Market Briefing For Monday, Nov. 4

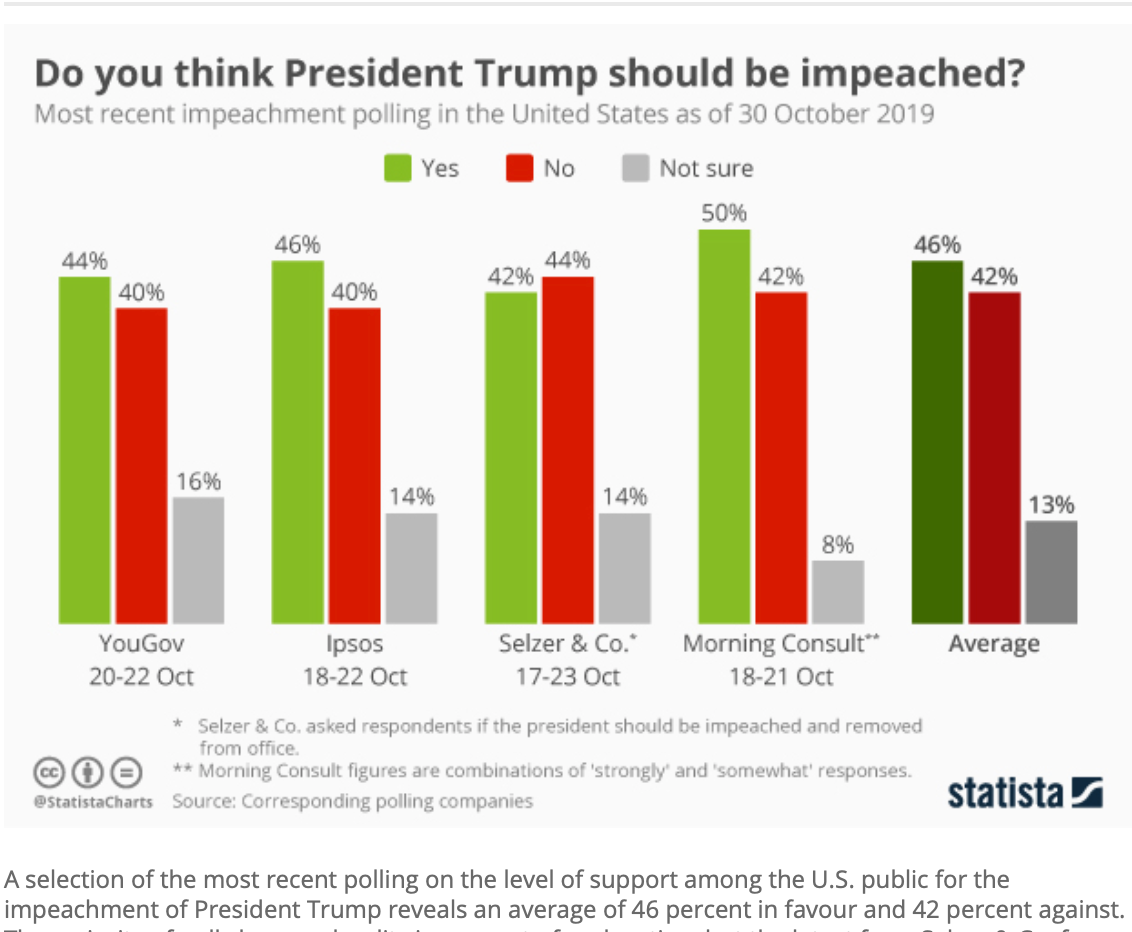

Skepticism reigns supreme as the S&P surges to record highs. All the increasingly dubious pundits and outright bearish technicians are missing something a bit surprising: the bifurcated nature of this market. If viewed in this way, it shows the difference between dormant Industrial stocks, versus the FANG type expensive 'grand dames', as clearly defined as a political poll about candidates or impeachment prospects.

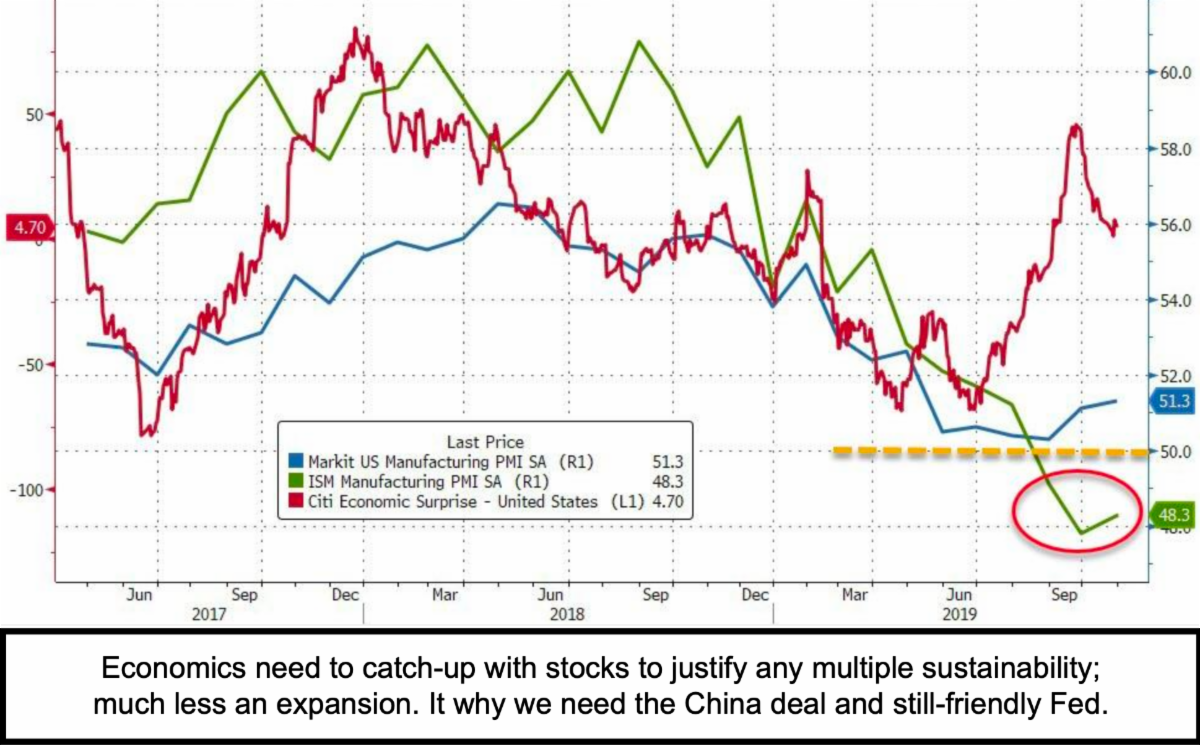

What's somewhat odd about this is that neither the S&P's cap-weighted or structural split, or US political divisiveness, really (at least so far) is impacting equity prospects. What does matter here is getting a deal with China; seemingly illusive, while we do see it coming together 'this' month based on Navarro's comments Saturday morning as well. So for now the question is whether post-news-spike selling occurs.

That's of course the question, and I'll address that in the main video. It may depend largely on whether or not the uber-strong S&P has by that time corrected again, or just just languishing at high levels, since it is a bit unrealistic to expect it to surge forward at this angle-of-attack for a long time, once the benefits of short-covering scrambles subside a bit.

Even the political scene may take a bit of a prolonged pause; given a Federal Judge potentially slowing the brisk pace of inquiry by declining to rule on whether a key witness needed to testify before the House of Representatives. Instead, he gave relevant parties several more weeks to prepare their arguments. That raised a prospect that public hearings on the president's conduct (regardless of both sides obvious biases as we'll not debate now), could drag on into the holiday season; that's a scenario many in the Democratic leadership once hoped to avoid.

In-sum: while the Bears or even some very skeptical normally flexible managers, have been shorting and fighting the Fed and this market all year (and continue doing so); the S&P has worked higher as outlined.

Yes, it may have limited potential near-term; but the TINA (there is no alternative to stocks) viewpoint dominates, dragging capital into higher price levels, which require a (dubious) multiple expansion to justify as profitability continues to diverge from prices.

However markets can do that as a discounting mechanism. It's exactly why in 2016 my contention was 'to the Moon if Trump wins'; regardless of anyone's political biases (to wit even if you hated Donald and loved Hillary, we suggested separating your politics from investment moves).

That worked out superbly then; as did our rolling correction approach following the January spike of 2018, and the crash alert of September; and then the probable 'cycle-low' forecast on the expected implosions that culminated (aided by that insane Fed hike that month) just before last Christmas. Even while calling a couple corrections or shakeouts as well as rebounds this year, we have repeated argued against shorting (aside a few particular stocks or fading them, and that usually worked), because we have said 'no catastrophe' is coming.

That won't always be the case, but is for the moment. And if there was an Election today; the President, with all his flaws and lack of tact in so many ways, would probably win handily. What happens as we progress toward an Election next year matters; because at the moment with the market where it is (S&P anyway) there really are lot of citizens worried about what happens to their portfolios 'if' certain candidates prevailed.

I realize Trump's playing that card (yet-again today); and it may not be 'proper' to do so. But if enough people believe it, that's having a similar or well-recognized influence on how they may vote (their pocketbook). If many New Yorker's move-out to avoid high costs and taxation, won't many (regardless of political leanings) not support certain platforms if they purport to intentionally aim to drain their finances. Not to mention that most employees of big companies own stocks too; and businesses that have higher costs associated with such high-tax proposals, would probably have to pass those costs on to customers or see low profits.

Bottom-line: we may get a pullback 'soon' but any first dip should not be significant, unless it was a complete collapse of China talks (as that is unlikely incidentally). The beat goes on and my political assessment was really just to emphasize that the market will be more complacent in next year's meanderings, 'if' the Democratic candidate is 'centrist'. The heart of both Parties really does care. So yes, 'it's the economy', and I will say no, the American people are not stupid and they get it; thus it does matter if candidates don't stop campaigning on higher taxes.

Charts aren't opening automatically; however I don't post this directly. ALSO if you are attending the Trader Expo Show this week; I'm speaking (an open forum workshop) on Friday Nov. 8 at 1:30 pm (at Bally's Las Vegas). During this week we have a 'show special' so if you subscribe to our Daily Briefing we'll include the intraday MarketCast service at no additional cost for the first Quarter. Visit us at www.ingerletter.com/subscribe

What do you mean? The charts look good to me.

You're right; it depends. I checked on my iPhone and they look fine. On my iMac (using Firefox) some setting prevented them opening. Thanks for your interest in my work. (full MarketCast with my videos less than half price for the 1st Quarter at our website this week only due to the Trader Show in Vegas... though you won't it noted). Just subscribe to Daily Briefing and we'll upgrade at no charge.

Thanks for the explanation, Gene.