Thursday, December 3, 2020 4:08 AM EDT

|

Lost in space might have been the title for President Trump's little-noticed late afternoon comments today, which I haven't contemplated deeply, since it appears the 'woke censor-drive' media either barely reported it, stuck warning label captions to it, or as usual, taking ideologue positions about it (don't know and no time to review what commentators tonight ... typically not doing proper journalism right.. have to say). So why mention it here?

|

|

|

Just because something might, it seems, be in his mind with his reinforcing all his previous positions, disputes with others in his Administration (despite what purports to be the Dept. of Justice saying the AP distorted AG Barr's comment yesterday, and again I don't know about that, other than Trump wasn't happy, to say the least). Now the President is talking about not enough judges willing to uphold the Constitution, which is 'his' primary job. Is he preparing us for the kind of political stunner that would indeed be disruptive to civility or markets?

|

|

|

I definitely don't have the answer to what's in Trump's mind, or plans, if any. It is a time in the stock market where we're overbought in some areas like techs and COVID stay-home / work-from-home stocks and associated vendors. I am suspicious that President Trump (and I'm not expressing any thought about all the argued issues, which most people seem tired of and just want to go forth) may be triggered into doing some extraordinary (and viewed inappropriately) judicial move that gums-up any hope of an orderly transfer of power, for now.

|

|

|

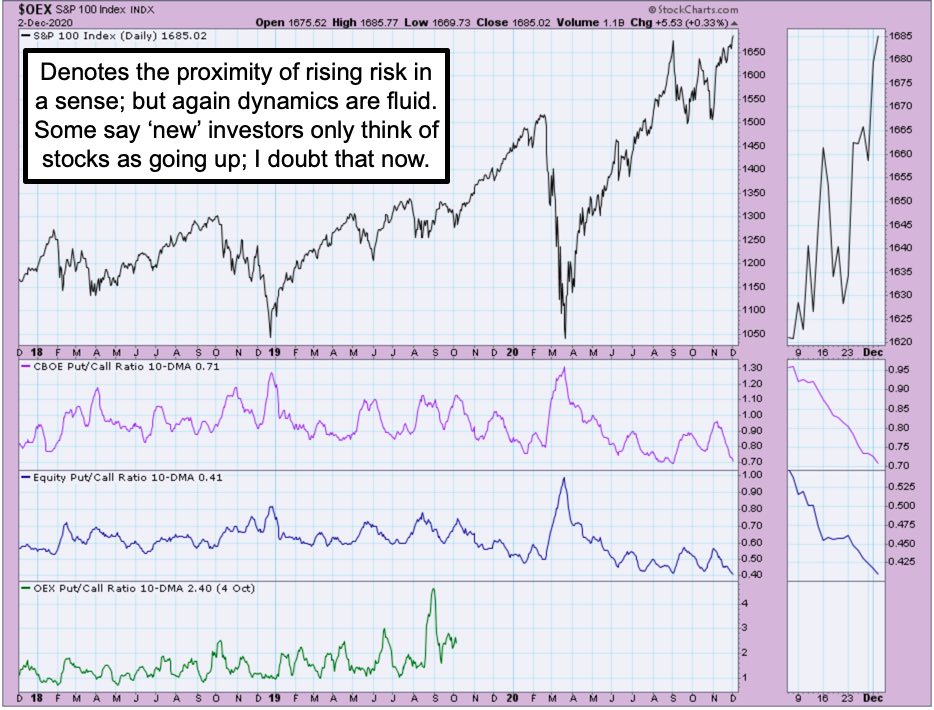

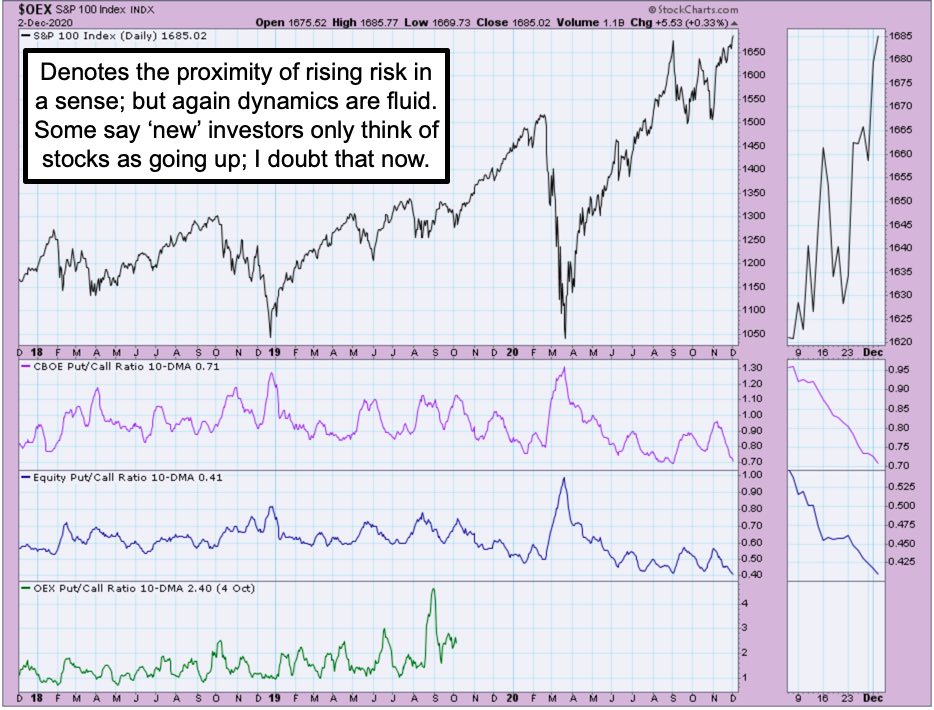

Just a suspicion, no idea, and no reflection on his words. It was a 2 minute or so comment, without a real conclusion. The market itself persists as you know an with the intraweek rally, while it should show signs of modest exhaustion, at the same time the Put-Call ratio is also around levels often associated with at least a short-term topping process.

|

|

|

Last night I spoke about Government money having mostly focused just in the direction of big pharma and vaccines, which we all hope are very effective (as again we're told by numerous officials). Actually it's almost a PR campaign as I am aware they're trotting-out executives and researchers who aren't even in the vaccine business to express awe and confidence in the trio of vaccines. In fact they're even mentioning that China has no less than 5 candidates now in Phase 3, and suddenly the tone is more favorable towards Chinese pharmas. (That's fine, after all they either designed or unleashed COVID, so good to think they can be helpful in resolving it.)

I pointed out that Moderna (MRNA) was insane yesterday morning pushing 180, and though it a sell, at least in-part. And it dropped about 50 bucks after that. Now we know it was Merck doing the selling, as they had a huge position. That's of course how you do it, but low and take gains rather than getting excited after a big run. So we focused on next-generation vaccines and therapeutics, and that's not changing eve if the vaccines are superb, and I truly hope they are.

So, Lilly (LLY), along with Sorrento (SRNE) are Regeneron (REGN), are prominently among the most-centered in that particular area of antibody therapeutics. And if they are able to partner-up, you might get a belated move from Heat Biologics.

|

|

|

Executive Summary:

- Confusion over the President's 'intent' of his rather bizarre brief speech.

- Vaccines are progressing after a bit too much euphoria about prospects.

- Ideally we will have a terrific economic recovery, but that's not what is right in-front of us.

- Economic fragility is here, but the proposed Stimulus would help, if they move fast enough, which hasn't happened yet.

- The President is supportive of the Stimulus Bill put forward by McConnell, so presumably that's helpful.

- Near-term big-picture catalysts are somewhat consumed, that's been our ongoing belief about S&P in this 'overshoot-zone' as I've termed it.

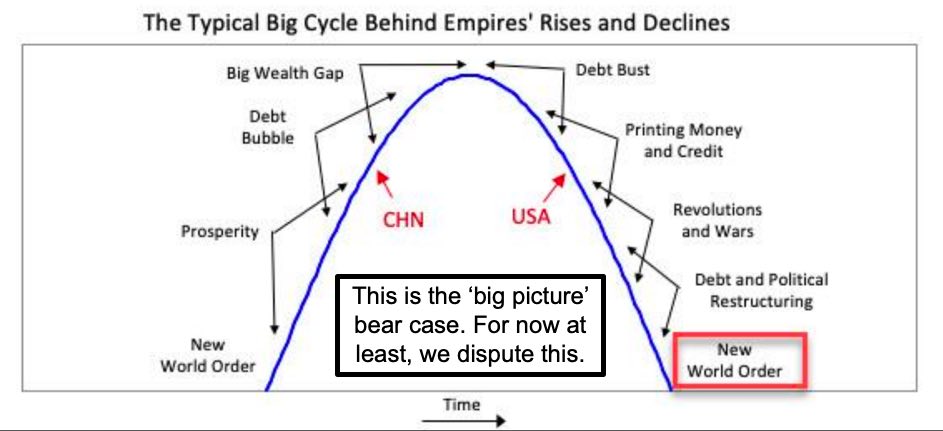

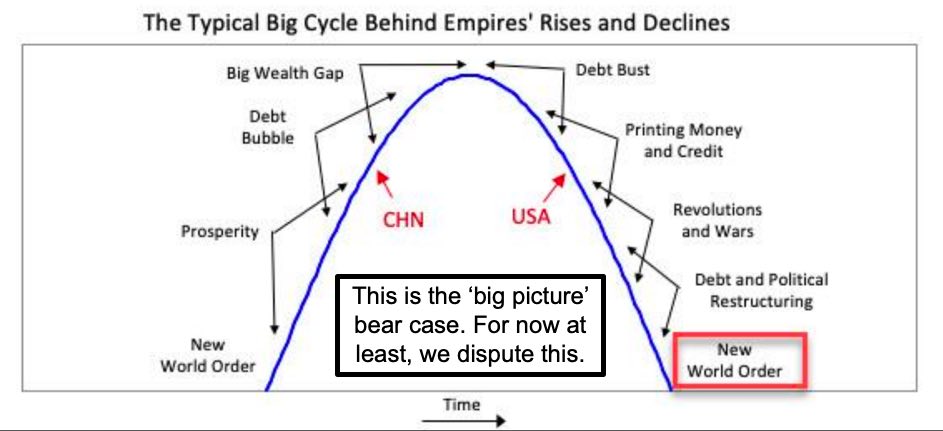

- Hedge and analyst types (yet-again) calling this the most dangerous ever seen for stocks, are the very same ones bearish for six months or more.

- Certainly that doesn't mean stocks aren't vulnerable to a shake from our 'overshoot zone' of the S&P, just means it won't be catastrophic.

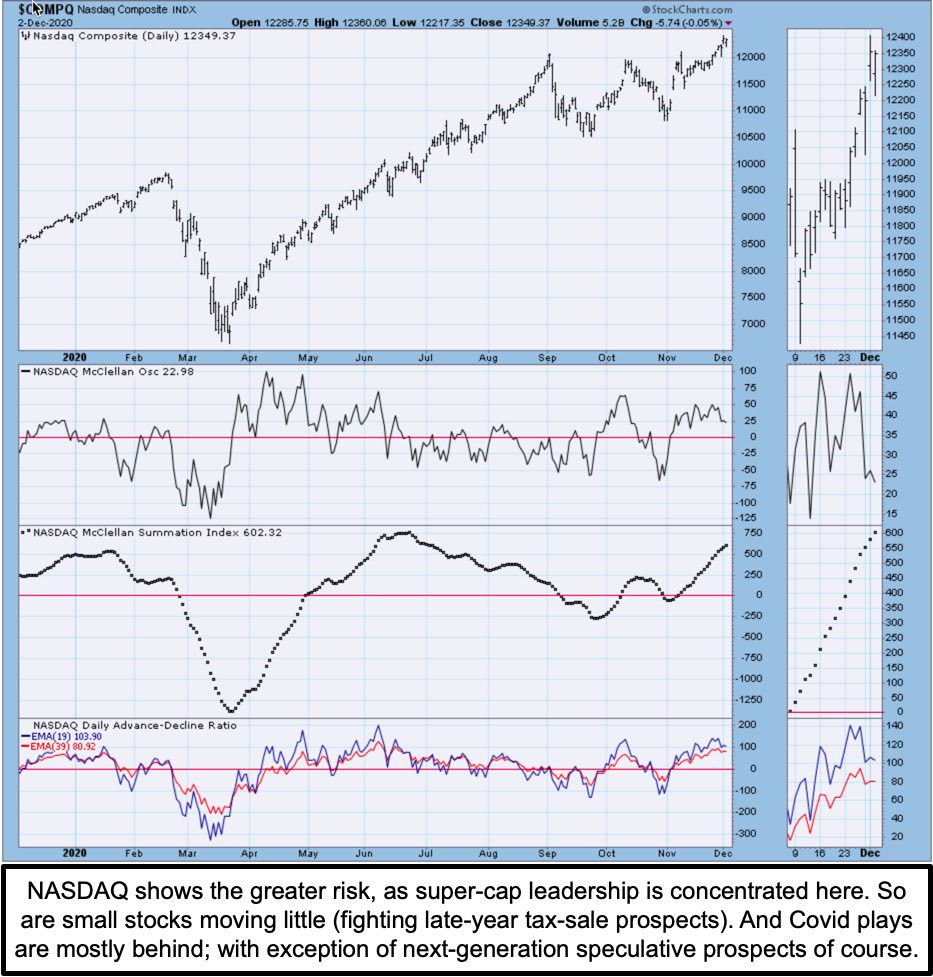

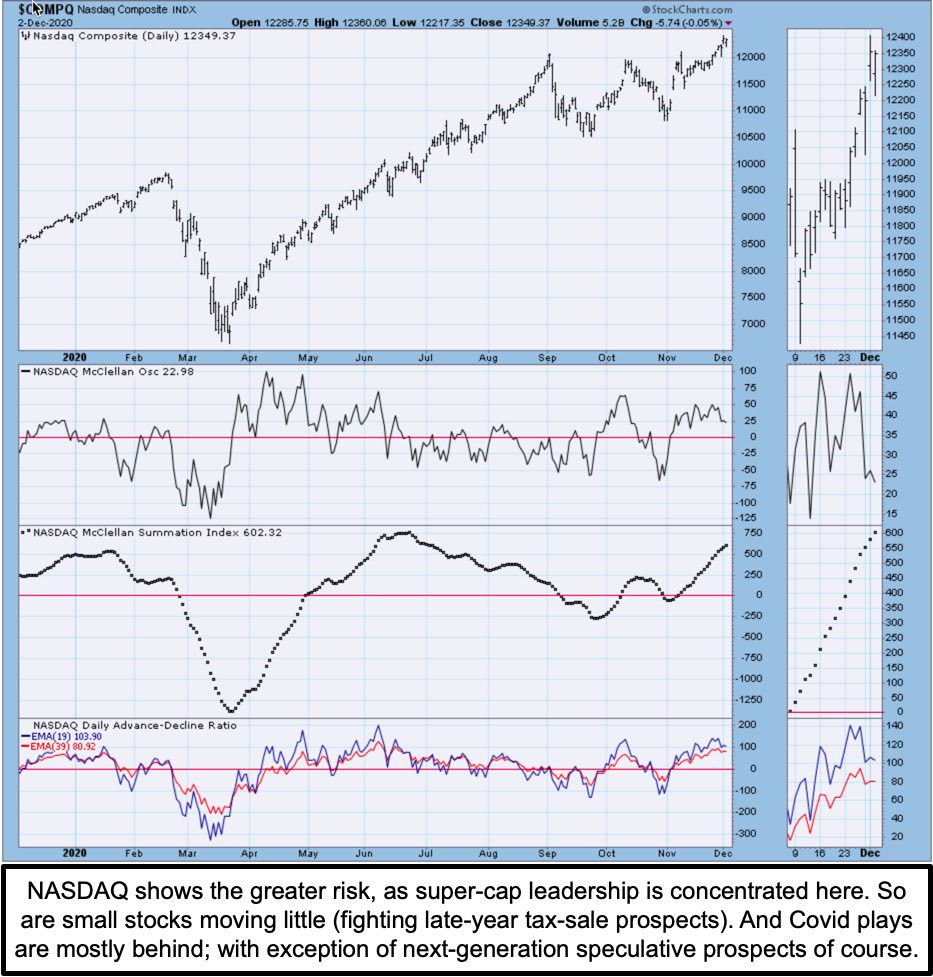

- The behavior of Zoom (ZM) and now Moderna or a couple others, proves my point about upside excess in a small universe of stocks that have been at the helm of S&P gains, they may go back up, but greed can't dominate.

- Most pundits calling for disaster omit the detail of narrow leadership.

- Political uncertainties are factors, but not significantly definable for stock market purposes 'yet', because both parties contemplate more spending.

- The proposed 'thin' near-term stimulus discussed today was disappointing to the market, which hoped for more during this difficult time for millions of our fellow citizens,

- Yes we are in a situation where the 'poor get poorer' due to no stimulus, in that regard it not about blame, but perhaps shame on politicians, for inertia about those struggling, overdue to have more than what was proposed, but the message got across, yes there can be an interim 'double-dip'.

- Contradictory views continuously clash about these issues, but it comes down to COVID mostly, and that's why even an interim therapy would help and we don't have that on a 'scalable' level yet, but stay tuned.

- Friction in OPEC+ is part of what's afoot, with the meeting Thursday, but so far Oil holding up quite well.

- Tough 'dark winter' looms, and at some point the S&P should shake just a bit to emphasize the nearer-term economic aspects.

|

|

Bottom-line: what matters now is opening the economy, ending lockdowns, and putting vaccines in proper perspective versus antibody therapeutics.

Clearly I'm 'not' joining the fear-mongers, but remain an enthusiast for weeks and weeks about what I call the 'Roaring 20's' (not Great Depression) though some perceive this as an endorsement of vaccines. Not really, although I sure hope they actually work. Meanwhile our contention that antibody therapeutics in a lot of cases is the preferable approach persists, but really both are clearly needed to enhance the armamentarium to combat this scourge on humanity.

|

Daily action - saw momentum firm in the Senior Indexes, while overall this remains a high-level record for S&P, against a fragile background sense.

|

|

|

While we envision the market grinding even a bit higher in this range, realize it is due for a shakeout and any exogenous event would merely expedite that.

|

|

|

Conclusion: the market is nearly 'full bull' as some might put it, but this beat persists until it doesn't. Generally a bit too stretched, but not suggesting taking an overt bearish posture, as too many still persist in doing. For sure arrival of 'antibody therapeutics' on a mass-scale would help markets by the way, but none of this was going to be clarified yet, but getting there.

|

|

How did you like this article? Let us know so we can better customize your reading experience.

Thanks for the interesting and insightful article. I am especially impressed with all of those "Black Box" comments,, similar to the warning black box on some medicine information sheets. It definitely provides emphasis to the statements. And the comments of attribution of this plague do make a lot of sense.

Could this whole scenario be the start of the rush towards the Judgement Day predicted in the Christian Bible? Then certainly any recovery would be totally different than what it was before.

And even if we do wind up with a good medical solution, it will not be a quick recovery. Creating the production facility for any medicine is a very complex process and operation, at best. And the logistics of inoculating the majority of the population will be quite daunting at best.