Market Briefing For Monday, Dec. 10

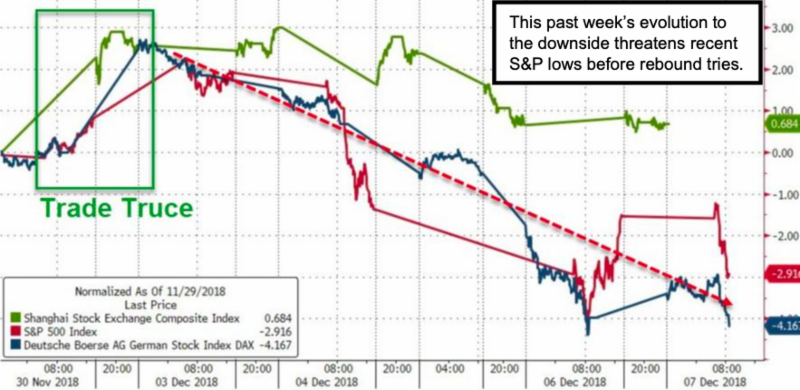

Alternating sorties of dive-bombers ahead of and on Pearl Harbor Day (Dec. 7) were reflecting how repeated attacks occur regardless of crowd tendencies to try to hand-hold or somehow psychologically buttress investors, with calls for stability and new growth phases. That's not what's likely to happen yet.

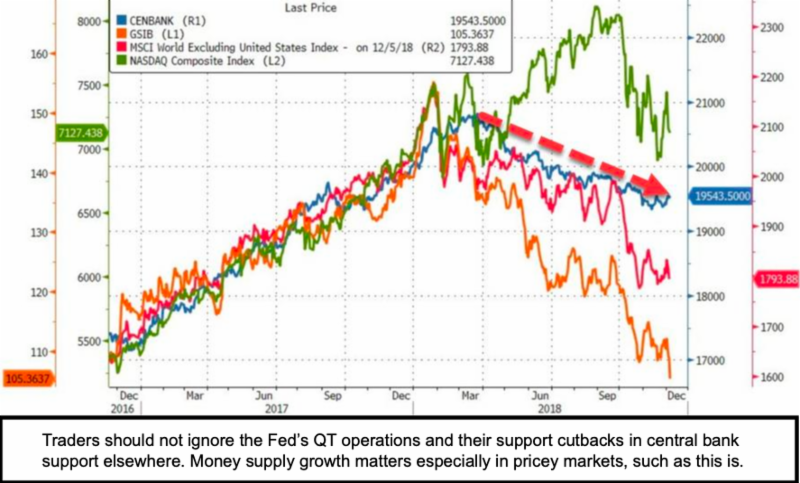

It is not that trade 'alone' has derailed the market; nor was it 'just' the Fed. A general exhaustion of upside occurred 10 months ago; and culminated with the parabolic thrust we often refer to (our first 'crash alert was late January). But my point is not that China needs to pound the table; nor does Japan of course need to buy more Treasuries (they have a lot). And if I had to note a sidebar sort of influence of the market; it might be FOX's Tucker Carlson's blast of President Trump's competence in a Swiss magazine interview. It's not the first time Carlson hit on the President's 'pomposity'; but this went lots deeper and while financial media generally ignored it; I think it took a bite. In terms of bites, we have Paul Manafort & Michael Cohen; details pending; but the market is increasingly aware those are.. on the docket.

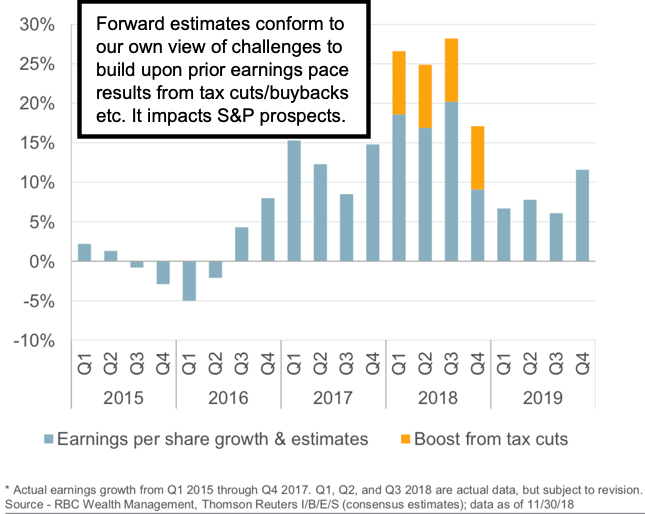

It was rotational action by that narrow universe of stocks 'artificially' masking ongoing rotational distribution; finally succumbing to the Oct. 2 'crash alert (at the ridiculous high close of the DJIA and S&P); and that related more to competitive awakening (and absence of buy programs to artificially inflate a lot of earnings 'impressions' that often occurred without rising revenue); as of course did tie-into trade (and is why the market sees fleeting relief on talk of a trade deal; though one is not at hand yet; and won't be for awhile).

The markets are pricing in deceleration of earnings (already underway) and an uncertainty about 'trade', which would of course help matters. Markets in addition are concerned about a number of issues which pundits generally of course avoid addressing. The political turbulence of the past two years has not impacted volatility very much; but as mentioned recently; don't take any solace in that. It won't be today's sentencing recommendation regarding the Presidential Attorney Michael Cohen, or Manafort; but a new Congress that will promulgate upheaval and perhaps whatever Mueller comes up with. I'm expressing no opinion on that; I simply think the market's a bit more wary.

Aside the issues confronting the market; it's difficult because so many stock sectors 'already' corrected; although that doesn't mean they can't 'do more', as far as downside. And short-term you have the dichotomy of tax-selling of positions people have losses in; juxtapositioned to stocks that are swinging but way up from where they may have been bought more than a year ago; a concern for some selling of those as soon as 'tax years' settle in 2019.

In sum: this is an ongoing process; and no need to review everything we've covered all week. Facebook (FB) announcing a buyback won't mean that much; but it is a reflection on what companies 'think' can bail them out. Investors at last realize the 'massaged' implications of the buybacks and tax cuts; which follow-through to a degree; but not with the impact we had previously.

We're likely to see a distressed market environment next year; but also one where some of the cast-of-characters that lead, will see rotation too (part of it will be the domestic-centric focus I advocated over a year back because of trade and related issues); and that will be especially visible in technology or especially communications and entertainment; as we move to new devices; to greater electrification of vehicles; to competitive streaming services (that is know at OTT or over-the-top); with of course 5G as a future backbone to so much of the newer services (OTT won't require it; but will improve what's known as 'latency' to make everything smoother and incredibly reliable).

Bottom line: next week 'might' see a down-up down overall pattern; but let us not forget further disruptions that can occur even between now and then. Paris may be burning with more riots (threats to attack the Elysee Palace on Saturday are very disconcerting, so I'm surprised not considered sedition in France because of the specific threats; or maybe they are now); plus new threats of demonstrations in Belgium and The Netherlands are out there too (not great for EU solidarity; although only Germany had a smooth shift to a new CDU leader today); and even Italy.

You can add to all this the arrest of the Chinese CFO (but she knew of those charges; and incorrectly figured Canada wouldn't pick her up on a US arrest warrant, but they did); and whether it's Peter Navarro or even the Chinese, it seems they are not blocking the pursuit of justice in this situation; so far. But I would say this is not a good time to travel to China; noting that Delta today sent an email offering a round-trip up-front 'flash sale' to Shanghai at lowest cost or mileage (for Frequent Flyers) I can recall. And through Spring too. (I am not traveling lol.. just making the point that they have low bookings.)

You can throw-in North Korea working on a new missile site; Iran flying 747 freighters with precision weapons to Hezbollah; and other factors (some of which are helping Oil prices stabilize and firm a bit as desired and which we thought the smiles between Putin and MBS of KSA at G20 inferred accords with respect to limiting further downside in Oil prices). And strong Oil Friday was insufficient to prevent a market decline; so there you go.

Conclusion: the 'diamond of death' and 'death cross' patterns tend to occur as confirmations of downside; and sometimes just before rebounds, which if we washout a bit more; could set-up a seasonal rebound yet again. From a longer-term perspective they reflect downside continuation behavior. Most all of this is what I've discussed as the scramble 'after' the trap door effects take the prior leaders down; but they got so pricey that even after seasonal efforts (to the extent we get them); lower prices may loom.