Market Briefing For Thursday, Dec. 27

Reflective (or desperate) rebounds from the vicinity of the key long-term S&P trend-line (but not the super-cycle) were logical expectations. It's why I said on Christmas Eve that it was where a desperate effort needed to be made; regardless of the ultimate outcome. It didn't have to become 'history's largest point' (not percentage) gain; but boy did they run-in anyone flirting with a 'proximity challenge' to the trend-line.

Actually this move was a little tardy; it's been about three sessions since we not only talked about seasonal rebound suitable for nibbling (not gorging) on stocks; but it's a perfect spot to swing this for four reasons: 1) tax-selling is at an end; now trades will settle in 2019; 2) algo-driven decision making had a big awareness that any close below the long-term trend-line had horrible potential consequences (given the yawning gap below), so it was their best last chance to move this market off the last-ditch precipice; and 3) year-end Pension Fund re-balancing was thought starting last week; but some did seem to wait until the last possible minute (and last possible technical point from a 'save the overall' market or portfolio perspective) to pull the trigger.

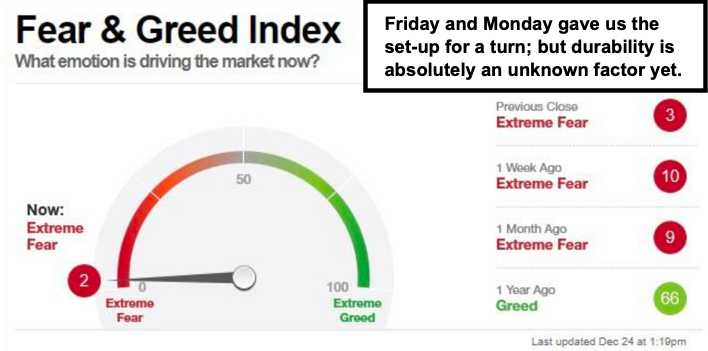

One more thing: the defensive stocks were tanking Friday and Monday too (including Utilities). That's why I said it was a true 'liquidation' finally; which meant setting-up ideally for a rebound, even if temporary. Well we got one regardless of those say there was no reason. There was plenty of reason.

Some say there was no catalyst, or give the President credit. Oh please. A) OPEC cuts were outlined as the turn off the low-40's in Oil was the idea; B) reports suggest the Pension purchases were about $80 Billion and most of it has hit late today, where they needed it to save the market (for the moment) and C) tax-selling is done. Those ARE the catalysts and outlined (granted of course with fingers crossed) to stimulate a short-term rebound; but leaves a lot of questions about 2019. Those have not changed, which is why we had suggested an year-end rebound, but with unfinished downside business for 2019, barring obviously a really friendlier Fed (which it was for too long; that being the problem Chairman Powell inherited); and a deal with China.

Certainly comments by the President and so on regarding independence of the Fed, and 'good job' by Chairman Powell (Trump flip-flopping ... hah); of course lauding Sec'y Mnuchin too. What it amounts to is they were trying to help stabilize the market, precisely where it was at-risk of 'la deluge' heavier crashing (so far there actually was only semi-panic with lots of bottom-fish chatter). And as you know, on Friday and Monday weakness I thought some 'light' nibbling not gorging would be o.k. (and expected the VIX peaking for the moment at least). So needless to say Trump and Mnuchin sure knew what they had to say; so they did. Neither that, nor the 1100 point Dow rally, doesn't ensure longevity to this move; which is more than a colossal short-squeeze (and I have no idea why anyone would have been caught short at any point over recent days; when a cascading washout was ongoing).

As this is a process there was no assurance of a 'classic' panic; but this was time for a rebound (off the vicinity of the trend-lines noted and Pension fund buying), with tax-selling washouts done (hard to imagine anyone waited this long; and if so they probably are looking to take (whatever gains they might desire taking, or even losses if of course they took enough) in the 2019 tax year which really starts now given trades will settle in 2019 (unless specified 'for cash'); and that means any tax due need not be paid until 2020.

Before the opening (and after the President's kinder comments), requisite or expected comments of '100% safe' confidence about the Fed Chair' per the Council of Economic Advisors (this is all psychological panic reaction and a requisite of course from Government); plus this Chairman is not the issue; he's simply a scapegoat for what was done before (rates keep low for way longer than necessary; under the Bernanke Fed).

If there is visibility for good times (and that includes not going through very unpredictable challenges like an Impeachment effort in Congress), then we might see a better structure. Just keep in mind there is real potential event risk in 2019; and the volatility responses will be assessed if and when these materialize. So far we know big 'black (or gray) swans' are circling, but of course not whether which if any are likely to swoop-down to kill demand.

In that aspect, aside Washington, a deal with China matters a lot; so does a perception about 'global stability'. That is not merely about DC dysfunction; that much is front-and-center, but the more illusive grasp of 'global order'. By that I'm referring to the nation that assembled the essential 'modern order', and having a President actually teetering on dismantling some of it. That's the United States. Trump so far has shaken and stirred post-War structures but hasn't really disassembled any. However the skittish nature of policies in this realm does not bolster the 'perceived' unity of Alliances, although oddly enough (as I've observed occasionally) his demands did trigger European countries generally being cooperative about 'doing more' for themselves.

The point is the world is not used to intentional dismantling (perhaps threats of it actually strengthen the organizations; which has been my argument this year; optimistic about how things go). Nor a President trying to disengage from long overseas wars, without necessarily leaving a power vacuum some politicians claim. (I am trying not to delve into this; but as suspected there is a presumption that Russia and/or especially Turkey, will finish the rest of Isis in Syria; while the US maintains its bases or so on -with larger deployments- in the Region). I also suspect Iranian-Russian-Syrian activities are ingrained sufficiently in Syria now; that the U.S. isn't going to reverse it, and we know it. By the way today the President DID show-up in Iraq and mentioned there is no intention of leaving our bases there; which is a correct pronouncement about the potential to respond 'should it be necessary' in Syria. Notably the Iraqi Prime Minister did not meet with President Trump, citing protocol about how the meeting should occur (well Iraq is almost an Iranian puppet state at this point, and maybe the slight was intentional for that reason).

In sum: the market is having a late year reprieve; but it's beyond that due to the proximity of the primary rising trend-lines; a break of which exposes the market to extreme sucking sounds of the technical vacuum that lies below. If you were going to mount the rally with any chance of remotely looking real, it had to come from where it did; right around S&P 2350.

The majority of buying (and selling) over the past year has been algorithmic in a sense; and unless the money managers are seriously ready for manual control, they had to stop or control the machines this morning. They did. For sure, they never should have turned-over control to algo's; but that's part of the lower fee-based structure and discounted everything phase.. revenge of the robots and increased productivity; but it's not necessarily based on real profits, revenue, or business prospects.

It was and is reminiscent of program trading. And it had a 'nifty 50' version (a reference to concentrated leadership in an earlier era); although this time it was less than a dozen securities that constituted over 90% of the previous buying and volume; and that created a upside 'overshoot' as I'd consistently described this year (during which distribution occurred); and those controls also contributed to the washout (though it was actually ideal; not overshoot, and it leaves an open question regarding much of next year).