Market Briefing For Monday, July 20

Special report: 'global' urgency rises amid biotech shuffle

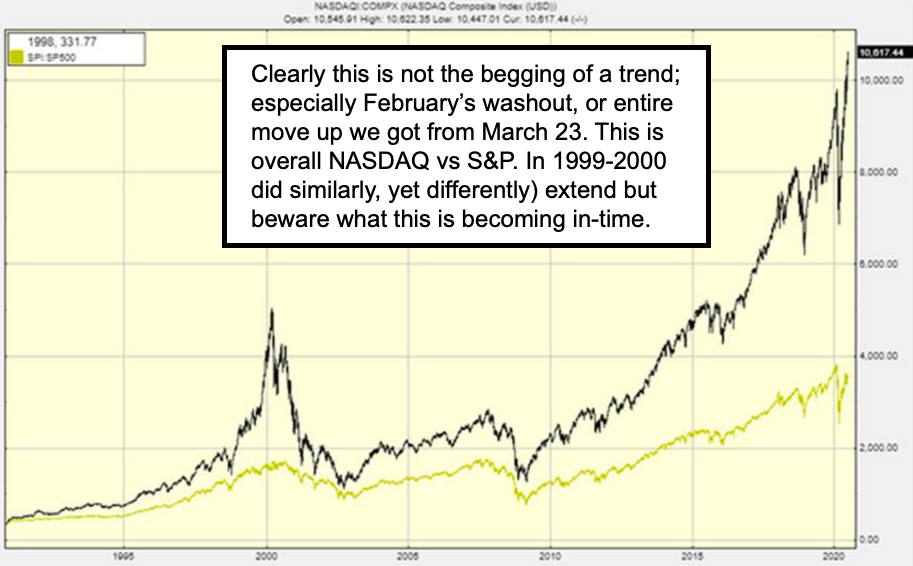

Aside sector rotation - in this incredible time of sharp individual stock movements; the Indexes generally maintained a high-level trading range without greater drama. I am clear that this has been achieved as we've moved into some of the Industrial or basic economic stocks; while they faded some of the overpriced super-cap stocks.

Of course Covid remains the biggest challenge; whether it's vaccines, drugs, or yet again an incredibly hard-to-believe shortage of PPE. It's not just interdependence as does exist between the U.S., China and Europe; but in some cases basic delusion. I would say that wishful thinking if fine; but can't be the core policy of leadership. And it's not now; but even the debates surrounding it can be mind-boggling. Onward ...

This afternoon there's another revelation; two actually. Iran comes clean (no choice as every knows); as a third of Iran is apparently infected... or worse... given officials everywhere tend to underplay the stark reality seriousness of the pandemic. And in China, a 'wartime footing total lock-down' has been declared in Xinjiang's capital Urumqi; and it's a very poor area of China.

And definitely, with charts like the NDX (100 largest NASDAQ stocks) in dramatic ascending wedge patterns, things were ripe for a setback. But at the same time 'strategists' would have told traders to try holding S&P 3200 for just a bit longer if they could; hence the shuffle into conservative basic stocks.

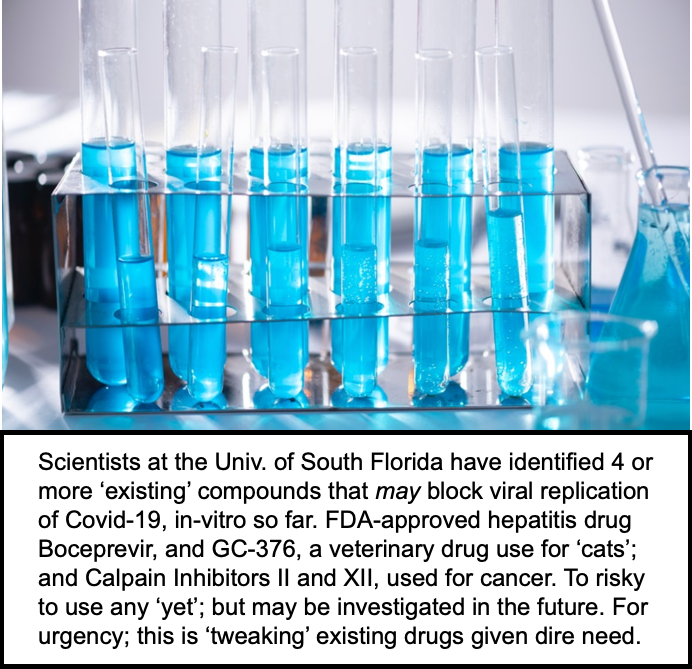

What's wrong with that? Nothing. Except that includes lots of small banks, small oils and so on, as well as sectors that indeed are depressed, but will likely see lots more failures especially if this persists. Now of course 'affirmation' of a truly efficacious (a proven reliable vaccine, or therapeutic) drug would lift all those; and that's been over the course of this entire outlined historic pandemic-controlled market environment, a backdrop to being ultimately optimistic, provided these 'solutions' to anxiety; not just to business, appear soon. We can get to the Fall (and as Dr. Fauci concurs, at least some sort of 'available' vaccine); but that would require supportive governance.

It's going to be very tricky; there's the political aspect as Goldman notably points to in a suggestion of a 12% market vulnerability should Biden prevail in November; as well as failure to recognize that if the mainstream market is 'heavy' and Covid not at that point contained; well wouldn't that direct even more focus toward biotechs? In my opinion it's possible until there's a clearer picture of which treatments, not just a couple of viable vaccines. will be the dominant features of addressing this global pandemic, which has seen lots of mistakes made by leaders in many countries; not just the U.S., not just the U.K., and certainly including WHO, and China's horrendous mistake for their own people too, by trying to cover-up or minimize the early stages.

I hearken back to the huge increase in bank loan-loss provisions; as supportive for Jamie Dimon's concerns about economic catharsis 'even if' we open the economy fully. Sort of what if you gave a performance and nobody came? (And I wasn't just thinking of political rallies, which is true too; but that's almost a distraction given the very real life-altering challenges so many are dealing with; here and abroad.)

Executive summary:

- Congress and the Fed have to stand-ready to provide sufficient funding for workers and the unemployed to get us to the hoped-for optimism this Fall; it's my preliminary view that even if they do the economic situation will struggle, so the view of valuations might be that they're high outside of Covid-era beneficiaries;

- Markets and the economy will reopen dramatically and rapidly if we get the type of backdrop that too many governors and some in Washington were in a sense properly wishing for, but failing to realize as an 'aspirational view'; but for now it is dicey at best, and pretty grim at worst.

- Meanwhile the disconnect between rotating between the 'broad list' and the 'super-caps' misses another trend; there's a distinct hot Bull Market going on;

- Biotechs are in a world of their own; rallying strongly early in the year; plunging as well during the February / March 'cratering' into 'The Inger Bottom' (my term that very day in-hopes history would reflect that March 23rd 'max-panic' fear); and of course rallying; but in phases ever since; with some breaking-out now;

- We'll focus again on biotechs; because that's what's fueling NASDAQ, and with the grim 'bombshell news' out of Iran today, admitting that 25 million citizens of their country are infected with Covid-19 (almost everyone in Tehran??); well, it's so idiotically political here, as this is an evolving global catastrophe begging for medical help, not nonsensical debates 'as if' there isn't enough blame around;

- That matters because they generally sold-off when the first Moderna story came out; but not so much now, as investors recognize that it may not be optimal for one vaccine; and that there are other treatments that may be complementary (in fact there's concern Moderna's has longevity; requiring booster inoculations; or a complimentary vaccine or immune T-cell booster shot to elicit a better-response by the body (especially in the elderly) beyond more neutralizing antibodies;

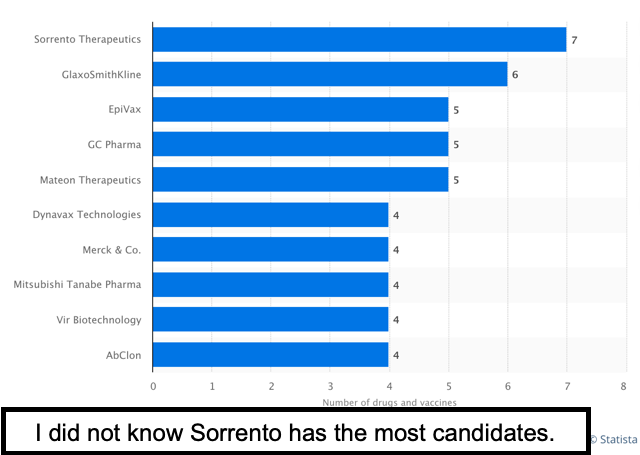

- Hence a lot of biotechs related to vaccines or treatments have bounced; tend to continue this rotating (high volume series of swings; generally in uptrends); I'm sure there are more, but both Sorrento and Heat Biologics are plays in this field; but both are extremely volatile with more 'in the oven' but 'not fully baked' (there may be news on both of these, which I touch-on in the long main video);

- In a lengthy discussion (below in the last Briefing if you'd like to review) I spent a lot of time reviewing at least a handful of such volatile clearly speculative 'bets';

- Most such stocks 'probably' have additional upside potential; but once you get a 'pill' (and I don't mean the oral vaccine, though that's important) to treat Covid in the early stages, that's a point where the sector might see the brakes hit;

- Until that time it likely remains the foremost sector for speculation, riddled with much fast-money and even day-trading activity, which is why the Exchanges now have restricted several such stocks (meaning investing is fine but not same day in and out); that's fine to temper insane speculation; maybe get things orderly;

- On the drug front, there was news after Friday for Sorrento Therapeutics which may respond favorably in the new week; and unclear if it's financial to the deal I address next regarding a Chinese cancer drug that may work on Covid too; (so it's probably a 'plus' that online and TV cheerleaders of this weeks ago are now negative, which probably washed-out panting-chasers to set-up a new move);

- Back in May Sorrento agreed to acquire 'Exclusive Rights' to Abivertinib; a drug that was in Trial to treat Non-Small Cell Lung Cancer; and there is some indication that it may be 'complimentary' to other treatments for Covid; but it's unclear if this relates to it 'alone' or some other aspect (hard to follow all this); (ironically Heat Biologics also has a vaccine previously aimed at cancer now focused on immunocompromised and the over 65 crowd to boost T-cells); in both cases traders should use discretion (if involved at all) due to insane volatility;

- For the moment the mainstream will focus on the Astra-Zeneca and Oxford Univ.vaccine studies; then earnings reports starts with IBM earnings after the Close Monday; Snap might do well; then Lockheed; with Texas Instruments;fair; Microsoft and Tesla Wednesday; AT&T Thursday (mixed); Tractor Supply (probably good with all the focus this year); all of which along with many others coming up (sluggish American Express and robust Honeywell too);

- All this portends more focus on individual issues during the course of earnings & biotech dominated trading; with the S&P possibly within this high-level range (a resistance of 3300 and preliminary support of 3100), if they manage to crack this; although I suspect a possibly-mediocre but bifurcated and choppy market due to widely-differing earnings reports and probably vague forward-guidance.

In sum: the market remains bifurcated as we've assessed. A bit of shakeout looked for in the 'super-caps' is ongoing in an alternating way; and a big earnings week now looms for a greater number of stocks; suggesting both disappointments and also the sell-the-news phenomena on a few stocks that initially soar on good numbers. Likely for the most part guidance will remain 'opaque' given so many known unknowns as regards Q3 and Q4 business prospects.

Bottom line: aside handling the early-year decline, anticipating pandemic risk (sad that we had to, but it was realistic even as it was not and is not political; just trying to take a reasoned assessment of where things stood; the opportunity during collapse that followed; the max-fear capitulation low; and climb-up that gets us less enthused about the big stocks that helped get the S&P here; and justifiably calling for ongoing trading ranges (rather than catastrophe); and not just because of the 'Fed backstop'; which eventually will get dinged by higher rates and/or inflation; but clearly not yet.

The upward movement in Industrial Materials and such may be a bounce within what becomes a sector-bottoming process (some could pull back); but I'd not be negative further out as some are, simply because once we get through the 'acute' Covid stage you will see such stocks move higher, with less reliance upon the big-cap 'stars'. The institutional crowd will revert to seeking value rather than just chasing momentum.

Conclusion: many distortions persist; politics are exhausting or counter-productive not just for investing, but often socially, and as relate to combating the pandemic. At the same time this frustrating stage for so many states (increasing for other nations as well incidentally, where viral 2nd or 3rd waves are appearing) suggests that we're nowhere near the 'chronic' stage of the pandemic (at least in many states here); and thus as much as we'd rather see normal life return, than returns in the stock market; we are not at that point; given the great returns already from our March lows. It also is why a lot of the speculation in biotechnology and big-pharma will persist for now.

| This long commentary, aside individual stock focuses, emphasizes that this virus is a formidable foe. |