Market Briefing For Thursday, Dec. 31

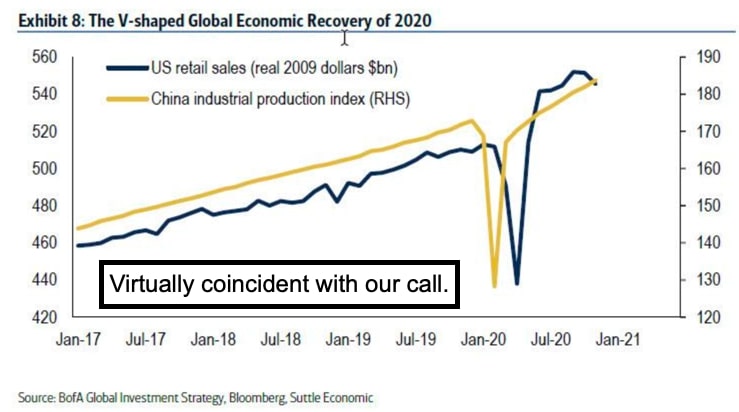

Price movement sensitivity - is limited, as markets tend to finish a year fairly stable, with the concerns secondary to contemplating many challenges. For sure we've had two years of overall great technology performance, and for us it was better than that, because instead of panic in March, we caught the low, and more important (to me personally as a couple comments brought-forth a bit of emotion), was the identification of pandemic risk back in January.

It was remarks about masks and PPI that helped at least two families let me know, that made a dent, causing me to realize this at times can be more than about investing, and better to have erred on the side of caution last January.

The long-expected bit of a rollover, most recently occurring over a month ago for many smaller-cap stocks is behind for now, remains elusive for bigger-cap stocks that sustained near-record highs, while internally stocks corrected a bit already, and probably have more of that ahead, but not immediately in 2021.

The concerns about an early-year retreat are understandable but variable. It's almost as split a viewpoint as the odds for the Senate runoff race in Georgia.

Today we got a new record S&P close, led by Oils, banks and usual suspects.

Good move in small-caps today, Russell fairly lateral, and nothing parabolic except for some of the Asian stocks, which have moved quickly both ways. In a benign sense, you 'bleed-off' the overbought condition with internal rotation and so far in the US, that's what we have.

However we don't want to get too comfy with this behavior at yearend, but for sure you have the Fed Put in-essence, and that underpins the market. There is the rising tension with Iran again, which may be behind Oil's firmness, while of course actual conflict with Iran would not be taken well by markets overall.

If in 2021 the economy outperforms stocks, that's for later in the year and for sure the market is anticipating 'post-COVID' behavior and (hopefully) not really too euphoric about the impact of vaccines on suppressing the pandemic. The smaller stocks 'should' do better for now, if one considers the 'January Effect', which of course is traditional and not precise to contemplate in this backdrop.

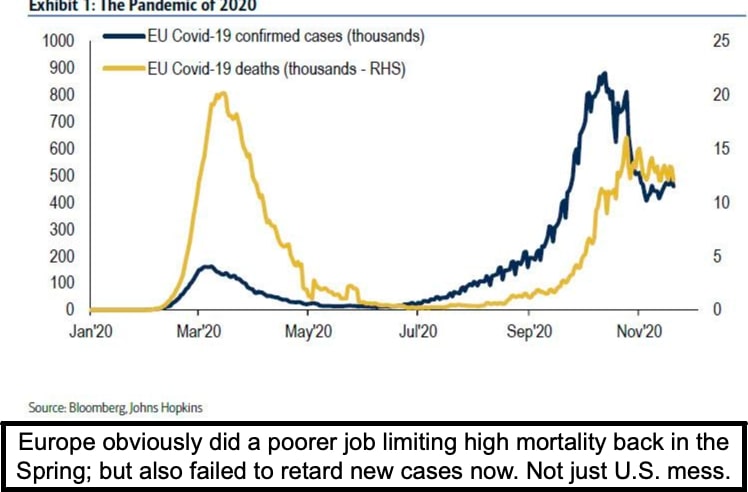

It is by no means as simple as rolling-out vaccines, hence a market concern as well. It is almost a year since I first warned of 'WuFlu' and as this pathogen has (and continues) to be more at the core of what happens to the economy, to our lives, and to the markets, I will continue this focus as long as needed.

Perhaps it's true that most professionals do re-balancing (including tax moves as well) in November, not December, and we pointed that out this week. Now we will see if we get 'the January Effect' this go-round. Concurrently biotechs we watch took-out round numbers where stops might have been clustered, so that combined with tax-sales unrelated to forward prospects, for that matter it created a possibly interesting entry point while some were exiting.

.jpg)

Let's review where COVID relates to Sorrento (SRNE), which is always a been just a 'pending, pending, pending' story to so many, hence medical and more so the analyst skepticism that has prevailed. So is that about to change?

Sure, if they finally get a test approved, with actual treatments the longer-term key. Today they applied for Authorization to market Covi-Stix (antigen test kit) in Mexico, which they say did independent tests that validate high sensitivity. I could speculate Mexico could be a bigger deal: free-trade-zone manufacturing since 'rapid test kits' for home will be a very big long-lasting market. As many of you know there are tax-free Maquiladora zones which could enable 'cheap' mass production and affordable consumer pricing for these kits. Besides that assuring affordable kits 'in' Mexico, with the Peso around 20 to 1 vs Dollar for now, and the NAFTA2 situation better than China, to avoid any import / export issues, you get rapid manufacture and sale in both countries. Just a thought.

But again this is 'pending'. But once something is approved, it won't be at 7 although so far every good news gets a bump and then crushed anew. So it's not going to be surprising 'if' the EUA for Covi-Stix is approved yields that sort of action again (a rally and drop), but this time an ensuing rebound sticks as it seems for the first time with regard to COVID solutions, something's approved.

Herd Immunity? Some start to question if this is a myth pushed by Fauci and others to calm an anxious world (or to market vaccine compliance?). Having the flu or common cold never conferred future immunity to people. Thus why should anyone out there think you are immune to a future case of COVID-19 if you get a vaccine?

Especially as 'governments' aren't going to want to pay, to do this herculean immunization task year-after-year after year, it must evolve. Vaccines will in the form of annual flu shots (remember the Spanish Flu is today's Influenza A) but many people will simply not conform, even if they're barred from travel etc.

Even 'this' winter, many people who had COVID once will get it a second time. It may be less severe or hopefully not more severe. A body of knowledge will grow from this winter's experience, and blinders will be removed for those with a propensity to deny anything other than the 'promoted' leading vaccines. The emerging variants (or mutations) may contribute to more-open medical minds.

The inescapable conclusion: herd immunity is wishful thinking for now at least and perhaps for years. Rapid test diagnostics plus easily administered lower dose (than the President got) effective therapeutics are likely solutions plus of course vaccines for those who get them, but it won't near universal adoption.

Once realistic (low dose or nasal drops/spray) therapeutics become available and vaccine shortcomings are grasped (especially lack of durable protection), the scientific community and the public will demand the efficient prophylactic or early-symptom responses we're talking about, and Sorrento claims (among others) to be working-on (hence that dreaded term: pending). Wait a couple of months when or if thousands of vaccine recipients catch COVID 'anyway', and it may be that it triggers a stampede to mAB therapeutics (like STI-2020 etc.).

Will these low-dose outpatient monoclonal antibodies be available in quantity then? Hopefully. Perhaps officials 'know this' or that's why they grudingly offer the Regeneron IV (REGn) treatment and know what is needed but isn't here yet, and that's the Sorrento IM shot (or they want one from Merck (MRK) or Pfizer (PFE) or others, they are all scrambling). Sorrento either has had 'inertia', or something else is going on. All we know is that 'if' they have it, this needs to be known, and it's a long time since they proclaimed recruiting for trials, with no logical explanation of the delay having been forthcoming, even though DARPA funding for Phase 2 tests suggests that more is going on than we know of yet. Surprise ahead?

Now, as to buying power, it's typically thin, with net liquidity continues to slide until 'seasonal' reinvestment funds show up in the 1st Quarter of a new year. It is not at the precarious state some contend, but it is a bit shaky for now.

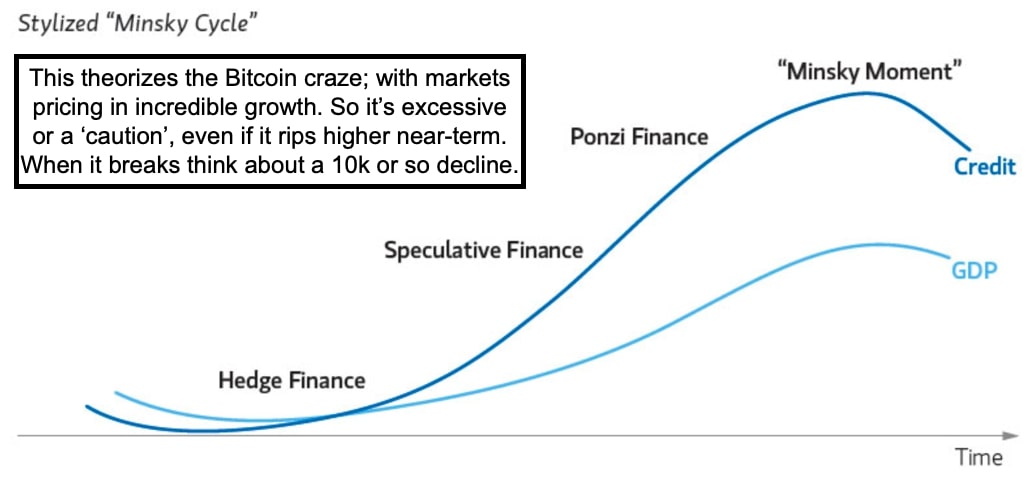

It's an ebullient period causing bubble talk partially because of long-call levels that some have pointed out. True, but depends where they are concentrating. If it's to avoid tying-up serious cash in speculative stocks, that's something I'd contended makes sense, so one has a 'vegas bet' at risk, not betting a ranch.

If it's in mainstream stocks, that's another story. Those being held typically are better used to 'write' (sell) calls to those who want to speculate at high levels, with no argument about valuations being stretched in many of the super-caps, as well as some stocks that seem particularly benefiting 'from' the pandemic.

So, the last two overly enthusiastic periods ending in the dot.com 2000 bubble I warned of at the time or the 'Epic Debacle' I called for ahead of Bear Sterns and Lehman in early 2007, were followed by the heaviest S&P bear markets in decades, with both basically halved from their peaks. While a replay surely is reasonable to occur one day, this is not that day.

While there has to be lots of rotation to hold the S&P up in 2021, the values in stocks already historically at highs are often very limited (not all). Growth will have to occur in post-COVID stocks, but many are also not exactly bargains. So the prospect of extension, or a sharp break (but not catastrophe) is out there, 'in-theory', while it really depends to a great degree on results not propaganda about the success (and embrace) of vaccines, or later therapeutic drugs, that will really take serious COVID concerns off the table as I've noted quite often.

Executive summary:

- S&P and small-caps rebound a bit after annual tax/trade deadline passed.

- Mandatory negative test proof for all air travelers in Canada now ordered.

- AstraZeneca (AZN) vaccine approved in the U.K., and that's a conventional as well as easily transported and stored approach (speculative efficacy and that's why it's debated with different assessments by physicians).

- This is what some call risk/benefit profile of the patient, hence you'll have markets (hate to use that term, but accurate) for several varying types of vaccines, and need for antibody therapeutics for many people or where it (the virus) rebounds or infects 'anyway', even if one has been vaccinated.

- The market for antibody therapeutics and also rapid tests is incredibly huge, ideally Sorrento's 'test' EUA will be approved within 10 days.

- The mutant variants (whether new strains or not) will be more challenging to the vaccine makers than to the testing sector, for which it's no problem.

- How we coordinate and navigate COVID 'is' still key to the market ahead.

- Ironically the economy eventually may do better than the S&P (SPX), should we really (miraculously some think) emerge quickly from the pandemic, with so much having been discounted.

- Despite the Fed remaining 'friendly', they can eventually get stuck with a policy requiring inflation, and unable to dampen excesses without major disruptions to markets being risked.

- They know this, and are more focused on getting through (bridging) this, than they are dealing with the ramifications, but it's there.. just not yet.

- Be cautious about the push-up by Bitcoin (BITCOMP), as promoters hawk ideas of a double or triple 'after' it already did just that, might again but like chasing a FANG type after they ran big-time.

- Also the weak Dollar helps Oil prices stay high, and is avoided in-favor of Bitcoin (or even Gold) by contrary-opinion players, but these can shift.

- Reversal could occur if 'any' major central bank comes forth with a digital coinage plan, it would diverge from a 'risk-on' view of Bitcoin as an asset.

- By the way Bitcoin could retrench anyway if we get an equity shake 'soon' although I'm not seeing evidence that such is immediately forthcoming.

- A few pundits got excited about yesterday's Russell shakeout and all that primarily reflected tax-related sales (now all regular trades settle in 2021).

- I do suspect many economic assumptions about (at least) early 2021 are indeed excessive for many sectors that would 'do better' post-COVID, and they will, just much of the early stages of that are priced-in (discounted).

- Nevertheless the backdrop will be 'Roaring 20's' ultimately, even though it is already reflected by what the market has already done, almost cult-like.

- Speaking of frenzied-like cultist behavior, they just put Tesla (TSLA) in the S&P, so there may be risk of a shakeout there impacting broader markets, but to overwork the term, after that Musk followers will 'religiously' rebound it.

- By the way I don't dispute that Tesla has the best charging network over the USA, but I also don't dismiss some independent networks cutting one or more deals with OEM (original equipment mfg's.).

- That's all part of the looming competitive landscape Tesla fans religiously deny will ever exist, but like Henry Ford and his 'model T', that wasn't the only game in-town eventually (speaking of Ford (F) they will be a player).

- In automotive, assistive even more so than autonomous driving, will grow over the next few years, and rather than debate Luminar vs. Velodyne, I have tended to follow both, and suggest for now both will be interesting.

- At the same time either or both are likely customers for LightPath (LPTH) visible or infrared lenses, perhaps even modules, optimistically expecting to see LPTH in double-digits during the course of 2021, if they execute well.

- Banks (allowed to do buybacks helps) and Oils continue viewed favorably here, and very pleased we were bullish on Oil from the mid-30's forward.

- The long-term damage to the purchasing-power of the Dollar is already a factor, as I've noted, while some politicians throw care-to-wind about this, as they focus on getting (crumbs?) to poorer folks who will pay the price in high food and other costs as inflation does rear it's post-stimulus head.

- The Fed will never be able (in our lifetimes) to reverse this, so it tends to drive up prices, as nominally stocks may actually rise beyond this crisis, at the same time trying to play how this impacts S&P risk is still premature and I'm glad we were able to urge 'not' fighting the Fed this year.

- The Fed is basically underpinning this market in 'surviving' sectors, that is the underpinning of our bullishness from March 23rd forward, but also it is stretched in 'some' sectors that benefited, so open to eventual shake-out.

- Again many smaller caps already shook out and bigger caps generally not so much, hence a different bifurcated prospect 'may' loom in 2021.

- Last night I noted the new UK virus variant, now at least in Colorado too, it was 2 National Guardsmen at a nursing home that caught it, so more it seems are infected by the mutant virus at that home, and elsewhere too.

- Faster spread has not 'yet' triggered panic in the U.S.A. (aside incredible lines where the elderly wait hours for the vaccine here in Florida, while it's a gamble, but even if getting it, some of us will wait to have it in pharmacy or doctor environments, which is a question of weeks, not months.

- People often act 'as if' a single vaccine shot will give them back their lives immediately, and I wish it were so, rather it's a couple weeks for immunity to even begin, and even when protected, one can still catch the virus.

- Not just because 'antibody therapeutics' mostly work right away, they both protect individuals 'from' getting infected, as well as not spreading virus to others, if they're given as preventative rather than after symptoms start).

- That means (unlike vaccines) the immune system isn't being tasked to mount a response only after cells have been penetrated by virus, my bias is to kill the virus, stop it in its tracks before or during earliest symptoms.

- That's for the future: for now the speed of vaccine roll-outs cannot keep pace, but if this causes more 'activity inhibition', that ties to the stock market if it compels delayed 2021 growth prospects, as contemplated.

- 'Growth matters' and to get that the US especially must emerge from this pandemic, and lead the world in distribution of 'useful' reliable tests plus treatments (antibody therapeutics more key than just vaccines, a problem that has been politicized by the funding priorities seen so far).

- We are extended only in some areas (but be cautious as institutions focus there due to volume that supports entry and exit in-size).

- So, while conditions for some sort of pullback exist, with greater odds for overworked big-caps than small-caps or specialized stocks suppressed and ripe for rebounds soon, the January Effect may hold this a bit longer.

- The biggest prospective destabilizing action remains COVID-19 itself, as a lot of value and growth projections 'presume' a modicum of true revival as well as likely pinning too much hope on vaccines alone.

In-sum: the market is mixed, with some post-settlement tax-related deadlines behind. The failure of getting a larger stimulus Bill through the Senate is clear at this point at least, with McConnell refusing to 'unbundle' new provisions.

Friday, ideally will be higher, especially if tensions with Iran don't ratchet-up in a rapid way. News reports the President is so worried about the attempt to try reversing the vote January 6th (the attempt may occur, its success odds are zero), are supposed 'why' he's flying back to Washington and not staying with his family in Palm Beach for a New Year's Eve party for invited guests. Just a thought crossed my mind: if there's some military move contemplated should a rocket attack (again) be launched at our Embassy in Baghdad or something, he might want to be in DC, not PB. I hope Tehran is smarter than trying that at this point, but just tossing it out, as otherwise I don't know why the return (?).