In my view that low turned into 'more' than a rebound to resistance/congestion, largely because of the 'calmer' central bank policies, really a global scenario that is primarily the catalyst behind the S&P 'nudging' above our upside goal just as suspected likely. So now what?

We already indicated that once we pushed-up into early February, risks of a short-term top would increase. Seriously; what's really happening is not a reaction to the President's State of the Union (which generally was the best speech he's given, even if he didn't pause or segue between topics).

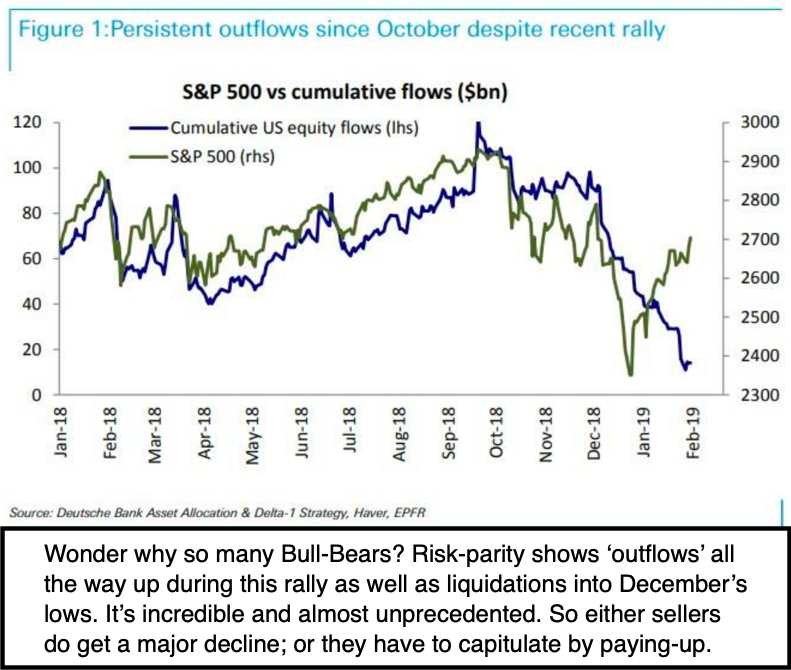

What the current 'seemingly jittery' S&P condition is, boils down to factoring in a deal (of some sort) with China; realization it's not bargain day; plus with so many (normally) Bulls missing our projected selling outlined last year, as well as the low in December; well they are sort of 'Bull/Bears', because that is not a strange animal, but rather hoping the market sells-off to let them in.

So let's summarize where this leaves us for now:

- When too many 'normally optimistic' technicians and analysts suffer with angina and keep talking-down the market; it often works higher, since it is uncommon for the market to announce a forthcoming decline;

- As I've noted during January; the market can stay 'daily basis overbought' long than those Bull/Bear types can stay short;

- We have advised against shorting or liquidating; with expectations that risk of a pullback would increase for February;

- Importantly, we believed (still do) that such a pullback will be within context of an overall uptrend dating from our December lows;

- This fairly optimistic assessment could change given many variables we all know of; but particularly if the China talks were to go awry; or we get more impact from Brexit than anyone wants to discuss;

- UBS getting approval to transfer something like 30 Billion from London to Paris can be a hint of the kind of upheaval that Brexit could presage;

- Most myopic U.S. analysts (Bulls or Bears) are overlooking international impacts aside the China talks; and seemingly view Brexit as benign (in my view it won't necessarily be so smooth if that even occurs);

- The U.S. Dollar has remained firm as suspected, which isn't welcomed by big multinationals, but is something we view as acceptable;

- Stock market behavior continues to be bifurcated, more as a market of stocks, rather than a stock market;

- A slightly diminished focus on 'passive investing' (that we warned of at all gatherings in 2018, which was a 'sell the rallies year') is welcomed;

- Given the bifurcation of markets (or stocks within sectors); analysis by analysts increasingly must focus on issues, not just ETF's;

- The downside of algorithmic trading and ETF concentration we warned of last year is increasingly grasped by money managers and investors;

- Again; the key focus on 'why' this entire rally would occur, was and is a perception of economic strength not quite so 'booming' as many say;

- Hence that allows (required) the U.S. Fed to change it's 'tone' just as I thought in the wake of China's PBOC and the ECB's earlier calls for a 'calmer' monetary policy (which translated to the U.S. Fed based on an expectation of 'coordination' between the major central banker policies);

- Technically the market is having difficulty right where it should; at the 200-Day Moving Average.

In sum: this post precedes Chairman Powell's evening remarks at a forum. However we don't anticipate any revelations about policies unless he slips. My view is that the Fed 'showed their hand' and embraced a less hawkish or QT 'pace'; but they had the help of the PBOC liquidity injections, and Draghi backing-off on ECB QT, to allow the Fed to focus on reality versus spin.

Of course 'spin' was the idea that QT was based on higher rates, to bleed a bloated 'Balance Sheet'. With that global cooperation it's not so bad. Before he 'switched his pitch', I suggested Chairman Powell was off-base with the idea of hiking rates because of a 'too strong' U.S. economy; and thought it to be essentially nonsense to mask the real issue: Balance Sheet demand.

Fortunately the Chairman recognized this in time; changed the 'context' of a monetary policy, and I suspect it only impacts the pace of the run-off (with of course the Funds Rate being comparatively irrelevant or overly focused-on, by those who don't want to discuss real credit market implications).

Bottom line: the President clearly wants to make decisions that continue to sustain the overall economic and market upside. Political disruption has at least a chance to interfere with those plans, which may correlate indirectly with his remark about governing in the presence of investigations.

The point being; yes we'll have more trouble getting this market lots higher, versus what we got in late 2016 and all of 2017, which was uninterrupted for the most part, apart from pauses. And the favorable impact on earnings by tax cuts will of course not have such comparative benefit as the recent past; but will (along with normalization or movement towards that in global trade) help hold markets together overall; 'if' everything goes just right.

Given that we're fighting the 200-Day Moving Average; we can set up for a bit of a pause as discussed into mid-February; but it's news-sensitive and of course with so many skeptics (who missed the boat) shorts can be run-in at any time. We have not advocated liquidation or shorting; and would only be interested in that if we can get an upside spike perhaps on a China deal.

For now, China may be a topic 'beyond the interim pullback' I've discussed as likely in February (or part of it, perhaps coming right up). It also depends on 'what level' S&P is trading at such a time. Stay tuned in the weeks ahead as we see (for the moment) if we get a down-up-down Thursday.