Market Briefing For Monday, May 24

Insane valuations increasingly are evoking downgrades; however typically well after peak rebounds previously reached. We should see more of this. So the economic recovery should have legs overall; but the stock market largely has discounted (priced it in) by now; and actually for several months.

Warning last December that a year-end rally could start seeing S&P topping behavior once seasonal money stopped flowing in (like February), it was not encouraging shorting the market, primarily because of 'not fighting the Fed' of course; but also because 'bifurcation' (a variation of rotation included) which could levitate S&P (and still does); essentially mitigating playing for a drop.

None fit this viewpoint better than Tesla, which I suggested could rise earlier; but then was insanely priced; given forward prospects. My main concern was not as a holder (or even the pattern of Tesla); but the fact that its inclusion as an S&P component; gave it 'capitalization weight' beyond reasonable, as that could impact the overall market, albeit not so much as Apple has for years.

Of course Apple has a far-better competitive landscape; so Apple winning vs. Epic or not; it's not an S&P killer (though losing the case would be negative for the stock, and probably reduce privacy and security for iPhone users who consider themselves, rightly or not, as better protected against compromise).

Friday Bank of America finally downgraded Tesla. As pointed out for months, Tesla was facing not only rising competition (globally); less enthusiasm from China and perhaps Germany (their domestic EV products increasingly impact the competitive landscape); and simply that it weighs on the S&P stamina too. I'm not increasingly bearish on Tesla like B of A; after all it's down about 300 or so since having identified topping action a good while back. My concern is primarily its 'capitalization weighted' influence on the S&P, as I suspect a lot of new investors don't realize S&P isn't price-weighted; but cap-weighted.

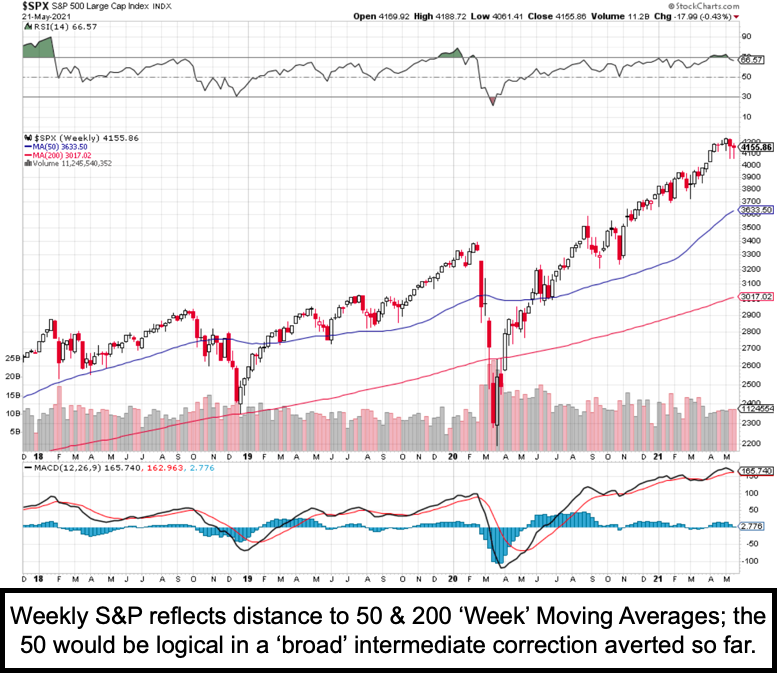

Overall... we got the first two back-to-back S&P weekly declines since early stages of our forecast post-seasonal pullback way back in February (forecast before I entered the hospital in mid-January). In stocks you have growth and value stocks trying rebounds; but nothing impressive occurred; slight negative tone actually. Call it peak enthusiasm about growth stocks, as hopes persist a rotation into more basic rebuilding stocks will help ignite enthusiasm.

No desire to throw cold water on prospects, even if we get a seasonally norm kind of rally into early June; but growth stocks (thinking of very high multiples, not average multiple stocks) are not only fully valued; but everyone with really any remote interest in the known names of the era; are already in or starting to take some chips off the table.

As some have dropped substantially; that's a bit of an argument for a rebound even if the rally is 'transitory' (the favorite word on Wall Street these days; usually related to inflation) and fueled by rebounds in momentum stocks.

In-sum: we got through Expiration; we do have economic growth with clearly justified enthusiasm; but as noted before, that doesn't have to correlate with a simultaneous advance in stocks; which rallies months ago anticipating this.

At the same time certain technical work doesn't really say we have to rally; but it does suggest most of the 'puff' has already come out of this market. Caveat: that measures the whole NASDAQ or NYA as the charts show; and hence will not differentiate extreme juxtapositioned price action of some pricey leaders, versus in some cases, the under-priced mundane behavior of so many others.

In the new week we'll presumably get a decision on the Epic vs. Apple case. That may be they key event that could move markets in this pre-holiday week.

Apple is sort of an adversary to some; but a blessing to others. Opponents for the most part might be among those who mine information and sell data even if they don't overtly use anyone's private information. One online broker sort of admitted doing so; and it's common practice on 'gaming' and 'dating' sites and 'Apps'. That's one reason Apple keeps the iPhone itself so secure; but fights a debatable degree in terms of security efforts they pronounce a key feature.

I'll not debate it now; but that's part of why iPhone's viewed even more secure than a Mac; because in normal browser-based environments; there's not even an attempt usually to prevent in-App or on-site 3rd party purchases or so on. I think there are a thousand ways for surreptitious hackers to gain information; a lot more than existed before. No wonder so many corporate vulnerabilities are only addressed 'after' their computers have been infiltrated or hacked. In many cases including Colonial Pipeline's fiasco; they weren't even proficient at doing updates and patches, for which there's no excuse in vital industries.

However you want to assuage the near-term future; there's obviously a better perceived risk-reward ratio in value rather than pricey growth stocks. It's how high the growth stocks got that influenced (for instance) the S&P's multiple; an example that reminds some of the pricey ones are really extended. But with a lot of technicians and analysts worried; that actually helps deny/delay decline of any magnitude. Or as it's said: they have downside protection; not upside.