Market Briefing For Thursday, Aug. 2

Quantitative Tightening has been a fellow-traveler with extended FANG (and similar equity) excesses; and while most await arrival of an 'inverted yield curve', or for that matter a penetration of the primary S&P uptrend; all that essentially will be after the fact in a chain-reaction process.

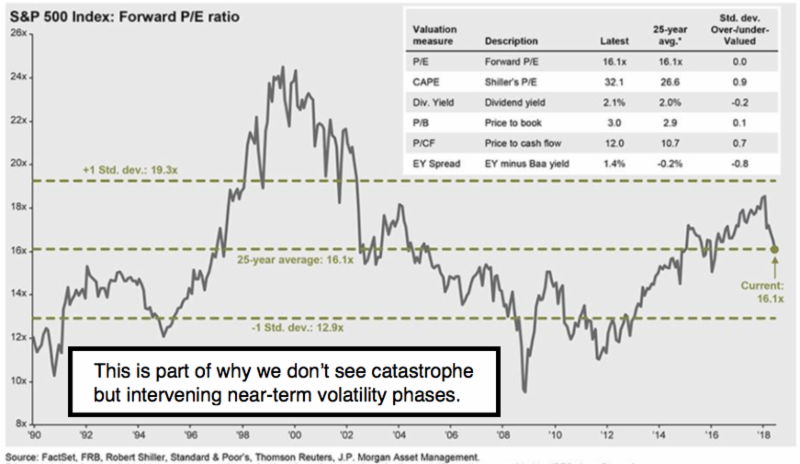

Aside the early-year nailing of the parabolic thrust as a time to lighten-up a lot; and the only actual short-sale in the S&P (or seriously long VIX beyond day-trading); we anticipated a ragged pattern for months, primarily based on the 'structure' of passive-investing ownership/management these days; and believed this would forestall a calamitous decline.

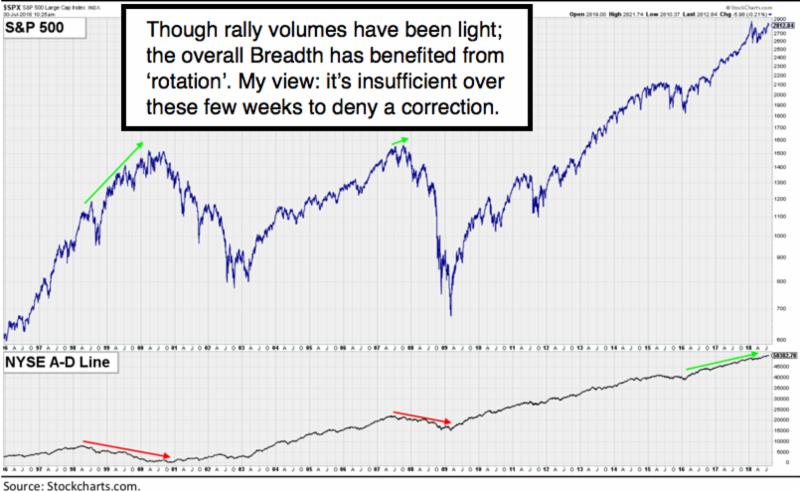

Hence we not only nailed a 'to the Moon if Trump won' preceding 2016-'18 rally; but warned of a form of 'distribution masked by FANG narrow-based concentration (small universe of stocks) leading a light-volume and ragged pattern, which I have labeled 'Rinse & Repeat' for some months now.

Fine. However more recently we called for 'stability' to exhaust in early-mid July; setting up a vulnerable (and nailed) false-breakout led by Google just a couple weeks ago; followed by retrenchment back into an S&P 2810-20 range that preceded (and prevailed until now basically). So what changes?

Quantitative Tightening replacing Quantitative Easing has been a point I have made for some weeks; as it moves toward an 'inflection' zone that's likely to further inhibit significant earnings gains especially in this Season. It was ironic that I suggested the July stability would end concurrent with a talk I gave at TraderExpo Chicago (and it did); and now I'm departing for a few weeks (my annual sojourn) to Europe, and also expect a correction in that time-frame (and yes I do a majority of daily reports during my travels; although a bit more abbreviated depending on schedules).

As I mentioned last week; we'd already prepared investors for what's most likely on-tap next; and how to handle it (proportionality and realignment in certain sectors and a couple stocks we think were and are attractive while rotating-out at least partially from the overextended narrow leadership).

Essentially QT alone has never been a welcoming incentive to buy stocks; that's why I recently shared a chart 'correlating' periods of QE and QT, and the effect that had on the S&P. While one can argue alternatives to what's increasingly the 'off-loading' at the Fed; I won't embrace that 'this time it is different' approach; especially not at these extended levels or seasonality.

In-sum: the Fed adheres to its policy directives; and that's enough to give us a 10-year and 30-year both holding above a 3 handle; and concern as regards our emphasis on QT being a restraint; that few are respecting. It's probably a restraint on the S&P already; though after the market breaks, I am sure pundits will blame it on the very monetary policy they marginalize.

Also; you have unknown risks to an cavalcade of politics surrounding the President; who seems visibly shaken by the ongoing investigations. So far not much of this 'noise' has impacted markets; but that could change too.

P.S. This week ONLY prior to my departure to Brussels and Paris next week; all NEW Daily Briefing subscribers will be able to renew the ensuing Quarter and be refunded 100%. That means half price for the next six months; both due to reduced frequency of reports during my travels for 4 weeks, and during the most crucial time for this market. Visit www.ingerletter.com/subscribe to join us. This offer is this week ONLY and will not be repeated.

Gene is humble and proud to be the only guy not shorting and believing the S&P would go to the moon 'if' Trump won back in 2016. Now a bit more concerned but only from a cyclical not secular basis.