Market Briefing For Sunday, Jan. 27

Preface: I delayed this Daily, wanting to see progression, in efforts to contain the virus, even though I doubted we'd see any signs of that. President Xi described China as being in a 'very grave situation', and has restricted travel on Sunday even more; and that includes intercity movement from Beijing too.

Meanwhile the United States and Russia are chartering planes to fly their diplomats and personnel out; and there is no visibility regarding the severity or duration of this crisis. Of course I don't wish to be alarmist, just realistic and circumspect about this; or the extent to which it impacts markets, beyond already expected time for S&P's corrective phase.

So for sure, the market cannot be the top priority; but it's our area of focus; and we will. I believe it's essential because as the coronavirus spreads through Asia, not just China; it will affect the speed of recovery (can even derail it for now); the excessive price run-ups in certain groups, especially big-cap technology stocks that garnered the lions-share of investments by funds; and aside the alarm it causes, might even setback the Olympics, scheduled for Tokyo this Summer; unless this 'alarm' is met sufficiently quickly to quell the spread of the epidemic, and stop it short of being a pandemic.

This is clear uncertainty, and the market abhors uncertainty. So discretion will remain the better part of valor, irrespective of minor rebounds, and well, let's dig into this. Apologies as I'm certainly no doctor or epidemiologist, but I'll try to assess the core issues a bit, as I appreciate input from members (especially in Asia or recently there) who updated a bit of what's not widely report about the gravity of the situation.

Global pandemic fears - literally have the world holding its breath, while markets hold their breadth (slightly negatively on-balance). We've warned of what I termed a 'China Syndrome' virus for some time now, as likely expediting the S&P's pullback behavior looked for in this time-frame; and clearly the exponential growth of the epidemic gets full attention. For now it matters more than earnings, Impeachment or much else.

I'll touch on stocks of course; but we must recognize this may be what we termed a few days ago as a 'Black Swan' (exogenous event) of concern, beyond a technical 'check-back' for an overly-expensive S&P (many other stocks remain suppressed and are not so exposed as multinationals).

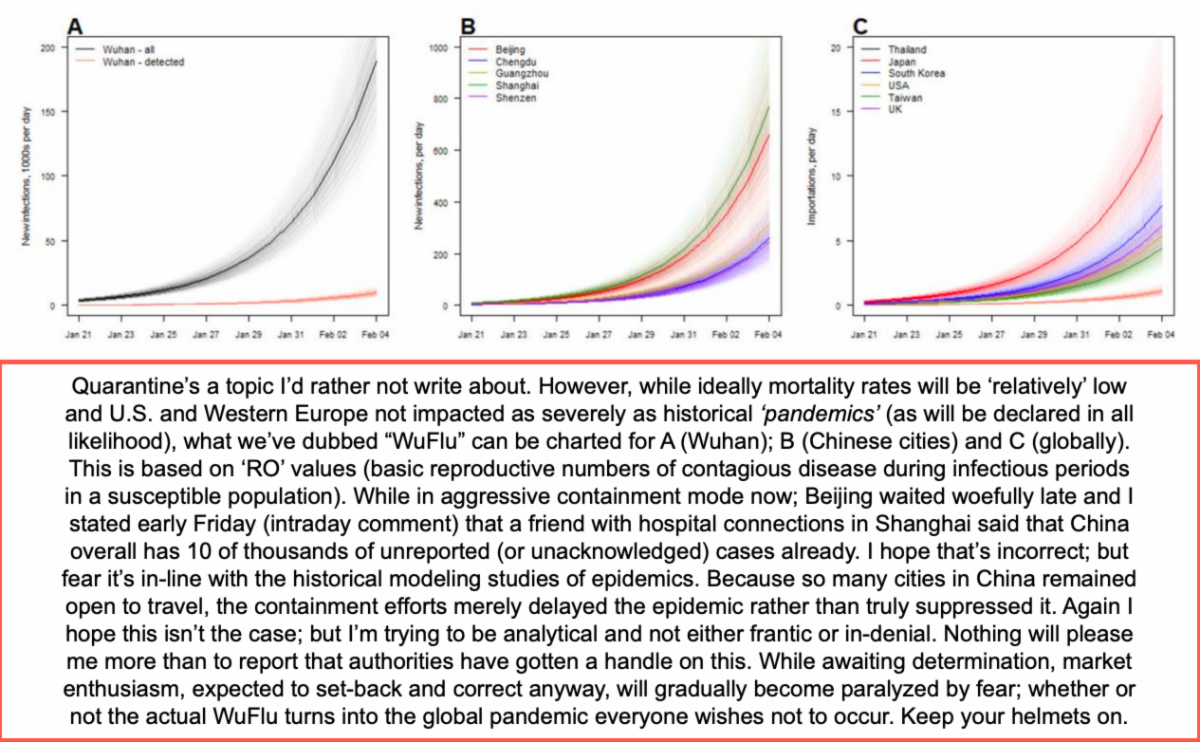

For now let's go with 'WuFlu' to describe the flu, given origins in Wuhan, as you know. I'd rather not use China Syndrome; although sadly the virus will likely be at that epidemiological level within days, if not checked in an impossibly swift way. It was first identified about 3 weeks ago and China's response, while incredible 'now', was insufficient early-on. That's danger; and they know it. Dr. Read of Lancaster University in the UK provides at least an idea of how this could (but hopefully not) progress over time.

On Friday a Doctor from John Hopkins made TV rounds in the US and of course that triggered more alarm (he had recent done a test). While we'd not question the multiplying factors; some of those are algorithmic-based, as was the SARS outbreak; and as you know the outcome was milder (of course for those not affected) on a 'global scale'. But we don't know that, yet; so we have to contemplate both optimal and theoretical progression as opposed to presumptions that it goes out of control globally; which it may well. Hence the fairly wide range of potential cases, and responses by authorities, as well as by markets; and certainly human behavior.

So presuming historically (and hysterically) we are still in the early days of this outbreak; there is much uncertainty in both the outbreak's scale

as well as key epidemiological information regarding transmission. So for sure hope and efforts to deny Europe and the America's having to deal with anything approaching the scale of which China must contend with. At the same time as of now there are a few cases in France, Malaysia, UK and Australia; plus several suspicious beyond generally reported.

However, the rapidity of the growth of cases (and reports of overwhelmed medical staffs, with videos of hospitals being suppressed or deleted from posts) since formal recognition of the outbreak, is much greater than that observed in outbreaks of either SARS or MERS, according to experts in the field. This is consistent with higher estimates of reproductive numbers for this outbreak compared to other emergent coronaviruses; hence we'll share the data that has been seen; not to be alarmist, but to confront it.

Bits & Bytes: reflects on a bifurcated market, with big-cap leaders mostly holding the Indexes at high levels, while investors exercise a modicum of caution pending not just ascertainment of the epidemic's extent, but also a corrective period we've identified 'anyway'; ideally within context of the overall uptrend (context is in-doubt 'if' the epidemic becomes pandemic).

So let's just touch on a couple fairly normal issues this weekend; then I'll have some candid observations as well as the 'technical' range of risks.

One is AT&T (T) The technical pattern has been excellent, and bordering on a breakout to highs higher than seen in modern times. While traditionally it is perceived as a dividend play (and that's fine and welcome); clearly a view we've offered since recommending it over a year ago in the high 20s to 30 area; was for a 'total return' including capital appreciation based on being not just able to service huge debt incurred from the Time Warner or (mistake) DirecTV acquisitions; but the possible increase in multiple as or if it becomes perceived as a modern streaming integrated player too. We see it doing that; and also leveraging the power of its wireless network.

For-instance, as I mentioned months ago, AT&T is building out a FirstNet wireless public safety network for emergency responders. So the Federal Government awarded AT&T a swath of 20 MHz of radio spectrum in the 700 MHz frequency band for the life of a 25-year contract they signed.

While the FirstNet network sure will be prioritized for emergency services, AT&T can use that spectrum for commercial purposes as well. Ah ha. So, aside from FirstNet airwaves, AT&T has additional spectrum. It may be a reason CEO Randall Stephenson on their Q3 earnings call said it's open to talking to cable companies about network capacity, even if companies compete in wireless, streaming video, high-speed internet or similar.

We hear that AT&T is talking with Comcast (CMCSA), and may be able to offer far better arrangements than what they have with Verizon (VZ) relating to re-sale of wireless services. We'd keep an eye on something between AT&T and either Comcast, or possibly Charter, as the year evolves. And if the HBO Max product is integrated with AT&T TV Now (unknown as yet), there's a possibility that AT&T gains a multiple expansion based on more than its traditional value as a dividend play. (It is that too; and solid as forecast, as many others thought AT&T couldn't handle it. I believed they could.)

Again total return is why we remain optimistic on AT&T, even with roughly 40% capital appreciation as well as about a 6.5% dividend yield based on our entry cost basis around 29 +/- just over a year or so ago. Also I view it as a stronger hold through angst in the overall market that is anticipated during parts of February; or to the extent China's WuFlu crisis requires.

Financials and even Apple (AAPL) can use the proliferating coronavirus not just as an excuse for correction (that we were looking for anyway); but really it is a sobering influence, especially if angst becomes a quasi-panic forcing a much-greater 'circle the wagons' approach to markets, and to generally life activities in parts of the world until WuFlu is contained or dissipates.

Quite candidly I mentioned cancelling one trip; and a close friend who is a Vice President of Marriott (MAR), and normally flies internationally weekly in his capacity, has curtailed all travel (essential or not) for at least a month. I'm sure this is fairly broad among executives and all personnel now; so I am not going to be surprised at soft guidance (just unknown) in travel sectors of course; but also airlines being glad they don't have more capacity (the opposite of the clamoring for new aircraft, or the 737 Max return). They'll welcome the sort of subsidy from Boeing (BA) due to grounded aircraft; and in this sad situation is the opposite of what American Airlines' (AAL) Doug Parker said a couple day ago; as he fretted loosing some business to 'others'.

(As an aside; AA Flight Attendants have criticized the airline for not taking protective measures sooner. And I will add that if ever there was a time to 'really' close our borders, it might be now beyond merely checking temps of those arriving from China. If the airlines won't do it; the FAA should be considering isolating North America as much as it can from the WuFlu. It is China taking the lead on travel limitations; but perhaps we must too. In this situation, the WHO and CDC will need to make recommendations.)

Airlines and companies related to Boeing can expect more pressures as low traffic patterns (especially to and within Asia) will persist for months. I know that domestic airlines such as JetBlue and SouthWest are viewed as less risky near-term; but I don't entirely concur; with a twist. The fleet of JetBlue is Airbus and they're domestic; but travel will contract even in the USA for now. SouthWest won't have access to the 737 Max (nor do they need more capacity if indeed demand shrinks this Winter or Spring) and they'll need longer-range aircraft since the 737 in-generally shouldn't have been approved for long-range nonstop flights to Hawaii (no landing spot for emergencies within 2 hours... hymn 'The High and The Mighty' as well as references to the 'point of no return' transpacific way-point).

So speculation exists that SouthWest (LUV) might try to buy JetBlue (JBLU) ; as such a combination would solve key issues of diversifying the Boeing 737-only equipment to longer-range Airbus jets; or also likely to what will be newer Atlantic flights (to London Gatwick probably). Those will blend with a new JetBlue tie-in to Norwegian Airlines, a discount carrier to Europe, as it has (generally unrealized) favored low-cost intra-European flight rosters; for one reason ironically as they offer free WiFi on all flights. Not saying any of these are buys for now; but it's worth keeping an eye on, as of if airlines take more pummeling during this possible pandemic scare.

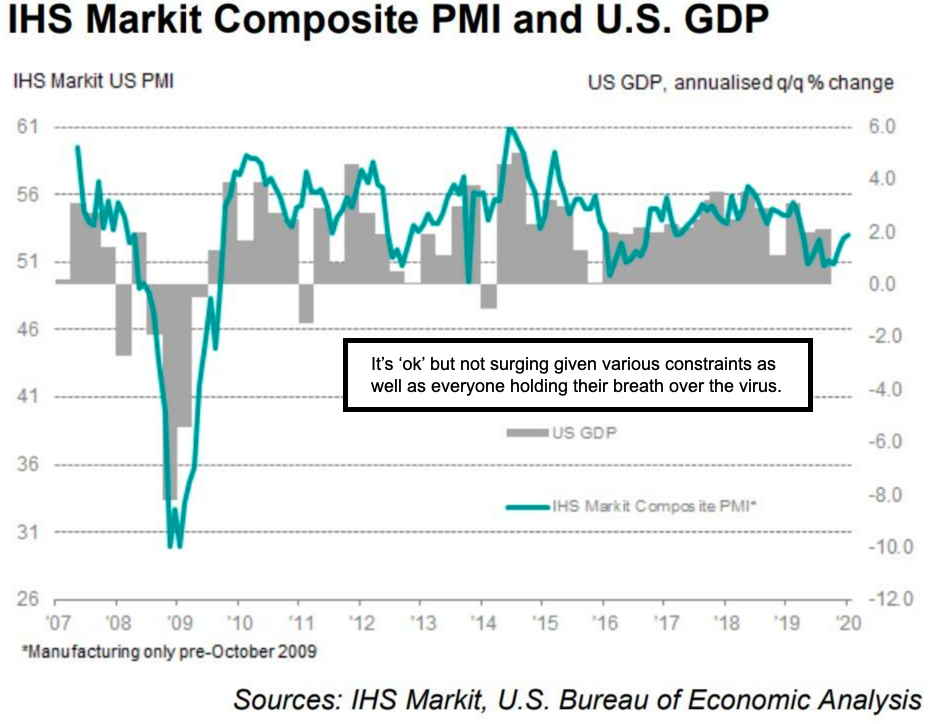

In-sum: the S&P (and to an extent the broader markets) were called to retreat, ideally within context of longer-term optimism. That required there to be expectations of growth and trade benefits as often discussed. Now with changed circumstances, the timeline to see accomplishments is lengthened, and that's nothing the Fed nor the President can change.

So it means we expand downside S&P expectations with core variables as relate to the epidemic and/or pandemic (to be determined but moving in a concerning direction), and eagerly look forward not just to rebounds following panic selling waves, but to containment and recovery.

Hence, there may have been a long enough period (not blaming but just saying as it's essential) of delayed intervention by authorities in Wuhan (a course suggests imminent arrest of officials there for tipping-off relatives and friends to evacuate before alerting the community), suggesting that containment or control of this pathogen may be substantially difficult for medical experts to get their arms around.

Again mortality levels should be lighter than some historical events; but that while the core of concern (because we have to address) stocks, it's not our only focus. Markets can become 'frozen', as investors get sort of petrified at acting, while money managers that charged-in late (as we've suggested they did for months, triggering over-concentration into FANG stocks or so on); likely find themselves confounded as to how to react.

Significant technical comments in the Daily Action section below follows. For now it is a fluid situation, with I think can be summed up in a report by infectious disease specialists at Imperial College, London on Saturday:they said that despite heroic efforts, the epidemic "represents a clear ongoing global health threat"; adding: "It's uncertain at the current time whether it is possible to contain the continuing epidemic within China."

(This charted trend may only be temporarily interrupted; so if ever China needs to call-upon every advanced resource to come-together, it's now.)

Bottom-line: S&P will try to not panic of course; but absolutely do expect defensive or even wide swings depending on news; that we hope is good; which would also allow minimizing the otherwise-significant dire downside possibilities. The Chinese suppression (based on private reports of many thousands of victims unreported) of the WuFlu situation ended abruptly yesterday as markets closed (already lower) ahead of a (holiday) week of suspended trading.

|

It is now left to other Asian markets, the U.S. and Europe, to reflect the backdrops financial implications, as may be better understood in China by the time they reopen a week hence. Certainly it's not optimistic, and it comes at a time when China was already facing more growth challenges and (certainly) an increased need for American agricultural assistance (it goes beyond purchases); and I suspect that's forthcoming. When I said it would be the U.S., not China, that lifts the world out of its morass, this is not what I had in mind; but it does emphasize global dependence on US help now, and I don't just mean the CDC. But at this point the signs continue to point to a widening health crisis and a prospect of people globally hunkering down; whether really threatened in direct ways by this epidemic, or not. Our prayers for those who are. |

|

|

Daily action - all year so far, the market (last year too) hasn't reacted as so many critics suggested; which would be a parabolic blow-off thrust. In fact the heart of our 'allowing' the S&P to advance has been a recognition of the concentration in that small universe of stocks that led the upside.

Hence, the risk here is from big tech stocks that really went parabolic. As things stand now, NASDAQ (particularly the NDX, the 100 largest cap of all NASDAQ issues) are perched at the highest forward valuation since I warned of the 'Epic Debacle' just before the Bear Stearns crisis and more in 2007 (based then on awareness of the brewing derivatives disaster).

Now, with late-comers to our more than year-old upward cycle for S&P, it is possible that those high-level (sort of 'Greater Fool Game' chasers of a really mature move) will get progressively less patient with failure; since it is clear their average cost-basis for stocks is higher than the rest of us.

This coming week, besides Impeachment (likely goes nowhere aside the angina triggered) you'll have several major FANG-type stocks reporting a sort of mixed Q4 report; because they have to provide forward guidance. If they heavily emphasize 'rising' uncertainty due to the epidemic, this has the potential to squash expectations of better post-trade-deal growth for a period of time, but obviously not indefinitely. But it may give concern that 'sales and earnings will trail most estimates for longer than otherwise'.

As those money managers get punished for buying stocks where at-best I would have viewed them as holds but vulnerable with little upside nearer term (we've warned of that for some time), the big difference between the holders from (say late December 2018 when we nailed the cycle low) and those that bought much later, will come into focus; along with their grasp of why I urged not being greedy for the last upside crumbs in such stocks for some time.

That crowd likely to get severely punished regardless of S&P thrashing in both directions as it tries to stymie the real problems. That might be akin to the little Dutch boy sticking his finger in a dike, hoping to hold the water back beyond momentary defense.

|

Overall earnings have stopped rising; but that's not surprising. That gap I have shared in many charts, realizing this was a 'liquidity-driven' market; not an earnings-based one. And now the transition to 'actual substantial growth' is delayed due to 'potential' global pandemic risk; beyond what is suspected to be a cooling-off period for the S&P and NDX anyway. I sure expect the focus on domestic-centric, healthcare and insulated stocks to dominate what active interest there is; while realizing that whether 'panic' sets-in (not because of the S&P levels, but a triggering WuFlu outlier) will determine whether we see the already-expected shakeout, or worse. It all is going to increase levels of jitters, and overall drama just ahead. Prior highlights follow: |

Now as to the risk of a 'global public health emergency'; China continues to be pretty transparent and proactive (that's great); but it's spreading as I noted not only to Scotland now; but also a passenger arrived from Mexico City on an American Airlines flight to LAX. So now you have personnel in an effort to decontaminate areas around arrivals in Los Angeles (patient condition or diagnosis is as yet unconfirmed).

The point is simply that we clearly hope this is contained; but regardless it is taking a toll on travel and related businesses (casinos, cruise ships and of course airlines). Macao is considering closing ALL casinos temporarily if need be and that's just an example. Load factors on all flights to Asia at this time are very light; with travel deferred where possible. The US State Department has issued a statement asking travels to China to 'reconsider their travel plans', where previously State had only urged 'caution'.

So it's a big deal and while it may well be contained, some plans clearly change regardless; and many holidays or business travel will be deferred until matters are clearer (and the safety of traveling is stabilized). Market behavior deals with overbought S&P conditions anyway; with correction prospects clearly outlined likely in this time-frame and/or early February.

|

Of course the S&P won't give up on a time; as this is a process over well a period of time. And the answer to quarantine's success in China also is not a situation that will be resolved on a dime either; but will be known in the fullness of time. Patience required. |

|

The U.S. markets may more realistically reflect the world's sluggishness; with a more solid focus on domestic-centric stocks. While I know fewer details of 'how' things will be evaluated, the story about FICO scoring to be changed, in ways that will downgraded the credit-worthiness of many middle Americans; I do see that as a sobering factor in this consumer or spending-driven world. Perhaps this is intentional to allow the Fed staying with low interest rates into the forthcoming (after we get through travel or other inhibiting factors related to the epidemic) period of global recovery and growth, without the low rates inviting consumers to overextend themselves further. We'll have more on this another time. Meanwhile, we do take the uncertain prognosis for the virus seriously; so that I called it a 'China Syndrome'. The real syndrome may be avoidance of unnecessary travel and mass gatherings; and that can easily affect the United States too, if we have just a handful more cases. It's psychological even if there's not a huge contagion in this Country. We hope there's not anywhere; but given this was only identified 3 weeks ago; odds do favor a poor prognosis for getting a handle on this as quick as we all want. |

We're not advocating complacency towards these issues; but realize to a degree you've got investment managers simply buying stocks regardless of the backdrop; thus based solely on money flowing in as well as a slight glance at the technical continuation pattern that certainly does not trigger any real sell indications (part of why I said Tuesday was really nothing).

I am increasingly concerned however that what I will call the potential flu epidemic (pandemic or not) quickly devolves into a real threat to optimism among travelers and tourists, even if it's only for the short-term (hence its ability to take a notch out of Q1 revenues for many consumer-based firms that would be impacted; from hotels, casinos, cruises, airlines, etc.).

None of this recent market strength should deter prospects appearing of a more notable shakeout (even if only short-term); although there are many variables. Of course if a 'pandemic' is declared; sooner vs. later.

Now let's focus a bit on politics. Today a Poll now has Michael Bloomberg as number 4 in the Democrat race; and all that says is that more voters in that Party are leaning towards 'centrist' candidates that the market would prefer. Again my personal preferences are irrelevant. The point is (like we said in 2016 with the 'if Trump wins, even if you love Hillary, you have got to put your money 'in' the market, as it will go to the Moon)... the point is that 'the market' is more likely to be stable if candidates on 'both' sides of this contest are viewed as not destabilizing American growth prospects.

|