Market Briefing For Thursday, August 13

Executive summary:

- The S&P is on the threshold of an historic high and the broad list firms as well.

- Most reactions to Biden tapping Kamala Harris are favorable.

- Controversy swirls around a 'bear-raid' against Sorrento (SRNE), I'll focus on it, after a quiet day with media pundits mouths 'zipped', Sorrento counterattacks.

- Federal Relief Talks remain 'in limbo', as Pelosi rebuffs Mnuchin, however the nation must have a deal emerge from this stalemate.

Strength-begets-strength - for the S&P, as now even the skeptics acknowledge it's highly probable (I thought today so maybe tomorrow) we 'eek-out' an historic high. In the past I've mentioned that I have never seen such a strong market with so many it seems 'up in arms' protesting the move, often the same ones advocating liquidating a lot back near the March capitulation lows.

Now the continued negativity is gradually coming around to grasp what's occurred (a concentration in mostly big-cap technology names that were able to do the required heavy-lifting for the S&P and Nasdaq), which gradually broadens-out to include of course some stocks that benefit during the Covid-19 pandemic, or offer promise to.

Hence there's less enthusiasm for the big major pharmas than before, but of course vaccines will be more for humanity than a profit-center for them, at least initially; then they'll make money on the annual vaccines (as it becomes combined with influenza vaccinations I presume, but that combo is probably a couple years away).

Additionally there is realization that 2nd and 3rd generation vaccines and treatments are already somewhat understood (and combination 'cocktails) as being ideal ways to eventually wean-off dependence on ICU's, and move this more to a 'chronic' rather than 'acute' situation. That's how we get to 'live with' the virus, in a more complicated but not unprecedented way, given the history of Polio, Smallpox, roster viruses, and so on. It is the realization that there will be no 'single' winner in the fight for treatment or testing or cute, that had us suggest (for those brave enough to enter what a wise older member described as) entering a 'minefield of Covid stocks'.

Daily action - finished near the day's high, and the historic highs for S&P. That's not to say we won't have a retrenchment shortly after the celebration, so be on-guard. I do expect more upside at least early Thursday, as is implied now in Asian markets.

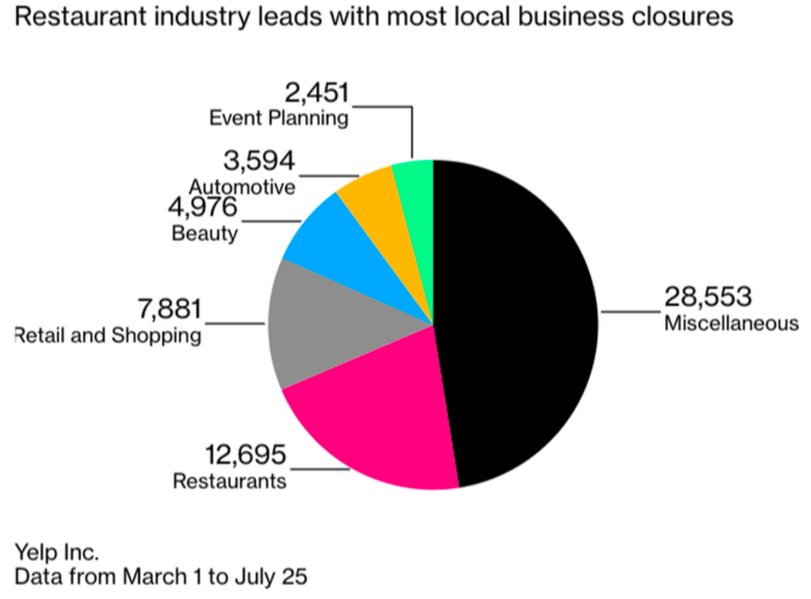

Continuing my slightly-rambling tale tonight . . pandemic alone, which we identified as a risk back in January (WuFlu before the name Covid-19), clearly bifurcated the S&P and Nasdaq, and to some degree society itself, into those that can surmount or even benefit during the horror-show, and those who would be repressed and lucky to survive the nightmare. Mostly it was 'work from home, stay home, social media, and distance learning', as well as streaming video and internet services, thriving.

It's unfortunate, but looking at daily news it's clear people are 'over it', but also very freaked by the expansion of case rates, especially in our school systems. Teachers in some cases are resigning or demanding proper mask-wearing, as if not universal, simply won't show up, and that alone compels closing of schools in some places.

In-sum: it's chaotic, it is not under control; the President has some new medical guy at his side now, and the networks (whether they relish on politicizing this or not) are compelled to go to the CDC or NIH independently of The White House, if they want actual medical guidance, and FDA if they want to know about actual drug progress.

As they should anyway. Dr. Redfield, in particular, today is more assertively warning that masks need to be universal, or the United States is going to have 'the worst Fall ever' (his words not mine). Dr. Fauci said similar things. Even Bill Gates said a couple days ago that this is really worse than even his ongoing outbreak nightmares that were honed all the way back when he and Melinda traveled to Africa years ago; that to a degree helped shape their nascent goals to help fight diseases. Gates also complained that he talks to everyone, but not Trump, during this pandemic.

Back to the future.. of treatment and sadly market chaos engulfing Sorrento

I hasten to add that up to now nothing is fully known, but lots is baking in their ovens as Sorrento became the stuff of controversy, hot embrace on the run to 18, and very volatile still, which itself is typical (and forewarned) when it comes to playing biotechs in-general. I mentioned the other day how someone orchestrated a 'bear raid' against Novavax (NVAX) some time back, and cut it in half, and then it went up about 5x thereafter, and at the moment down.

This all gets sorted-out over time, so I'm not suggesting that Sorrento is going to go up 5x, or at all. But what if they did have a monoclonal antibody that actually shows efficacy? It's literally all up in the air, which is why I'm going to mostly focus on the technical price action. To me that says up for now, especially with Sorrento coming forth with an accusatory press release this evening toward the short-seller. We aren't opining on Sorrento's financials, already noted they had they fingers in many places and it was 'Chinese Water Torture' to wade through their 10Q. That's why I said last night that I'm not saying they're not a bit sketchy, I was saying 'up is up' and even as it took a hit our entry price has one heck of a cushion now. I suspect more tomorrow even if there's a predictable defensive/aggressive response from the bear.

I'm not at all against being bearish on a stock (separate from my initial skepticism on this one), but I am against manipulation or possibly fabricated statements, especially when a website (two actually) quoting them didn't disclose that the research firm folks were professional bears.. and short. It was their last chance perhaps to suppress Sorrento before they lost more than their shirt. I have no idea about details, just suspicions. In this timeline provided weeks ago, the rollout schedule was anticipated, but there has been no particular follow-up, and that might be why (assuming it's forthcoming) the 'bear raid' was launched trying to preempt a favorable response to news.

Bottom-line: We believe improvements as regards both testing, diagnosis, treatment and certainly prevention of disease, is coming, just not fast enough for humanity. We pray that any of these tests are improvements over what's out there now, treatments excel in helping those infected recover, and antivirals finally appear that suppress the beast (Corona) before it presents even initial symptoms (part of why fast testing is a must and the rest is almost useless except for recovered patients to donate plasma).

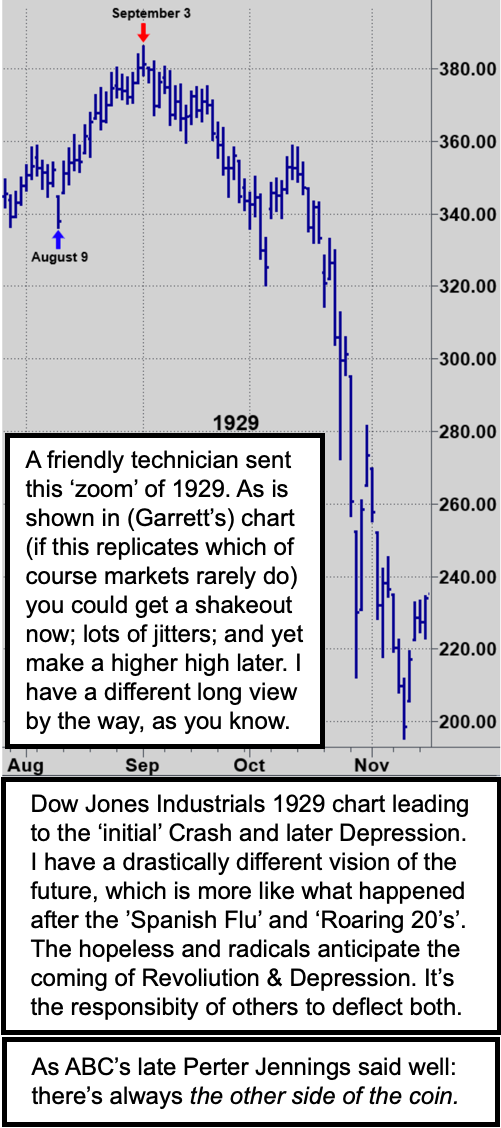

It is the greatest challenge of our time, and the threat to this nation greater than the economic suffering of even the Spanish Flu, according to some. Just remember my thought that contrasts with those calling for 'physical Depression', we already have a Depression for many, but enough hold together that this isn't the 1930's. After the Spanish Flu there was a recession and people were calling for worse, but they got the Roaring 20's instead, and years of thriving prosperity before the roof caved in.

I'm not looking for roofs caving in yet, but I am considering the Roaring 20's ahead, which can be encountered through a couple different paths forward. That depends on the course of disease, and not even the Street level Apple Maps knows exactly how that's going to appear in the next few weeks (probably more detours, troubles and school closings, and more anxiety hard to grapple with by so very many).

The times are certainly changing, and not for the better. The very unfortunate thing about peaks is that they are surrounded by valleys. That fact has been clear through all of history.