Market Briefing For Monday, March 4

Persistent resilience set the stage for this week's holding action and the late-week surge; very much as we interpreted the market's ability to limit all pullbacks, even in the presence of challenging new (whether North Korea or Michael Cohen or even sketchy economic data and mixed sentiment).

Besides being a preferred way the 'worry wall' was handled, just 'absorbing' all the conflicting assessments, the various Hearings in Washington, and of course a slew of international developments (aside Vietnam's 'encounter' of course), which included near-war tension between India and Pakistan, and on Friday the Canadian Court agreeing to 'extradite' Huawei's CFO from Vancouver to the U.S., to face prosecution. (Whether she then becomes a bargaining chip in the U.S./China trade negotiations is denied but we'll see.)

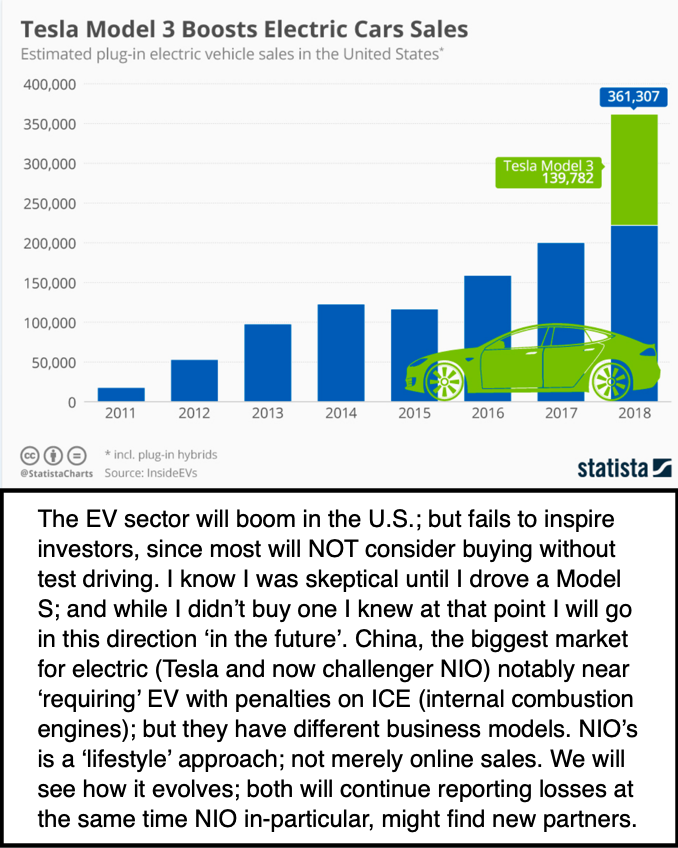

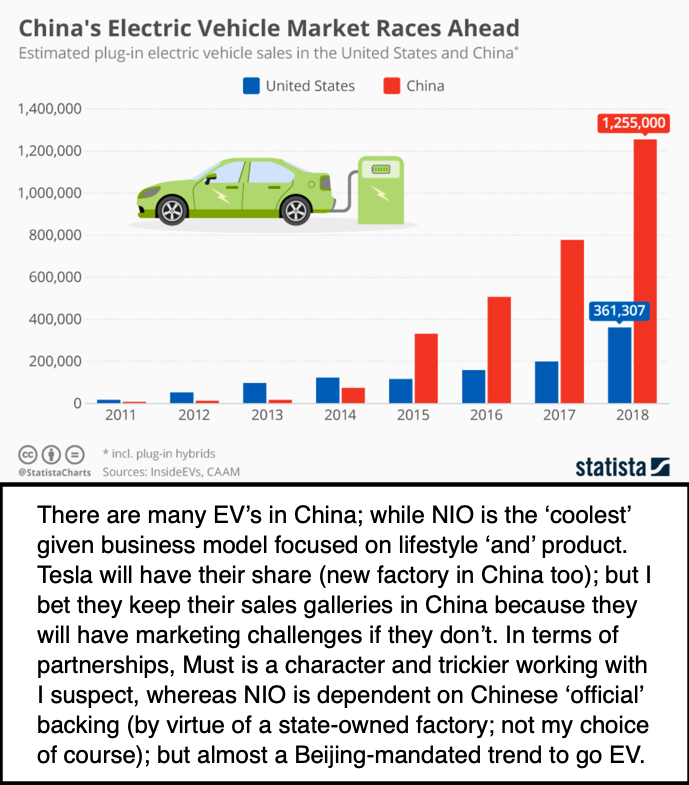

In any case, the reticence to use Huawei 'gear' in networks persists in many countries, especially in the Free World. And by the way, it's not contradictory to have favorable views of certain companies that behave correctly with the Chinese 'model' (and that includes Tesla), or those that are purely Chinese and thus not even impacted by how the tariff/trade talks go (eg NIO); although of course if they go well, eventually it opens potential export markets later.)

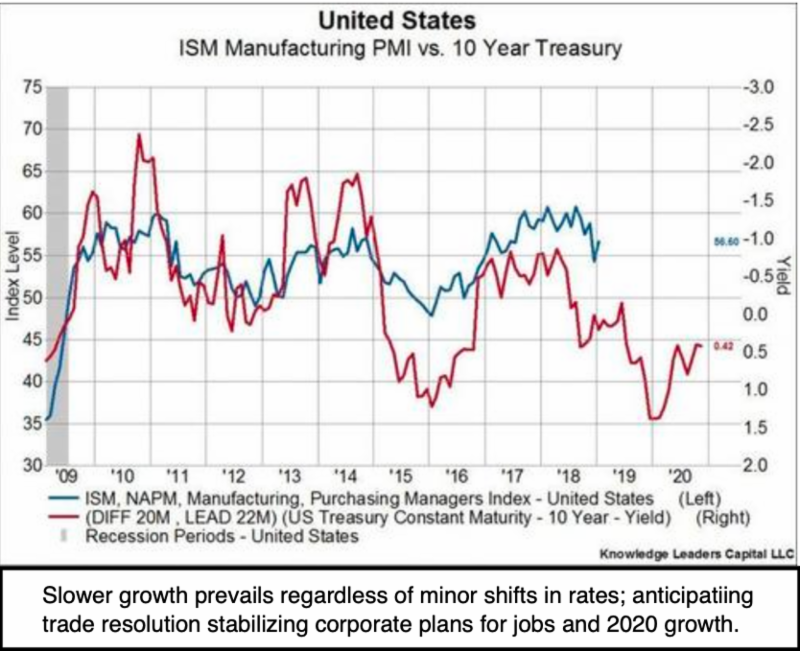

So many actually hate the stock market at this level it is encouraging! While of course I'm open-minded to the complexion of this market getting a bit more volatile as time goes on (I've outlined how it may behave in the wake of deal time with China; and how that depends on where the S&P is at that moment of course); while believing the 'recession' was (or began) a year ago, as we outlined at the time.

In sum: the general recipe for this market has been nibble, nibble, not really gorge, and certainly no (I won't use the word) 'eating disorder' for stocks. In this case that meant buy or add as individually comfortable or suitable, with a scaling-in approach (and that's still the case with speculative stocks).

Most important was to not spoil the meal by shorting or fading at all this year thus far, as that would be painful indigestion. Even if an investor did nothing other than leave alone what they had; maybe adding more around indicated washout lows into Christmas, it's been a good approach. The worst as we'd warned was a temptation to short or fade, which we didn't engage in. That's not to say we won't down-the-road a bit; but as I say every week; 'not yet'.

However... after the close Friday, as you likely already know, the President, in his special style; 'tweeted' that President Xi should remove ALL 'tariffs' on ALL American Agricultural products 'immediately'; since the United States did not raise tariffs to 25% on Chinese goods. Whether this 'pans out' of for that matter throws a cog into the wheels of negotiators, or is just pandering to his 'base', is hard to tell. If it's rebuffed in any strong way by China, then of course you'll see it in Sunday evening Futures markets. If it's another of the many 'neutral' posturing comments; it won't have much impact. We will just have to wait and see (or hear) what comes (if anything) from Beijing.