Market Briefing For Monday, Dec. 7

Defense radars are searching for a reversal of this market bubble as 'they'll' term it; while the overall market isn't quite so eager to listen to the technicians and pundits, yet. As the bifurcated market churns (or grinds higher for S&P); it is obviously overbought, but only by measures focused on the 'super-caps'.

Nearly 80 years ago on 'The Day That Will Live In Infamy'; Army radar guys had been searching the skies for enemy intruders; barely recognizing that the United States and Japan had ended peace talks in Washington; and alerts at that point were being sent to 'all Pacific stations'.

(Contrary to the traffic-light market signal technicians; there is radar detection of incoming threats; but defining the extent of possible damage is trickier.)

Confident nothing was at risk, the Admiral commanding the Pacific Fleet ignored a brewing situation; although he did (thankfully) dispatch our three Carriers to a 'training mission', while keeping the Fleet 'and' our (lined-up in rows) planes concentrated. That's sort of like the 'concentration' of equity trading in big-cap stocks now. They 'are' lined-up for damage should an attack come; and sure it is appropriate to disburse the assets (diversify a bit); but not necessarily flee if it's uncertain when the enemy (bear) air raid will come.

So the dive bombers may be forming, but not yet forming attack formations; at the same time I will call this a coming 'air-raid', because the S&P is up there in thinner air, just shy of our maximum 'reasonable' near-term 3800 or so goal.

One more thing: what happened after the 'air-raid'. The United States and our allies regrouped, got our senses about us, and went after the 'raiders'. That in fact is what we did with our March low (having predicted topping in January as well as early February) and for weeks we've warned of a possible shakeout at the same time what we've done is refocus on smaller specialty stocks, versus big-cap behemoths. We caught this S&P washout and run-up year; why would we see any reason to chase them now? But this is a unique year bifurcated in so many ways; thus it has also proven unwise to short this market. Perhaps it may be that the best suggestion I've had is 'don't fight the Fed' or the trend.

It's not yet a 'breaking point' for the S&P though one looms; short-term at least. S&P can indeed stay overbought for quite a long time; and a shakeout does not mean an actual 'trend reversal', despite protestations from a bearish contentious crowd of technicians and analysts calling 'doom' for months.

(I've tried to again describe some of my thinking about markets; and I think it might be useful not just to newbies in the market, but experienced players trying to 'force' a move. They continue to 'fight the Fed', and to fight the post-Covid enthusiasm which I hope doesn't turnout to be the problem next year; if vaccines aren't so good. I realize that could be a bigger opportunity for stocks like Sorrento of course, but overall for the Nation and humanity, I'd like to see the vaccines work well.)

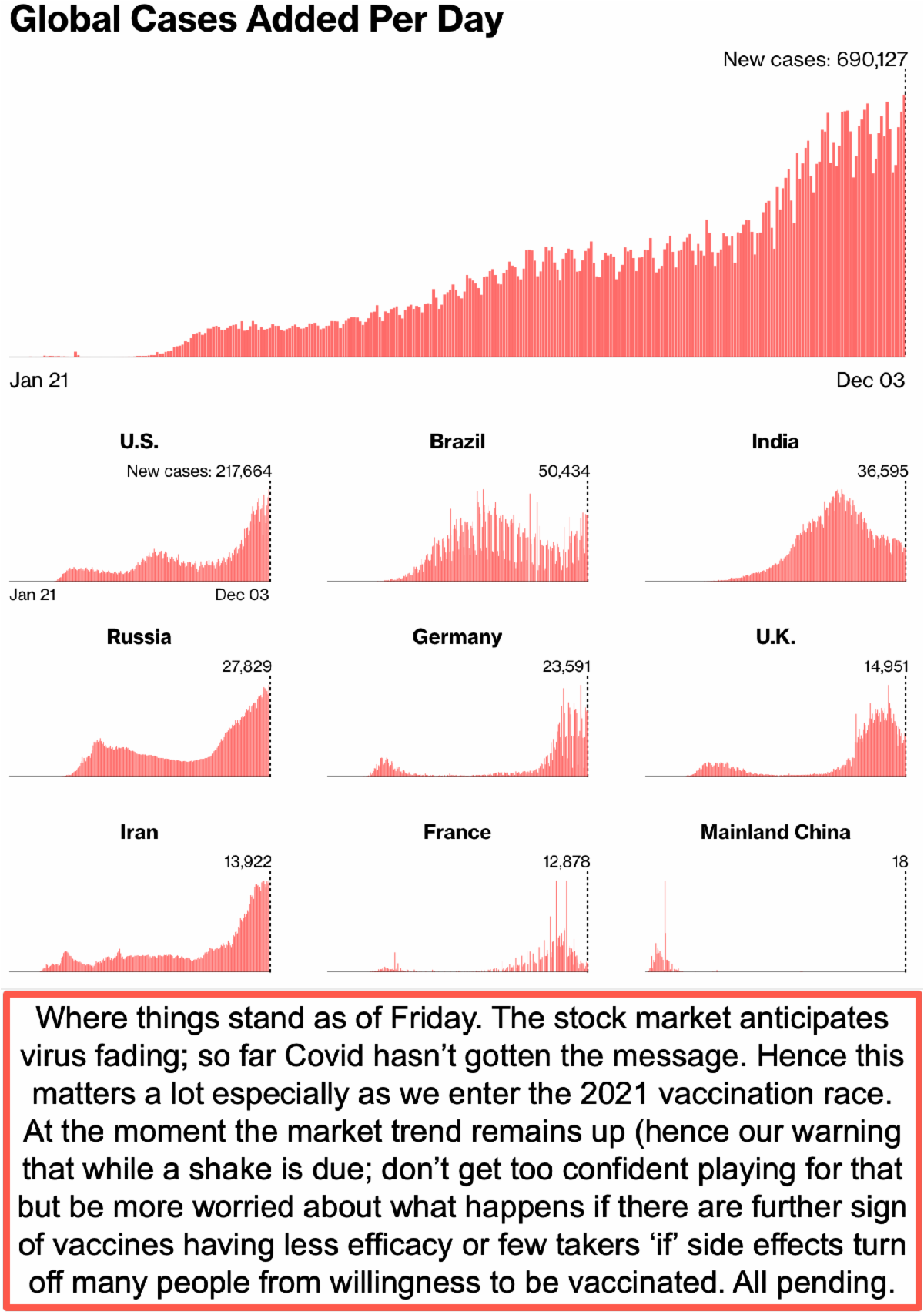

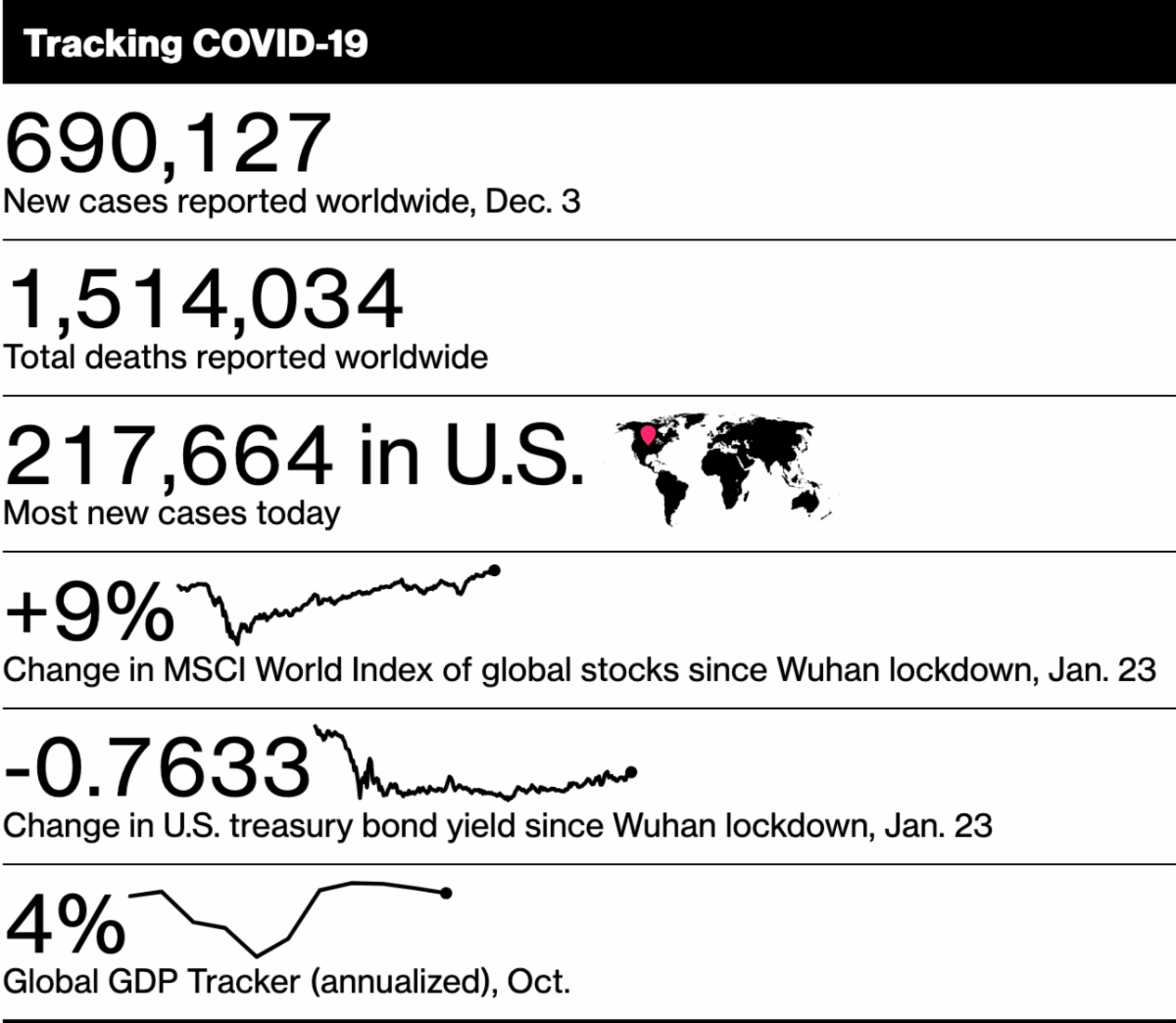

Concurrently the positivity of Covid-19 has indeed impacted the entire Nation; and for that matter much of the globe, except where they were very strict, like China for instance. This kind of struggling 'with' positivity; all along creates the backdrop for a fragile economy over these few months; prior to broad vaccine distribution; and a reminder even that takes weeks to build immunity.

Also ... Ed Bastian, CEO of Delta Airlines send out a memo Saturday morning I have heard about, saying they are bringing costs under control; and cut cash drain by about 50% in the most recent Quarter versus the previous. He further states they 'hope' to be at breakeven cash-flow by late Spring of 2021.

Conclusion: risk-mitigation may be appropriate these last few weeks of 2020 given concerns about another draw-down in stocks, or at least the super-cap primary leaders being pushed to records.

There are even unique cross-currents that cause sector-shifts and tax change concerns; that can make the usual late-year considerations topsy-turvey. Sure we want to be wary and try to pick-out levels; hence the 3800 S&P goal; and I noted as long as S&P is above 3500, and now elevated that to 3600 and may be 3650 early next week (barring exogenous weekend shocks).. as long as it trades above some levels it's noise/swings withing the grinding trend. But with the right news (as Thursday gave a preview) the pattern can shift swiftly.

In sum: the market is nearly 'full bull' as some might put it; but this beat persists until it doesn't. Friday was a preview of when the drumbeat pauses.