Market Briefing For Monday, May 3

Circling the wagons is one way to view defensive behavior of big-caps, as some stocks are rallying, while others sello ff; even with blow-out results.

What that tells us is that we have brought 'demand forward'. And perhaps by conventional assessment, pulled liquidity from down-the-road; short-term very likely. It's not just economy and interest rates; it's spending and liquidity.

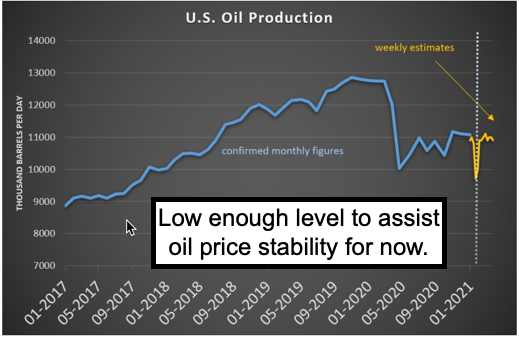

Meanwhile, the 'synchronized global recovery' (and inflation) is endangered as I have noted, in part because of the resurgence of Covid-19 and return to stricter efforts to contain the virus; beyond what optimists are looking for. The politicians for the most part are continuing to behave 'as if' everything is going towards normalization, and we certainly want to see that.

Probably that's the case in the U.S. and maybe gradually the U.K. But if what is happening in India with mutant variants spreads (as it has to part of Africa I heard this week), well that all bets are off with regard to a broader mix gaining ground. In fact we go back to big-tech leadership.

That might be facilitated by comments I'm hearing suggesting semiconductor shortages are going to be addressed and met by year-end; that would soften the concern about companies dependent on that supplies going into 2022. In fact Christiano Amon (who I had the pleasure to meet in Berlin 2 years ago, giving me the heads-up on waiting for SOC processors -now out- for 5G), the new CEO of Qualcomm, emphasized their foundry growth and noted how even Samsung has a foundry in Austin Texas; plus no problem working with Intel in the future.

Perhaps fundamental analysts focus on whether earnings are growing into the share prices that have moved forward. I suppose the directional targets we're hearing from analysts are getting a little crazy: one targets Amazon to 5500 (I wouldn't hold my breath for that). Untapped buyers aren't really coming into a slew of expensive stocks; but analysts will raise targets to attract interest, and it's impossible to comment as to whether they are disingenuous or believe it).

Last night I took time to listen to the Apple & Google compliance guys being grilled by Senators. The primary topic was failure to 'really' apply excess gains in revenue from 'App' stores to reinforcing security and stopping scams. They (the Senators) did not get clear answers; and the questions (for once) actually reflected knowledge of the structure of fees; the inability to control secondary products being sold within downloaded apps; and so on. Where this goes is a potentially interesting trend of containing the emphasis on profits, not service, in a true 'pro-consumer' fashion; and I think the data-collection issue aims far more at Google than Apple; though they weren't singled-out. Antitrust efforts?

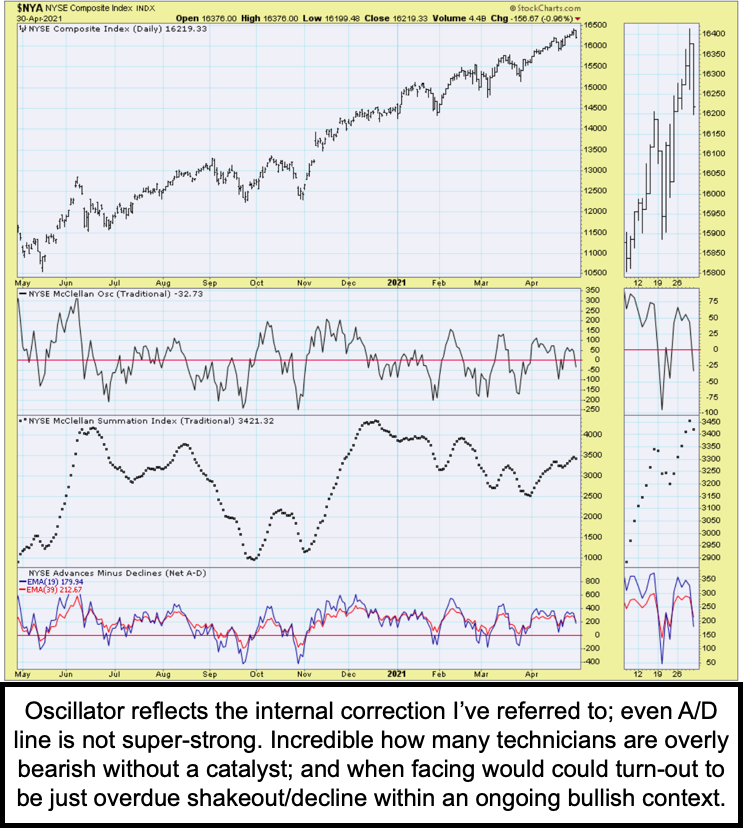

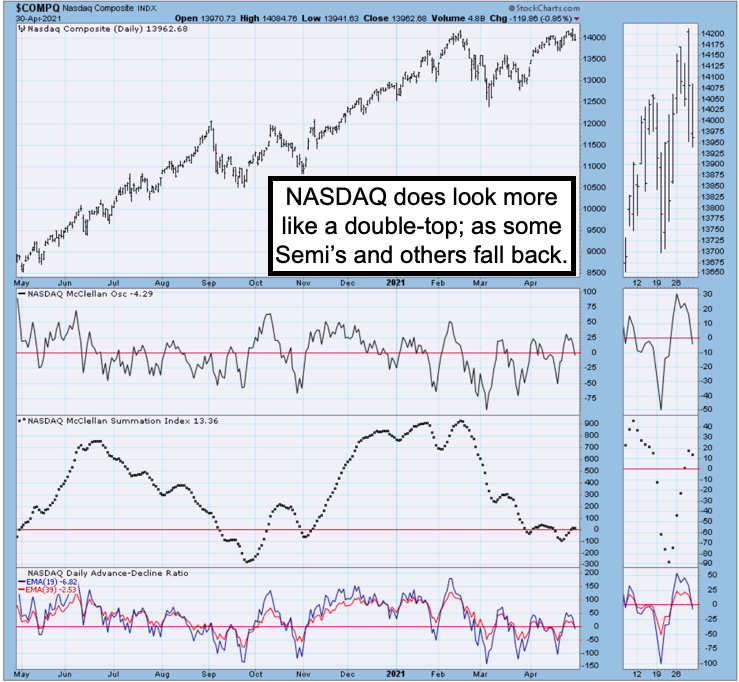

In sum: there are pockets of the market that are working and will work. What the market is saying about 'full valuation' or not; is sort of 'sell the news' style reactions, but not across-the-board. A bit of blow-off top was more Nasdaq than S&P, and certainly not in the DJIA.

So there is restraint; but it's not focused on fears of Fed tapering so much as I think it's the expected exhaustion in late April and as we go into early May. Of course we allowed that Amazon's showing might have led stocks higher; but it did not. Our overall view was get through this past week's Fed Meeting; and a slew of major earnings reports, and implement some sort of shakeout.

The market can meander in a relatively narrow range for awhile; and given so extended an S&P, percentages really are fairly narrow, considering.

Missed by lots of investors are some of the past and potential banking issues; which losses a handful of players recently suffered remind us of. Goldman Sachs as well as JP Morgan made more mistakes than they generally wish to talk about; while fortunately at the same time as they sidestepped the huge Archegos 'family fund' collapse, that cost several billions (Nomura and Credit Suisse, which just had management shifts, and a lesser degree others, were hurt by that).

The point again is how that fiasco truly reveals 'excess leverage' not only by funds, but improper oversight (and potential securities regulation violations) by banks 'willing to lend', which nobody wants to talk much about, it seems.

Perhaps it has reached a time to start closing some borders in order to stop the spread of this plague! Perhaps preventing the massive waves of death may be a bit more important than assuring the maximum profit for a crowd of multi-millionaires. Perhaps it is time to put the brakes on and stop greed and stupidity from wiping out huge amounts of the population.

OR, perhaps this is the run-up to that Judgement Day announced so long ago???