Market Briefing For Thursday, Feb. 6

Bipolar behavior - combines economic uncertainty over the nearer-term, with an acceleration (sad, but expected for now) of the epidemic into the pandemic status experts have suggested forthcoming for days. So, what does the stock market do? Take the S&P and Nasdaq to new highs.

In a sense this can be a variation on 'climbing a worry wall', but there also is a realm of the political involved, since you had Mayor Pete emerge as a seemingly-viable contender in the Democratic primary process, while a well-choreographed State of the (Dis)Union speech on President Trump's part, sort of invited (was his lack of handshake at the start a 'bait for her') Pelosi's shredding his speech, as ironically throughout the presentation she flipped-through it 'as if' it were the menu at 'Cheesecake Factory'.

Needless to say, her mood would be better with actual cheesecake, while the President probably doesn't need the added cholesterol; although he'll be celebrating (and perhaps the market partially is at) 'acquittal' as he will call it, even though he's still Impeached, just not removed from Office.

All of this is amazing, somewhat parabolic, and just as Tesla (TSLA) kicked-off a surge higher (eventually seeking S&P inclusion) as car sales are delayed due to the epidemic (again go-figure), it's subsequent retreat (we warned as it soared that the move was unsustainable, would peak and reverse in our view, and it did, while cautioning that it would) preceded a rebound and that is when technically, it becomes clearer whether a short-term top is at hand, and whether (just like the earlier thrust higher impacted the market psychology at least) now we get a simply flip-around for the S&P.

However breadth has been adequate, the political picture less worrisome (at least a bit), but most are behaving 'as if' WuFlu (the coronavirus as I'd dubbed it) is nothing more than a seasonal flu common cold. It's not, so is this sort of (forgive the reference) whistling past the graveyard? Actually it is not because of several factors.

First, I will commend CNBC for finally coming-forth to mention use of HIV antivirals as potential treatments (they named several major pharma firms with drugs sent or being sent to China for treatment efforts) for the WuFlu at last. We have been mentioning this for a week, as even on the CSPAN interview with the John Hopkins Doctor, it took a 'caller's question' before he would volunteer that there was evidence of HIV strands 'in' the viral genome, and he mentioned that all those 'medical peer review postings' were gone, and had suddenly vanished.

Again, that was my point: put all the viral genome information, and drug research or directions to explore, in an accessible format and let experts globally ponder the best approach. I originally mentioned Dr. Read at a UK hospital, who did some excellent epidemiological work and prognosis of spread of WuFlu, which seems spot-on (unfortunately, as expanding).

It was not Dr. Read who posted a 3 a.m. rumor on the Internet suggesting a 'cure' had been found for WuFlu in the U.K. However, yours truly noted a week ago or longer that there was not one, but at least three HIV drugs showing efficacy against the virus, and that one was a woman seemingly recovered fully in just 48 hours, using antiviral (HIV) drugs in a Bangkok hospital, and that Hong Kong doctors were about to try a similar program using multiple drugs on their initially-hospitalize 17 confirmed patients. So there may be something to it, and sure success would be welcomed by a financial market overloaded with uncertainty, which is climbing anyway.

Sadly, while transparency is finally improving the course of the disease isn't. Despite belated but proactive efforts 'in' China, there were more deaths and more total cases. Speaking of that, Tencent (TCEHY) has posted what seems close to an accurate number (remember I was told from Shanghai weeks ago that the numbers were 10's of thousands, not the less official data). I noted the 'before and after' below about the Tencent posting. Was it just a typo; or did Jack Ma get a demanding call to post only 'official' data? Of course, we don't know, but Tencent posted the data for you to see.

All of this achieves the stock market erasing the decline triggered not by a coronavirus scare, but accelerated from it (we were already looking for a setback), or it may show a decline around the time I speak at Orlando's Florida Money Show (we may actually get both), on Saturday afternoon, when my talk on markets, with a special commentary on 'Cardiovascular Heart Attack & Stroke Reduction' of risk, occurs.

In-sum: since we all know how high the market levels are, my theme last year for upside focused on continuing the liquidity-driven (Fed-enhanced) drive, and avoiding (to this day) shorting the stock market. We viewed all of it being liquidity and buyback-driven, and not earnings-based. Still is at this point, however the extensions in the face of impossible earnings that loom for this Quarter (globally especially) should be challenging, but are again given a reprieve by virtue of liquidity injections, for now.

Daily action - is certainly based on liquidity-injections, revised worry wall sort of climb, the Impeachment (charade or not) behind us, and confusion if not ignoring of the (per Goldman) likely Global GDP decline this Quarter.

It's the kind of market psychology that's not sustainable, but quickly runs the gamut between overbought and oversold and back to overbought, at least on daily-basis S&P charts. We are skeptical more so than usual for the short-term, but ideally (and especially if the optimism about treating a horrible epidemic likely to become a pandemic, with the existing antiviral drugs pans-out successfully), we can go back to estimating how a better world with trade improved can sustain the upside.

Could everything fall apart? Sure, but not here and not yet. So, even in China there is dismay at the delay, (we talked about the WuFlu before Beijing's leaders did) and people are outraged, but they're not about to start a revolution in the middle of a fight to save lives of millions of their fellow citizens.

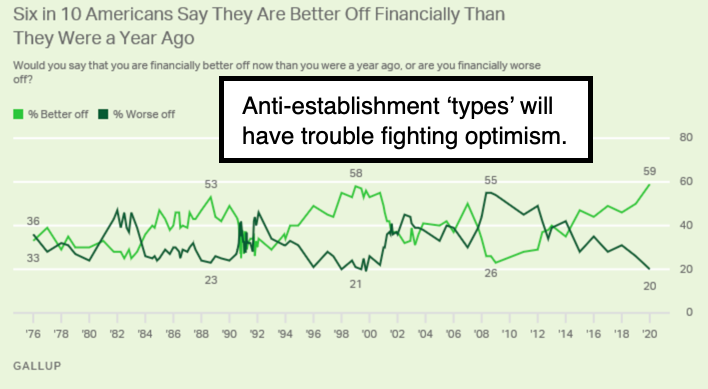

And incidentally, no matter what one thinks of Trump, voters aren't eager to trade something closer to prosperity or optimism (or perceived as so) for any sort of shift to the radical left. It just isn't going to happen, it seems the stock market knows that now and is pleased on that score. It's less of an endorsement of Trump than a critique of the other side, and hence the market was pleased that Mayor Pete did so well in the Iowa caucuses.

Thursday should be more upside, at least for a bit, but beware of 3 am stories that some traders might stick-in when it's actually not news (that's what happened last night as UK reports shared what we had days ago.. doesn't make us smart.. just means whether it was Dr. Read or another epidemiologist in the UK... it fit the desire for traders to spark an extension so they got on existing news).