Market Briefing For Monday, Dec. 30

|

Interesting hints about early 2020 are starting to appear; as nominal selling of hugely profitable stocks has not and/or will not 'really' crimp a surging market significantly. As stocks now settle in the 'new tax year', it is interesting to see how many big managers hold onto their positions.

I think this may be slightly illusive (or premature) to emphasize as of yet because while gains (or losses) can be taken in the new year (sales for 'cash settlement' can be made up until Tuesday's end), lost of manager attitudes relate to 'mark to the market' pricing; and if they're measuring comparative performance (or representation), they may want to show a heavy presence right into New Year's. (Many investors will look at what they own, but not necessarily 'when or at what price' they bought into.)

So you're getting some breakouts and short-covering combined with all this end-of-year crosscurrent activity; and this all happening just a week before we get into Press previews of CES that I'll be reviewing. I think some things like GM's 'Bolt' without pedals or a steering wheel, of course will get attention; although I view that vehicle as controversial at least. 5G will be all over everything; but that's what we've anticipated would start rolling-out about now; and increasingly into 2021 as well. Yes there are laggards that can do better next year; and others that are known but undervalued relative to their potential; and plenty overvalued stocks; or ones that are upgraded by analysts because of prominence, or capitalization, as impacts an Index or Average (Apple is the king of course of all of those). Stocks like Intel do not fully reflect the role they will likely emphasize in AI and AR, and it's true for Texas Instruments too. Financials may be suppressed, but not terribly exciting; as some Oil stocks at this point may offer a better combined return prospect.

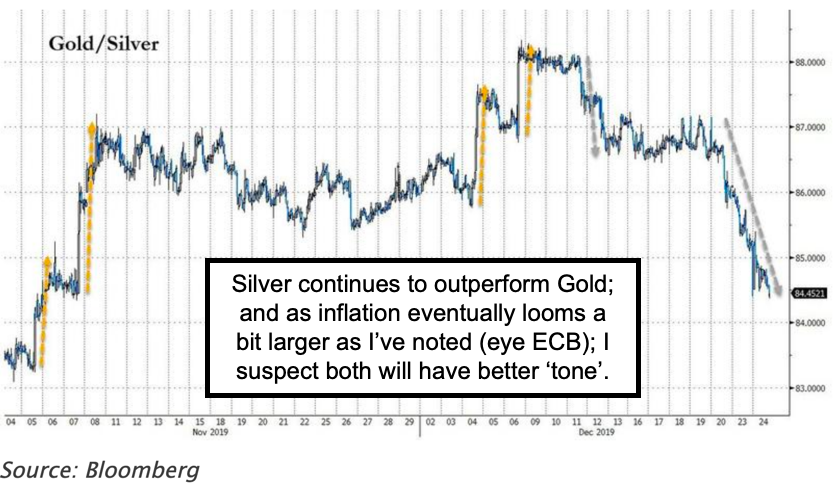

Then there are situations like Amarin; fairly unique, a bit speculative of course, but even after moving up, retain significant potential (including takeout or buyout or partnership prospects, as well as simply growing). And existing favorites that doubled or tripled like AMD might just work higher, at least for now (but bargain day is behind for that). It's harder to find value especially as institutions levitate many stocks beyond what's really fair or reasonable valuations. That's especially so for FANG type momentum stocks. They can forge ahead for now; but remember what is called a 'Bigger Fool Theory'. Someone will be at the end of the line; as institutions, not so much individuals, press into big-cap players long after everyone knows the stocks, and the big money, has been made. Of course everyone from Facebook to Google to Amazon fit the mode although some more so than others (Amazon depends primarily now on AWS, their Cloud and internet-support services; and that's where they might actually encounter more competition from Microsoft's Azure). Of course a break in the (often overpriced) big-cap stocks will impact what is called the lagging broader market; but even as prospects would be a pullback within context of the primary uptrend; it could get interesting. Then there are the higher dividend stocks that remain represented, until credit market competition appears closer (eventually). A year ago when I'd selected AT&T around 28-31; most market pundits dismissed my idea, with their arguing about debt-service and urging the purchase of Verizon instead. Well AT&T robustly outperformed, and I'm not opposed to Verizon (about a 4% yield); while AT&T is actually hiking their own dividend a couple cents (to prove the point that it's solid); so it's still a 5% or so return. Total return for the year was over 40%, and I think it's still a solid hold (and yes many pundits 'now' like it). In sum: while we see some perpetuated gains in healthcare, perhaps a bit more in semiconductors; or specialty situations; we increasingly will have an eye aimed at the credit markets and particularly the monetary policy 'reviews' and where that might lead for the EDB and our Fed. Oil prices might rise and initially help mask a future distribution in other more-overvalued areas. The Fed does 'want' to see inflation (ironic they want it with lower rates... ultimately an impossible combination in 'real' serious growth, which is not broadly what we have so far); and there's the rub. In Europe they understand that higher rates would suggest the better times ahead (that's why Germans saved not spent more when it was curious interest rates fell so much); where in the U.S., 'consumers' (many think like consumers not responsible citizens) thrive on low rates and would probably curtail spending on signs of actual prosperity on a broader front. However, this is all something to assess as 2020 unfolds.

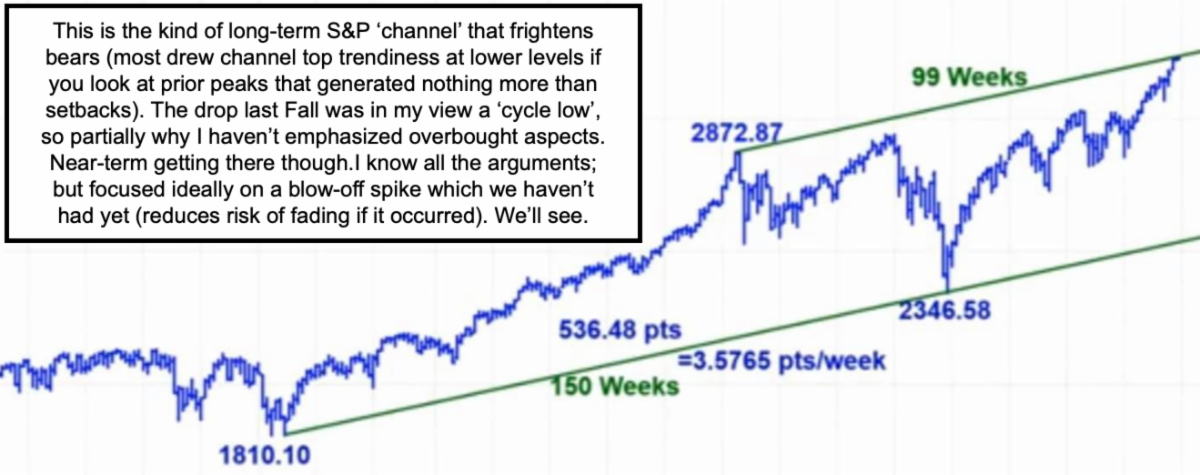

(I actually caught a typo: I typed 'trendiness' and meant 'trend-lines'.) Bottom line: Change is inevitable; but a new 'social' course isn't always well-received by the stock market; and could be more dangerous than a Fed hike; depending how things unfold. And again that is NOT to say it is necessarily bad 'for people'; but for the market's 'perception' at least as it might be initially. Pretty clearly the market would prefer a friendly Fed and consistency in policies; although 'even with' the present set-up I suspect they'll encounter problems down-the-line (starting with a shift in ECB policy perhaps; though even there officials are nervous and for sure the Fed recalls the reaction to their hike last year). Conclusion: The liquidity-induced Fed-facilitated market continues; with a multiple expansion that's unlikely to be matched in 2020. That's not to say we won't go up; or that others won't catch up (rotation); but it's not going to be a time to be complacently relaxed at the switch, especially later in the year. |