Market Briefing For Thursday, Apr. 29

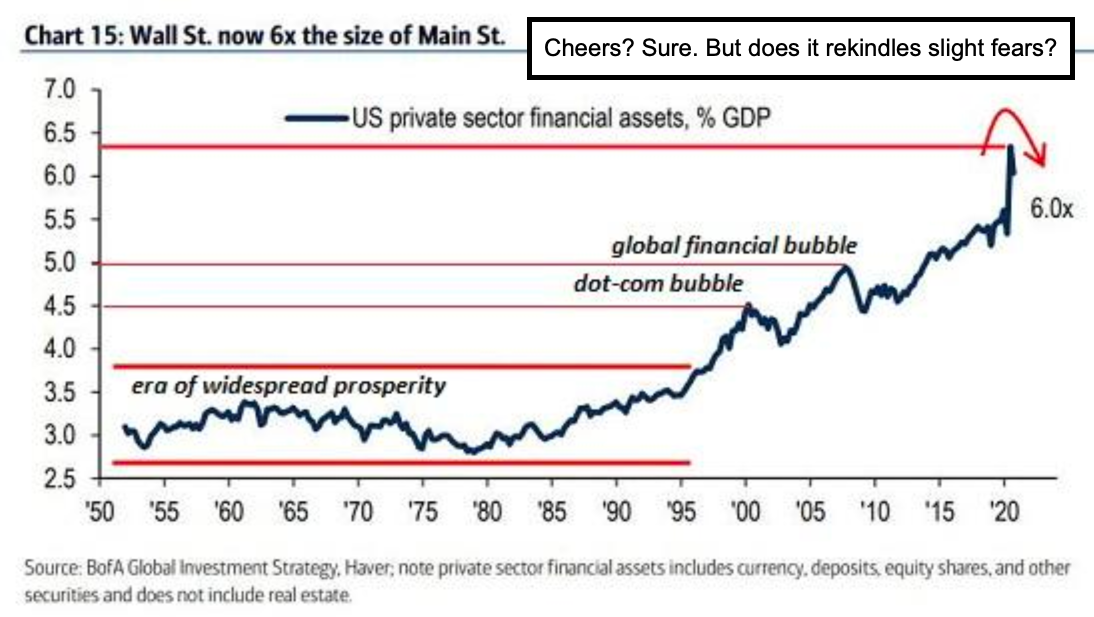

President Biden's Address and the passivity of a Fed fearful of moving too soon towards tapering, reflect the dominance of leaning-upon financial assets, based on extreme expansions of debt, higher taxes, and not cracking-down a bit better on excessive (even dangerous) leverage and speculation. We recall how 'algorithmic trading' drove prior markets (probably this one too, higher), a reminder that this works in-reverse if the plug is pulled on the celebratory run.

Little noticed, last night one value-fund manager in New York committed what is said to be suicide (there have been a number of money managers doing so over the last year but little reported) by jumping off his 10-story office building. Just last week he had liquidated his two funds, which had dwindled (via client redemptions and price decline) from over 2 Billion to around 800 Million value. He had refused to abandon his fundamental value proposition, and like Buffet for-instance, stuck to ways that are responsible, but don't fit the times. Even it seems Buffet (by embracing Apple more) budged off of his deep value views.

Many analysts (mostly strategists) point to what they see as red warning lights of extremes in sentiment, valuation, and just duration of the upward move. For the most part they ignore the internal divergence I've called 'bifurcation', that's dramatically separated the performance of the 'grand dames' versus the rest.

So warning signs can flash for quite some time, and I've certainly pointed-out that broad shakeout risk would return again in late April and May. Here we are of course, although that's no assurance. For sure we at least didn't fight most of the way up, as so many pundits and technicians did. I have noted that over a period of years, speculative bubbles often display symmetry.

Then you have JP Morgan, after the Fed news conference, saying 'buy every dip'. I don't entirely disagree for now, but they (like most) fail to distinguish the bifurcated sectors from those working. This is a big-cap and Oil-led market. If there's a bullish argument (actually mine) it's a need for broader participation.

Concurrently, bond investors are glum about future economic prospects. Bond yields are below where they were before the pandemic started. Current yields warn of paltry economic growth and little inflation in the future. We demur, as the 'facts' of economic supply chains (and even Oil demand) argue our view. If that opposite is correct (and it is), we do have inflation, and already upon us.

Today's bears contend the S&P moving that spike higher, tends to collapse in a mirror-image of the manic rise, aha... but that's when you have a manic rise. This one isn't exactly manic in a broad way (it is selectively), and it has been greeted by the aforementioned cynicism all the way up.

Correlation efforts for any extended market are rarely if ever perfect, which is why I'm surprised that so many pundits ascribe a symmetry to this market that really doesn't exist. But as a generality, bubbles tend to display symmetry as manic greed slips into doubt and then cascades into panic (SPX, NYA).

In-sum, generally, bubbles tend to display symmetry derived from mania. As that manic greed slips into doubt it can (but doesn't always) cascade into sort of a downside panic. In this instance, from our ('Inger Bottom' March 23 low of 2020) dramatic bear-to-bull reversal, the downward cascade became a mostly persistent climb to record highs, albeit not with the symmetry many claim. So why would anyone in-sync with us for well over a year now, start chasing? (AAPL)

That leaves us open to 'correction' but likely not catastrophe. The overall take of March 23rd last year being a 'bear market cycle low' and not just a gigantic blip, goes along with our view of the 'Roaring 20's' having pauses to refresh of course, but not terminating nearly as dramatically as the bears postulate.