Market Briefing For Monday, Dec. 31

Investment risk clarity for 2019 is being sought by everyone, bull or bear alike; trader or long-term investor as well. While the potential catalysts for all sorts of resolutions are generally understood (we have outlined most known and pertinent market influences not just for the past year; but now the next), the outcomes are entirely illusive, depending upon a myriad of concerns.

This is not the kind of uncertainty markets generally don't like; that certainly contributed to the evaporation of confidence over the last couple months. In the course of 2018 we outlined a 'masked distribution' ongoing under-cover of the rotating (at a higher range) Dow and S&P on a continuing basis; with the most important peaks designated with 'crash alert' warnings both in late January; and in late September / early October.

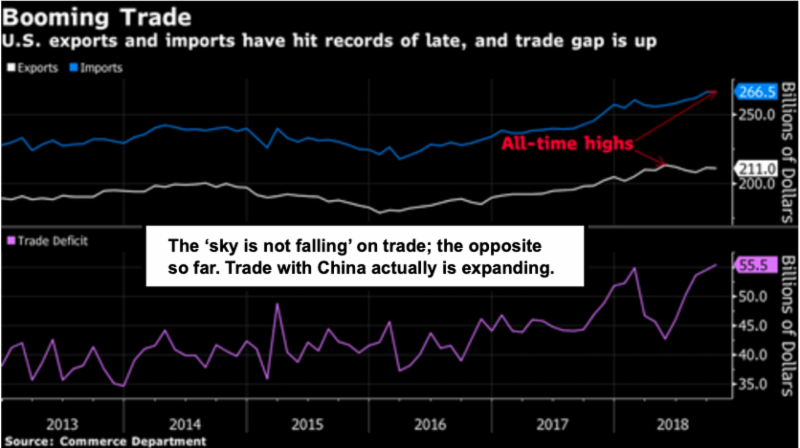

We got the purges and rebounds in both cases; but this time the prospects vary considerably. To wit: there is basically no prospect of robust recovery to all-time highs for the Indexes, 'even if' you get the much-desired trade deal with China (and you should; many hints already have been given by China).

Incidentally there's a perspective firming believing we shouldn't engage the Chinese with talks until they make commitments about not forcing 'transfer of technology', and they are said to be working on a new law about that, as well as a good faith gesture by releasing Canadians they detained solely in reprisal to the detention of the Huawei CEO, who is accused of a real crime which goes all the way back to the intellectual property thefts from Cisco.

I tend to leave my personal political views out of most discussions; tough as that is; but here when we speak of 'making or desiring a deal with China', I am referring mostly to 'what the market wants to see', not the morality of it in light of their pattern of taking advantage for so many years. At the same time, having called upon Washington to stop the outsourcing and impede a persistent deconstruction of American industry for decades -since my talks on that topic imploring CEO's to press politicians to intercede in the 1970's- it is fair to say the Chinese probed, and beyond what Japan or South Korea did during the same time-frame, kept pushing having found no resistance to their efforts.

To me it's really Intellectual Property theft and forced transfer of technology as well as compelled partnerships, which was a differentiator as contrasted with other countries. In any event; all I'm trying to convey is that the process went too far to easily reverse; so we end-up in a trade war scenario. Given the global integration; it seems reasonable to improve most circumstances, but unrealistic to expect a total unwind of what's been built; nor is that really desirable. But a 'more level playing field' is essential to achieve.)

Other challenges are sort of at an impasse; such as the Border Wall and Budget issues; but they have to be resolved near-term. The new Congress, of course, is another situation; and can be sobering to markets 'over time'.

The market's viewed as having cratered with the 'babies thrown-out with the bathwater'; and to an extent that became the case. However, most valuation levels are still above average for most of the momentum stocks, while given the rotational bear markets outlined throughout 2018, many smaller-cap and heavy dividend stocks generally corrected ahead of the second breakdown of the year (this Fall); and made decent-valuation (often actually attractive in some cases) levels for initial entry or additional accumulation investors were patiently waiting for.

What's not known is if those stocks will retest recent lows, as 2019 evolves; although the 'value traps' (like the FANG stocks) probably have far greater prospects of revisiting recent lows, if not even lower prices.

That's not to say we won't get more year-end and early 2019 buying; but for now hints at the prospects of traders (or those who were praying for needed rebounds) selling into a bit of strength whether that's their best approach or not (having failed to get out to some degree long ago). We'd be cautious as the S&P tries pressing into resistance zones (lower and higher) outlined.