Market Briefing For Monday, Oct. 21

Turbulence prevails - without the market's flight-path diverting, yet. Of course the S&P is on a ledge; but it's unclear if it's the peak of a domed structure; at least premature to arrive at that conclusion. If it's a 'gable' roof, a structure can be extended, if an edge isn't the roof's peak; even though of course things appear more precarious hanging there.

Sure, the S&P ran into trouble on Expiration Friday; but a contraction in relation to nominal Expiration, and expected pre-weekend contraction, it seemed was reasonable. So it was Boeing getting 'clocked' by some revelations, as it's greater influence on the Dow Industrials even than on the S&P, masked a fairly neutral broad market (nothing serious yet).

As to Boeing, I've forewarned for months of their 'team's effort' to ignore or avoid addressing 'flight dynamics and specific structural design issues' as being the basic 737 MAX culprit; given that there would be 'no need' for the MCAS software if general basic flight characteristics were comparable to other 737's as they've contended (and again to the point of deleting MCAS references from the original flight manuals for the crew... making it even tougher to at least grasp what the potential scenario could become and essentially 'how to' address it... that was corrected later, but just a bit too late).

Without delving deeply now; the revelations (even if slightly variable in context) sadly affirm the concerns I expressed months ago. The point I think I made simply is: the any and every successful air-frame design, aside specialized military aircraft, should be able to be 'basically flown' in stable flight without all those over-controlling computer overlords.

It's only a few years ago that I criticized earlier Airbus designs (better now) for believing the computer was smarter than the Captain; and it's sad to say Boeing followed Airbus with that thinking; but not to extreme at least until this hybrid 737 (which tries to 'mate' tried-and-true designs of 50 years ago, with lots of mechanical cables, with modern electronic fly-by-wire systems), and the result is anything but what they expected; a First Level technology mid-range showpiece.

Now Boeing's trying hard to piece it back together, and even American (and Southwest) pilots at this point are not defending it as they clearly once were, relative to foreign and smaller carriers. In fact I think I know 'why' Boeing 'largely' moved to fly-by-wire contrasted to their prior solid military-bomber-based design philosophy of mechanical redundancy. It was large to 'sell' incredible numbers of 737 Max aircraft to regional or less experienced operators; many of whom had few 'experienced' seat of the pants (tens of thousands of hours) pilots on their payrolls.

Boeing knowingly (according to pilots involved in the training) assisted 'pilot mills' (essentially schools to churn-out guys and gals capable of at least being licensed, and mostly based on Simulator training) in Asia. I believe Indonesia was most culpable in generating such pilots, with the new airlines in China doing something similar; though the 'ethos' might be better in China, and in Malaysia, which has used such 'mills' too.

One discount airline that did it 'right' was Norwegian. They are sadly in possession of a lot of 737 MAX aircraft and were among first to 'ground them'. They also were among first to demand turbine engine fixes on a series of (otherwise wonderful) 787 Dreamliner Rolls Royce engines. In this case when I say 'right', I mean that although their competition tried to criticize safety and crew experience (big legacy transatlantic carriers of course), they had crews from Asia and Europe (rated the best of all discount carriers in Europe, probably due to free WiFi on flights); and most Captains were retired British Airways, SAS or KLM (and seriously that means the pilot in the left seat had seniority; and an appreciation of bolting the aircraft to him (or her) and not just sitting in a Captain's seat to control flight procedures. Most airlines mandate retiring at age 65; but lots of pilots love to fly and they go to airlines like Norwegian or NetJets (corporate or share flights) for a few more years of aviation.

By the way Jet-Blue and Norwegian signed a code-share deal just the other day; I've commented on it a few days ago, and thought it brilliant. At the moment Norwegian (which many may not realize) is the largest carrier between New York's JFK and London Gatwick. Jet-Blue is very heavy at JFK, Orlando and Miami (Norwegian serves them too) so it's a natural fit to 'funnel' passengers thru each other's network. Merge?

Maybe one day; but at the moment Delta is the quiet acquisition King. (Buying part of LATAM, Latin America's largest carrier; and investing a bit more in South Korea as an Asian hub, China Eastern switching over, AeroMexico as well, and about to finally bring their 49% owned Virgin Atlantic officially in as a SkyTeam member. However, there is a trend to encourage using high-speed trains not airplanes if available; it is a favorable trend but may impact airline profitability especially, now in Germany, where departure taxes on intra-Europe flights are going to soar, as train fees are drastically reduced. Impacts discount airlines for the most part; but all traveling in or out of Europe will feel it so airlines either have to absorb it, or reduce their ticket prices to mask it a bit or simply raise prices to discourage air travel on short-range flights. In the U.S. this is so far an impossible situation with our ragged rail system.)

And finally, the market simply continues meandering at high levels; hit by Boeing but otherwise quite stable; if pensive pending a China deal, or of course another disappointment. And the Middle East is a mess; it is one in which I wish the President would admit he made a mistake (it might even be said about Ukraine) and people might accept an apology (even Clinton spoke to the Nation and apologized after Impeachment). Everyone knows that's not in his nature, but humility could be helpful.

In-sum: these random thoughts reflect me typing on a Saturday rather than wrapping-up on Friday. And it does matter. If investors perceive candidates on both sides as sensible and not moving to hike taxes (it's unclear unless John Kasich was running.. and he's promoting a book, but is not an avowed candidate to challenge Trump), and reasonably interested in humanity as well as global trade, that would be a plus.

So in a sense a shift (oddly enough) to discussing economics, stability and not just a 'wish' for politicians to move toward the elusive 'center', might help the stock market endure what looms very near-term, and in a sense contain the S&P above key breakdown levels (below here) as we migrate toward the seasonal (liquidity arrives) investing season.

In this respect that does not mean the market can't correct; it's holding, it's pensive; but it's also algo-driven so largely that it swings in a range, at least pending some news capable of it breaking that range. Sure, it has been our view that President Trump views the stock market as his 'Poll'. So, that's why you heard Kudlow (whose views prevailed with a President hearing calls for more toughness in his other ear) say things are progressing favorably with China; and we presume that they are. If so and if deal 'is' substantive enough the market will be relieved. Also it is the prescription for the S&P to mostly get 'a pass' if the Fed passes on another (counterproductive is my view) rate cut at the next FOMC.

Daily action - is well known as a Boeing-led Dow / S&P consolidation. I'm only surprised that more didn't grasp the serious 737 Max situation sooner; and the shares would be down here at an earlier time. There's likely 'clarifications' coming that will soften the blow; but the stigma on that aircraft is likely to prevail for quite some time after it flies again. It would have bee too much to ask Boeing to shift orders and teams very quickly to the unannounced mid-range 797 project apparently.

Aside that we've got Brexit to watch. The UK economy again remains suspended animation sort of; as the special Saturday Parliament delay at best, or 'hard no-deal Brexit at worst', is now back on the table. That will likely weigh a bit on markets as Futures open Sunday evening.

It's hard to know what to believe going forward. The Prime Minister had been pretty clear that he will not negotiate a delay. He says that the law doesn't compel him to do so. So now we watch early week action that's presuming he will tell EU leaders there should be no delays and that they should reject Parliament's letter asking for a delay. If you see that they introduce Legislation preparing for a 'no-deal' Brexit, that's a clue of course. Now the Pound has already priced some of this 'in', so in FX markets I wouldn't get crazy with 'bearing' Britain; though the knee-jerk reaction is likely going to be lower.

Conclusion: sometimes you have to shake up markets (this time last year and less so now 'if' trade policies especially can progress; which is why we need USMCA and nobody even talks about ratifying it), and sometimes you must shake up politics when false promises evaporate on either side of the aisle.

America's interest don't automatically align with all the politics recently implemented, although they do with some. And they're clearly hesitant to embrace some of the other proposals 'trialed', even though taxing sentiments regarding wealth are confusing; at the same time as many Americans aren't thrilled at constant spending without funding sources.

Politically there's an opening there; so if it were a Tulsi, or even Biden or for that matter Kasich (if he miraculously is compelled to oppose the President or Pence); what the market wants to see is 'stability'; not so much the 'cult of personality'. That's not an anti-Trump statement; but it reflects the idea that a lot of people are interested in healthcare, sure; at the same time they're interested in economic stability and progress.

So I guess that means something like the elusive 'Center'. And yes I think the market can generally (pending shakeouts allowed of course) take a lot of chaotic chatter out-there in-stride if they perceive stability and a path toward business (CapEx too) planning for the coming year.

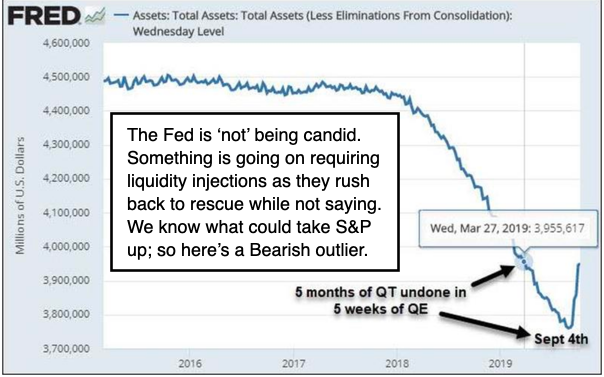

The new trading week (depending on news) might again sag initially, only to revive with yet-another intraweek rally; but not dramatic barring a break-thru announcement on trade, which isn't likely just quite yet. Of course knowing it's pending keeps the short-sellers a bit nervous. The Fed might be less of an event than generally thought for the moment; at the same time the return of huge 'liquidity injections' is curious (lack of explanation as to 'why' banks needs them remains bothersome).