Market Briefing For Monday, Nov. 18

Bulls are still circling for a deal with the 'China Shoppe' (as they are that for sure); amidst arguments of decades long trade wars or the like, with which I don't concur. It may be painful for Beijing; but the world has grasped how naive former policies were with regard to presuming they would become more democratic with achievement of greater wealth; so now the belated action to tame China's economic imperialism actually; as the 'Belt & Road Initiative' was clearly becoming, is unmasked.

This matters and can be tamed adequately; without destroyed globalist relationships that have been built over decades, and which aren't awful when contained in a fair way. Ironically, too many see things myopically in black or white terms, when globalism needs to be a shade of gray as relates to avoidance dominance; but with clarity understanding that the basic international trade between economic giants must settle-down to an acceptable 'order' and 'routine' again, but within limits.

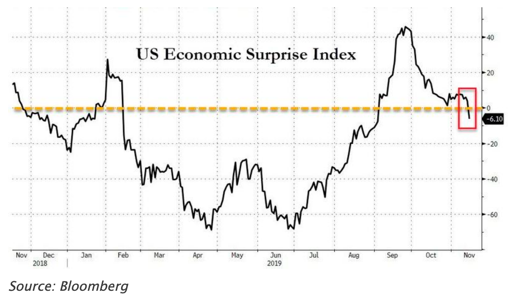

That's one reason we've address what's happening now as 'hopefully' the final throes of the recessionary nuances I've identified developing a year and a half ago and persisting until now; as today's lower Industrial Production levels affirm. Things may look like they're heading South of course; but they have been for over 18 months; so at some point we'll have gone so far South that almost imperceptibly we start going North.

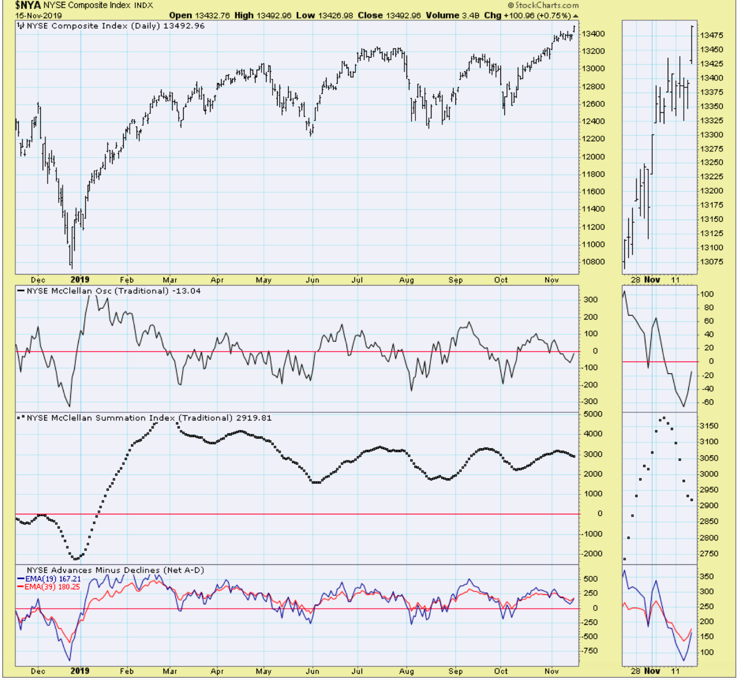

In sum: the market's climbing and not out of petrol as of yet. At this pace, the Bears are getting clobbered and will really be carved up by Turkey Day if this doesn't simmer down.

It might take a deal with China, or an utter failure to get one, to tame things. So far so good; and delighted by many things this week.

Daily action is pretty self-evident, in the Indexes and in stocks we've sort of favored. The S&P's at a new record close; as I thought we'd be holding traction going into the weekend, and we did.

Now the challenge is continuity, allowing for some effort to retreat a bit at the week's start (such as follow-thru and then a rebound) to allow for intraweek traders positioning patterns to evolve as often seen. Of course that presumes no bad news regarding progress towards a China trade deal. Getting a deal is 'more crucial now' given the market extension in advance of any such Agreement.

Then we'll play trading by ear, depending on what is agreed, and when it's signed; and incidentally, whether USMCA 'ratification' progress just happens to occur almost concurrently; though of course not exactly.