Market Briefing For Thursday, Dec. 10

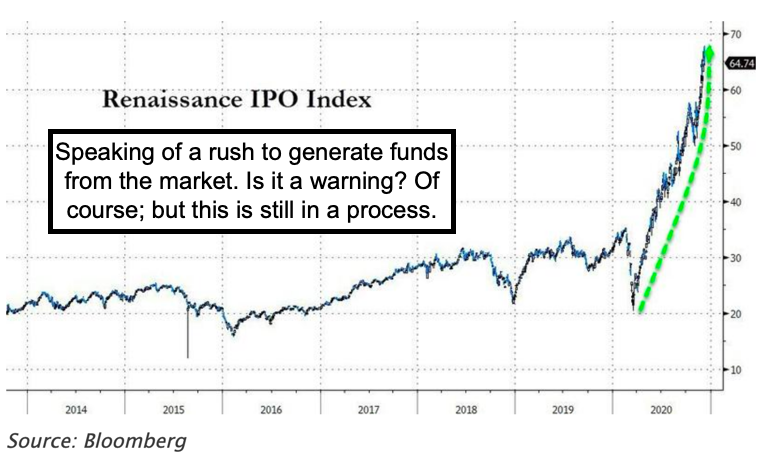

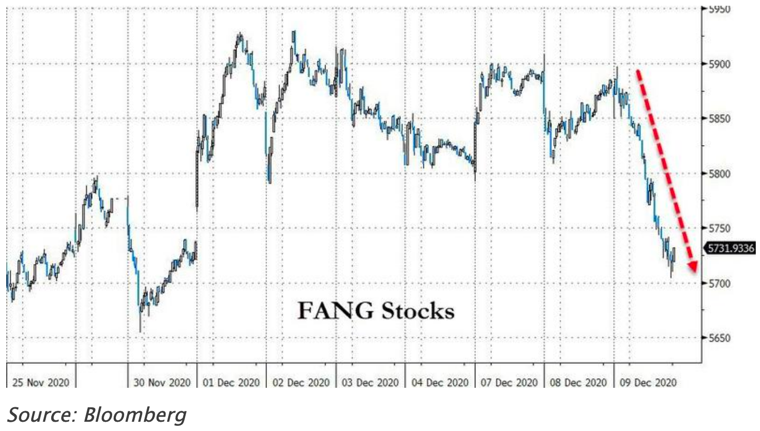

They don't ring a bell - to signal a market top (or in this case NASDAQ and a slew of S&P components that are of the super-cap variety). It's too obvious to conclude that Doordash's IPO today was that Bell, though it makes sense, it's also too obvious that Goldman's Tesla recommendation recently, worried me, as being an overvaluation situation that seemed 'odd' after-the-fact. Even Apple is in the overgrowth category for the moment, and evokes jitters.

JP Morgan (JPM) came out and said Tesla (TSLA) is overvalued, there were downgrades of Zoom (ZM) and other (somewhat COVID-related) stocks, and the focus returns to 'value' stocks, which I don't disagree with, but point-out we don't get from here to post-COVID, as quickly as we would all like, and that might be the ingredient that is missing on the surface of this.

It's really centering around COVID 'relief', with not just 'stimulus' to everyone of course, but emergency help to people that risk being hungry and homeless in a matter of weeks. Hence it's not political, it's essential and needs to happen.

Executive Summary:

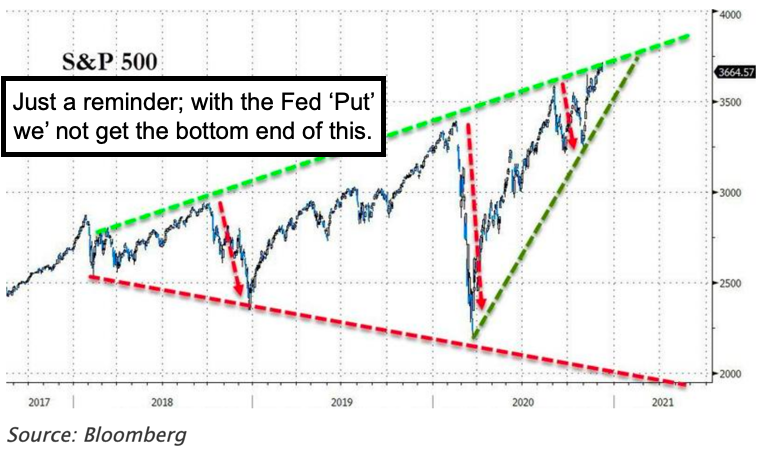

- An upward extension does have psychological resistance, but can be overcome especially if we get a solid (and quick) Stimulus Bill.

- That's important and more so than money drained to get into IPO's, and I call it a 'relief' bill as that's what indeed is really needed for now.

- AirBnB pricing is underway, and I smile as I see some of the rationales as to why they're said to be doing so well during the pandemic.

- So this 'hot' IPO following Doordash will be the focus on traders, though there's more.

- Notice that Sorrento got FDA go-ahead today for STI-2020 Phase 1, and I'll write about it a bit, then the shares got hit, and came up somewhat late in the session, ideally they'll work slowly higher despite resistance.

- This is not at all rare for this kind of stock, until they slam the shorts which ideally will be smashed by a resounding move higher, it's hard to fathom who might have that exposure (hedgers or even potential suitors).

- A big 'booster shot' for post-vaccines might turnout to be 'antibodies, and also testing to determine the residual levels of those who get vaccines.

- Although you got (of course) the Pfizer FDA approval, note that a few of the bigger vaccine stocks were again on the defense.

- This time it was the well-publicized British warning 'not to get vaccinated unless in a medical facility with resuscitation equipment', no kidding.

- I will talk about this later and in a very long main video, so this will be as brief as I can make it, so yes, the UK statement may be 'overkill' (no pun).

- Amidst this Sorrento, which promises lower side effects by virtue of the low-dose nature of their monoclonal antibodies contrasted even to others using similar antibodies, rebounded a tad, expectations are for (hopefully additional favorable) rulings from the FDA very soon.

- S&P and DJIA have slowed-down as numerous firms are warning of new hits, and of course we've been on the lookout for shakeouts anytime now that we're in the 3700-3800 S&P area, and all this shuffles are part of it.

- The Supreme Court throwing out Trump campaigns Pennsylvania case is not a swan, this was probably anticipated by most to be the outcome.

- 17 states are supporting Texas filed Motion against SCOTUS Decision, I'm not a lawyer and have no idea, and this remains pending, meanwhile I'm reasonably pleased with most of President-elect Biden's nominees, especially of medically qualified people in the health area overall.

- Overall this remains a tricky time with the COVID spread (which shouldn't be minimized in any way by anyone), a clear need for 'relief' for struggling poor, unemployed and medical workers stretched to their breaking points, while there are no perfect answers regarding shutdowns versus a more open approach, though broad closings are anethama to small business.

By itself today's FDA go-ahead, with funding allocated by DARPA (Defense Department) contract thru Phase 2, will not be sufficient to build sustainable gains in the very short-term, barring more favorable news which by the way could be forthcoming. So we thought it would be limited and it was. An analyst upgrade would possibly be helpful, and it's notable this isn't even reported by the financial press, as they probably felt stung because they hyped Sorrento (SRNE) up to 19 months back. So nevertheless this is real news, that merits reporting. It's not including an FDA go-ahead that as far as I know isn't widely known yet.

Phase 1 clinical approvals usually don't generate much response, unless they are accompanied by plans to enroll and complete clinical trials quickly. If and when that happens (such as 'fast-tracking') or perhaps aided by a well-known CRO (Clinical Research Organization), the stock would be expected to rally a bit more sustainably. In Brazil speculation suggests Sorrento apparently did sign-up with a respected CRO to administer the 'trials', and it has troubled us a bit that we've heard nothing more about that. We don't even know if they've enrolled or 'trialed' anyone, but if they have, results should already be known.

And that, importantly, emphasizes initial readouts on the safety and efficacy of STI-2020 forthcoming now in the USA, while the parent antibody (STI-1499) is still going to be tried for early-stage patients I believe they said. Also efficacy of Abivertinib, which may be the Brazil trial for ARDS (respiratory distress) is among key factors needed to start to validate the promise of meaningful value creation for Sorrento.

Basically the volatility on a day like today is 'perhaps' big institutions, the wild trading desks (from home even) possibly bought yesterday and on the Pacific when the California licensing news hit, then this morning they sold (or even a few shorted) on the big gap-up opening. Then perhaps bought the afternoon dip, because they know more good news is likely (Covi-drops IND approval for-instance) and ultimately it goes much higher. Why bother swinging? Well, if it is with 100,000 shares or even more, and knowing this stock's volatility, it becomes a money-maker for heavy traders on sharp-swing days on news.

If anyone is doing this, recognize that for weeks the bias was selling rallies, of course that worked today, but was on news. Now the priority for regular days without news becomes buying dips, given the newly more favorable backdrop and a greater surety of 'testing proceeding', revenue from testing (California at least to start), and the prospect of having a low-dose / low-toxicity / easy drug to administer treatment, a potentially well-received mix going forward. And by the way if you're thinking of scalping it, some of the COVID plays don't always rebound, and all this is against a backdrop of generally-rising market risk.

Bottom-line on Sorrento: testing revenues will likely help hold shares at this slightly higher range. Then, strength of STI-2020, STI-2099 and the advanced stem-cell tests nobody tends to notices (it's likely DNA-2020) will build on the potency and affinity of the parent monoclonal antibody. Hence these readouts ideally in the near future will be key to totally discrediting bearish premises as well as legitimizing the shares to the point of eliciting even broader interest (of course STI-2020 approval would possibly loft the shares a couple multiples).

In-sum - the market is more nuanced now, and with plenty of reasons. S&P is higher, political worries are mitigated by the mostly-reasonable or responsible choices for key appointments (hence no serious extremist prospects), and we have not only a market sobering from 'vaccine euphoria', but a bit jittery.

Today in the UK there’s a report that they tell people to only get vaccinated if they are in a medical facility that has ‘resuscitation equipment’ in case of need..Huh? Doesn’t sound like mild reactions…Well there was an earlier or very clear report of serious allergic reactions or even anaphylactic shock risk.

I'm sure (?) that's just extra precaution, cover their liability tails perhaps. Or as they say 'an abundance of caution'. Hence likely 'overkill'. (No pun intended.)

If there is something worthwhile to convey, PLEASE put in a text format instead of a talky video! Informative presentations deliver far more value when they can be consumed at the rate that they can be followed.

For those without an attention span great enough to read a whole article, too bad for them! They can do without the good information, and perhaps natural selection will thin the herd a bit.

And the general level of turbulence will continue to affect the markets, as exesss emotions have done for many years. Just a bit more now than before.