Market Briefing For Monday, March 11

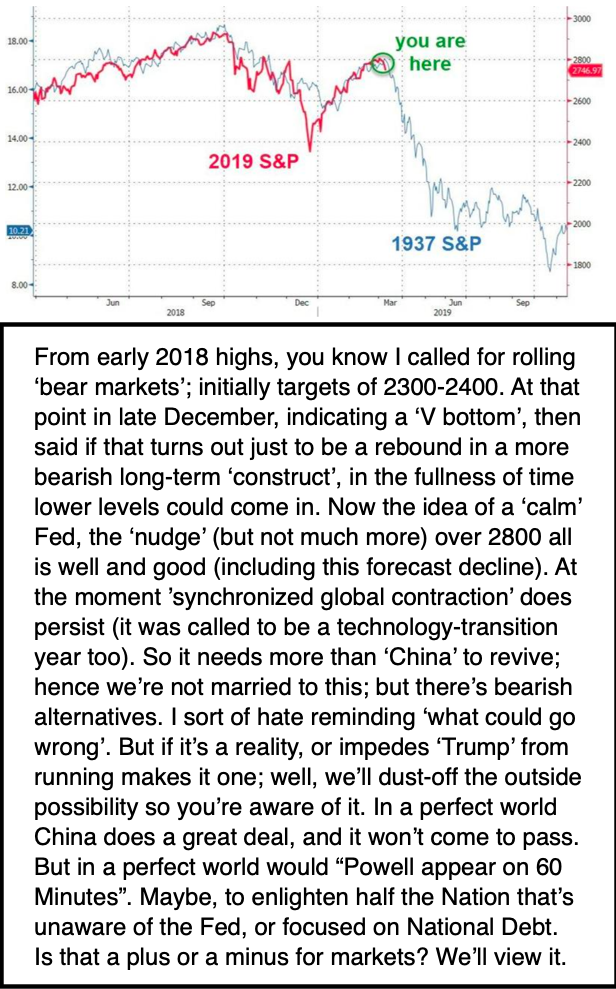

A wide spectrum of concerns persists in the marketplace, whether it's a shaky stock market, or renewed jitters recognized in the broad economy. In fact that's true here, in Europe, and certainly China; while Japan actually is a bit more stable in terms of economic stability. This week I mentioned the old 'bearish alternative' might have to be dragged out 'if' everything were to collapse (especially China); however that's not our preferred pattern. Here is the worst-case scenario I spoke of and which nobody should wish to see.

If anything, ahead of Brexit (the next real challenge other than concluding a China Trade Deal), market players 'pretend' they were shocked by a lower than consensus Jobs report; when in reality the economic slippage (macro comparisons have been shown) began 'before' the market's expected peak, at least for the short-term, just as it repeated nudged above S&P 2800.

The point is that many money managers (though few will candidly say so) really need a meaningful setback, since they generally were too defensive coming off of December's low; and need a chance to get in on a correction.

Of course that presupposes that the market will thereafter zoom higher as the year evolves, and on that I'd suggest they not be overconfident. This still is a 'transition year' for technology, and without it (and strong Oil), you'll find it difficult to get the market significantly higher solely in defensive sectors.

Now, that's not to say a number of stocks won't do very well; and perhaps in the 3rd or 4th Quarter of 2019, we'll see better-than-seasonally-typical S&P action. That could lead-into efforts for a stronger 2020 (ahead of Elections); but there are so many variables (including efforts to dislodge this President), that it would be unrealistic to make presumptions about 'late year' action as of yet. Visibility about that may become clearer down-the-road a bit.

That's 'after' we see what happens, not just with Mueller's investigation, but the State of New York plus continuous media-agenda efforts to drumbeat at least against the President (whether warranted or not). I've mentioned this a couple times, but Friday showed an example: as Space X 'Dragon' capsule was descending to a perfect landing in the Atlantic (first such landing in 50 years perhaps?).

After its perfect mission to the International Space Station, even Russians 'tweeted' congratulations to NASA (didn't mention Elon Musk), while surely Russia laments the $400 million annually they won't receive, to launch the astronauts on the old-technology Soyuz spacecraft.

It's actually fairly thrilling to welcome America's return at last. We'll be enthused about the human July launch. Next, how about simply a supersonic passenger aircraft that can be commercially viable (the smaller one coming will be limited capacity and very premium-priced tickets). In the conventional airspace, Boeing's forthcoming 797 popularity should be huge, although of course it hasn't even flown as yet.

(I'm sharing Nomura's latest charts; reflects action getting analysts jittery.)

Meanwhile the airline world clamors for 787's, as I thought they would, right from the get-go. IAG (essentially the joint British & Spanish firm that controls both British Airways and Iberia as well as discount carrier Vueling and more, as you may know) .. IAG's CEO said yesterday they may re-bid for the very popular (discount carrier) Norwegian Airlines. (That was a 'maybe' one day and not a suggestion of anything imminent. He actually wished them luck, as his Iberia started a discount airline named Level, which is really repainted A330's from Iberia, and he laments it not having a significant 787 fleet.)

IAG had sold their 4% holding when Norwegian rebuffed a prior attempt. But then the engine issues really hurt them with their sizable 787 Fleet, putting them in financial straights. It's not clear that IAG will make such an offer, but just be aware. (Norwegian is very popular with business travelers in Europe due to 737's with free WiFi. It's delays and lack of back-up equipment in the US that inhibited them.) Norwegian stock barely trades; they've curtailed the Asian routes to a degree; but applied for new routes from Oslo to Tokyo as well as Hong Kong and I believe Shanghai (over the pole easy for a 787-9).

(They cancelled future seasonal service from Fort Lauderdale to Caribbean Islands, while continue to service Argentina. Norwegian stock trades about 80% off it's highs (OTC NWARF, or EU bourses) at its 52-week lows now. No options and not suggesting it; just mentioning this for those interested and recognize how they disrupted the legacy carriers who are not a bit more competitive).

Meanwhile there is a deal that 'may' occur. That's why I recently mentioned JetBlue fighting Delta/KLM/AirFrance for landing slots at Amsterdam Schipol (Europe's largest hub other than Heathrow). JetBlue desires to service both London (probably Gatwick) and Amsterdam by 'this' year's Summer's travel season as I noted. They have A321's on-order, but they'd have to lease or in fact do something else to go transatlantic this year. I hear their Pilots met in the past two weeks with the Pilots of United Airlines, who are okay with ideas of a merger. I may have mentioned that too (getting older so who knows); at the same time noting it would also gain United more entry back at JFK and LGA. That would deliver 'feed' and possibly challenge Delta's dominance; which it got partially due to United focusing on Newark and American way too heavily (some say) shifting many operations to Philadelphia.

In sum: speaking of 'airspace', there is some downside potential for stocks; but not in a straight line. And, while we might get some upward thrust from a 'China Deal' that's substantive; unless the market has 'refueled sufficiently' (more corrective action); that will likely tend to be more of a rebound, than a significant major new 'lift-off'.

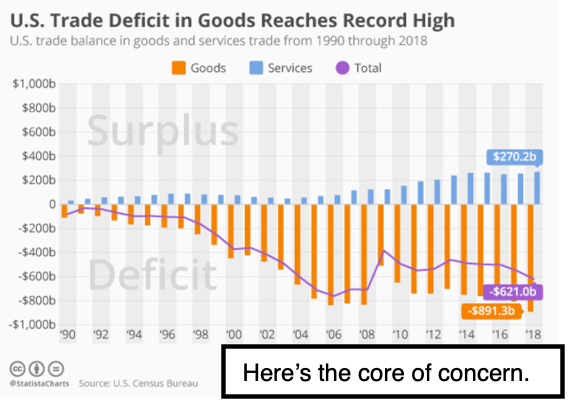

Meanwhile, there are lots of discussions about Financial sector legislation, that may create fees, as well as reflections on the last decade, for which I'm generally pleased, but blame former Chair Bernanke primarily for extending the 'low emergency rates' beyond the actual emergency. I hope discussions this weekend with Fed Chairman Powell (and maybe former Chairs) on CBS '60 Minutes' question whether the duration of that policy combined with debt growing substantially, was a mistake, and whether it now impedes American growth prospects. You know it's a real concern, that holds back firming rates normally. But whether they'll address it candidly (or should) is unknown.

From an overall standpoint we're getting 'outlined correction' from S&P 2800 as a 'process', and not a singular day or week event (though an intraweek rebound next week to lower highs would be normal). Barring awaking to big news about China Monday morning; we'd think more erosion should occur. But it's not major tremors at this point; while failure to get a 'deal' could just agitate things enough to trigger a bigger temblor than reasonable retreat.