Market Briefing For Monday, Jan. 14

A market on tenterhooks - just shy of resistance (and a 'congestion zone') has everyone debating the obvious concerns facing the market (and Nation) while we are focused on 'how' the market ends the projected seasonal relief swing higher into January, rather than expecting any dramatic levitation.

For sure, if the market were advancing from an oversold condition, I'd share a more optimistic view regarding 'duration' of the rebound, but if 'good news' (and of course that presumes we get good news) occurs at this level or just a hair higher, then I believe it will be perhaps energetic briefing; but likely to then be faded by traders.

Amidst all this, there is something brewing in Europe (if they conclude their pact); that might also be indirectly the counter to the Yellow Vest protests (it is noted they continue again Saturday; though losing broad social support).

What is it? Later this month, German Chancellor Angela Merkel and French President Emmanuel Macron likely sign the 'Aachen Treaty'. That governs a coordinated diplomatic front and even joint actions on peacekeeping (EU Army essentially?) missions; with an unclear linkage to NATO coordination.

Additionally, 'rumor has it' that areas on both sides of the Franco-German border will be encouraged to establish 'Eurodistricts' in which both countries would merge water, electricity and public transport networks.

The Times (of London) believes Berlin & Paris will offer cash to incentivize the cross-border areas; involving shared hospitals, joint business schemes or environmental projects. Some officials regard these experiments as a petri dish for the integration of the EU. How this impacts Brexit (and a fight this coming week in Parliament) is unclear; nor how peripheral EU member states will respond. Italy, Hungary and Poland come to mind as likely not to be enthused about even-greater concentration of power in the largest two economic powers of the EU. In some ways this may seem natural though; if they make it clear how the other member-states will be impacted. France of course has a permanent UN Security Council Seat; and Germany wants to have one as well. Will the 'Aachen Treaty' speed that prospect along?

There is a ramping of the domestic political situation too; aside the 'Wall' or the Shutdown. There is an interesting New York Times article yesterday that begs the question about the FBI investigation opened after Comey's firing. I will not opine on the issue; just saying this can reinforce Trump ultimately or not; and in some circumstances can trigger more of a market disruption this year than most believe. Generally they ignored this during 2018 and made an assumption the market doesn't care. Perhaps it cared then and in 2019.

Of course cynics generally also did not believe the economy was sluggish or market topping early in 2018. While hard to dissect (as well as Saturday's stream of 'tweets' from the President), with the whole thing beyond levels of propriety perhaps on multiple sides (of the issues), there's little new in the NYT story to confirm Trump was colluding with Russia; as best I could tell over a cup of coffee this morning. So was the New York Times story about Trump, or about FBI malfeasance? I don't know, but it's a weekend furor.

Back to the market. Do remember there are firms that suggest 'buying' into strength if the S&P gets above certain levels. I happen to disagree; and will suggest it's more likely that a thrust higher from near-current conditions that is sufficient to cause them to issue 'all-clear' indications, is just about when some selling of trading (as opposed to investing) positions from just before Christmas could be exited.

This 'congestion area' referred to (roughly S&P 2600-2650) is a term I used to describe an area we thought throughout the Fall would break hard after a couple 'Hail Mary' revival attempts; and it certainly did. Our target was more or less 2300-2400 S&P; and turns-out we nailed that; not just the preceding peak back in late September / early October.

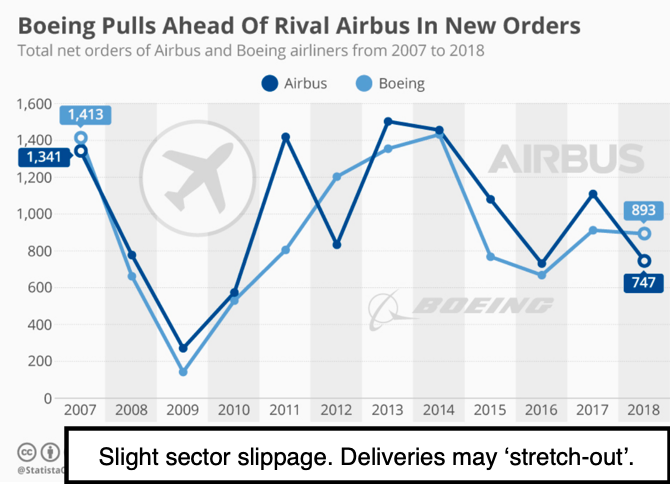

(Hard to say; but aside not wanting to lose 'delivery slots', China might be rather pleased because of a controversial Boeing satellite sale to China.)

So why in the world would we be buyers on 'confirmation of strength', when in reality that's time to pull back a bit. So yes, you could get a 'pop & flop' or similar unsustainable run-up, 'if' they get the news they want (ending a very unacceptable Government shutdown is only part of what markets want; with of course realization that it becomes more costly than any 'wall' the longer it persists). Markets worry about the Fed (they'll keep chattering; but policy is unlikely to 'actually' shift; though it may see an ease of the pace of QT); and of course about China Trade.

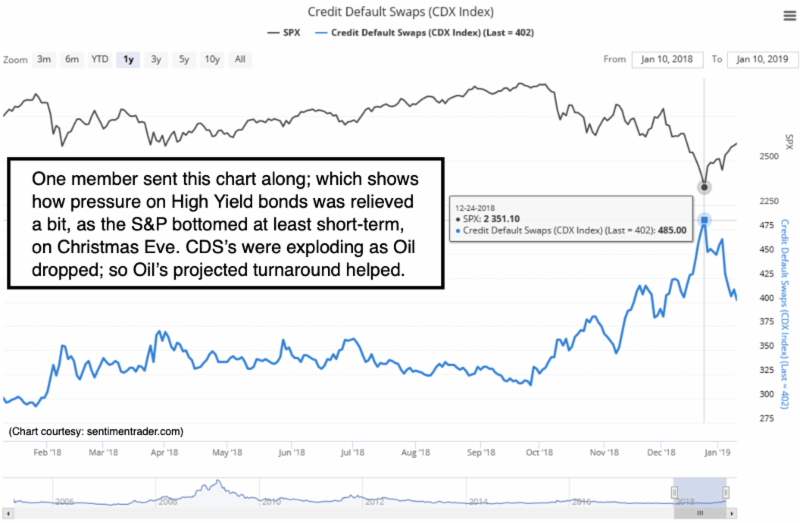

In sum: very little has changed beyond what we've discussed all week. So I will limit comments accordingly; since we all know where we (at least my views) are at the moment. I think the movement up in Oil and stocks from more or less Christmas Eve, also helped relieve High Yield pressures; and it all sort of correlated. But that already happened with our 'seasonal relief rally'; and there isn't a lot of confidence, liquidity, or excitement about any of this. And that transfers to perhaps a messy earnings reporting period just ahead.

Conclusion: regardless whether we 'formally' slip into recession (nuances evident since Spring of 2018 in my view as you know); economic prospects are sloppy; and mixed at best. This will have psychological relief, but won't necessarily improve earnings in the short-run, even with a trade deal.

Most market skeptics either want to buy into strength; or fade rallies; while a never-mentioned reality is most managers are desperately trying to commit a fair amount of seasonal (retirement and so on) income into stocks; trying to lift what they 'forgot to sell' many months ago; for overall performance. In reality it's a market led by levered stocks are and were overpriced, and for the most part (not entirely) remain expensive given forward prospects.

This is a transition year as I've mentioned; ironically from the 'Bear Market' that began as outlined early in 2018, to a basing period and then a new bull perhaps; while transitions in technology, geopolitics and domestic politics, all play roles in the shuffles that aren't going to replicate last year; but likely won't reward those failing to fade rallies just when the 'players' on the Street 'think' they have confirmation that we're out of the woods (for some stocks, we are since Christmas; for others..especially the pricey momentum types.. it's just a relief rally, that will have some testing (at minimum) to come; but it doesn't all have to start instantly. I expect us to dig into resistance first.