Market Briefing For Monday, June 10

The 'balance of power' in this market does not depend so much on more Fed moves; though that's been telegraphed for some time based primarily on sluggish 'real world' economic activity; not political or Wall Street 'masks' that attribute everything to Jobs or the Fed paying attention to pressures.

This goes well-beyond the traditional leading indicators or influencers of markets; and points to what happens when 'supply chains' to this Country are seriously disrupted; or (as was the case today); it increasingly looks likely the risk of that will be mitigated.

The potential consequences of the 'trade war' are understood (and that's particularly likely the 'actual' not 'perceived' case for Trump too); and that's why President Xi's remarks Friday meant far more than rising belief the Fed has indeed (or will formally have) pivoted; or even the jobs numbers influence (which were soft enough to give the Fed cover to cut rates).

You have an ongoing contraction (housing and autos ebbing while credit card debt rose) for over a year since I warned 'nuances of recession' evident as far back as Spring of 'last' year. Now that others embrace that, and if we get a 'formal' declaration of Recession; it should be near an end. Not to mention how that would set-up 2020 for a pre-Election advance in the stock market (few seem to recognize this possibility).

Full House

Seriously; a couple days ago I outlined a 'less bearish' prospect (actually it's a bullish alternative); which would exist technically if we moved forward prior to the next S&P correction (and we are); and if we had hints of progress (of course so far shy of a deal) on Trade, especially with China. And we do. As for Mexico; that progress persists, and is sort of like a poker game; where at some point everyone will show their hands, and the game will be 'called'.

Neither Mexico or the U.S. holds a full-house in this match; it's gone too far, and for too long. That's why the President saying 'everyone will just come to the U.S.' is nostalgic, but not realistic. Unless he means a 'trend' over years go come; and personally I think that's where he's aiming. To create enough concern about the relationship, that Mexico toes the line for now; and many businesses contemplating 'even more' expansion South of the Border, do a bit of rethinking and move some of those plans to the U.S. itself.

Like I'm fond of saying; most things in life are neither totally 'black or white'; but shades of gray. And that's where we are now. You can win in poker when the hands are 'called', if you have 2 pair and the next best is a single pair. It may not be your dream hand, but it can be a winning hand. So it is with U.S. posture at the present time; get Mexico to cooperate; limit tariffs to 5% with no further hikes (or none at all); and plant the seed of possible 'moves' down the road, which will keep managements on-edge and reluctant to expand or focus their CapEx plans there... or perhaps anywhere outside the U.S.

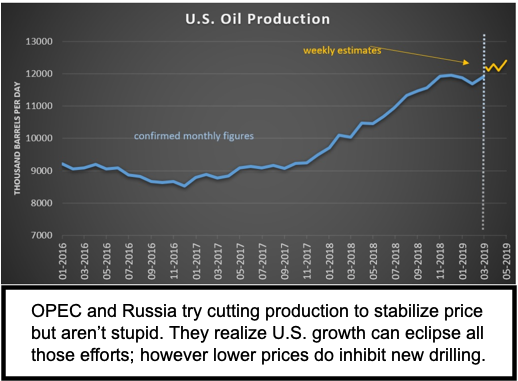

That may be too strong; but is probably in Trump's mind as a strategy. Sure, companies would focus on making products elsewhere; but mostly for-sale into those markets (or outside of the U.S.); to-wit, made-in-China for-sale-in China; not for export. At least primarily. There might ultimately be a variation on 'quotas' for products that can be made abroad, rather than in the U.S. It's just a thought, because totally blocking imports now is patently absurd.

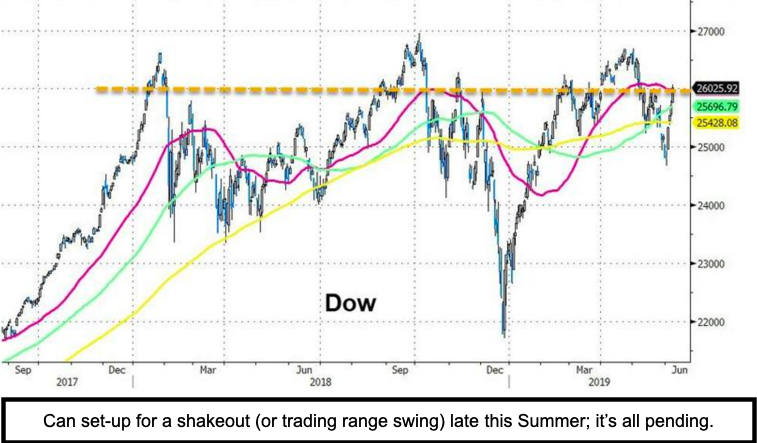

In sum: the market sees relief on the horizon; and Friday was particularly a result of President Xi's comments in Russia; about 'new rules-based trading' approaches. That matters and in my view supports a 'bullish alternative' for the S&P this year, even if it allows for corrections this Summer; not calamity.

As to Chinese President Xi, this: a) suggests he's looking for a way out of this (referred to Donald Trump as 'still his friend'; that matters as he views it as face-saving); b) there's already existing rules-based system which China violates consistently; so, c) that's a reflection of a strategy that let's Beijing 'bend' without seeming to capitulate to heavy-handed U.S. demands (as of course they see them); and e) remember they have involved this 'people's war nonsense' so heavily that they need a modified approach); and finally d) we we have further evidence of later this month (ideally) at G20 in Osaka.

It's worth noting that earlier this week when Trump aids referred to meeting with President Xi later this month at G20, media did not report that as what I saw as a 'shift'. Prior to that day (I think it was Tuesday or Wednesday), the White House had not confirmed whether Xi & Trump would even meet on a formal basis. I thought it was a key to a 'less bearish S&P process'.

Monday will be sensitive to Mexican trade arrangements (or lack of). Overall the short-term can run into resistance; but so far acting very solid beyond of course a significant short-covering rout anticipated days ago.