Market Briefing For Monday, Aug. 19

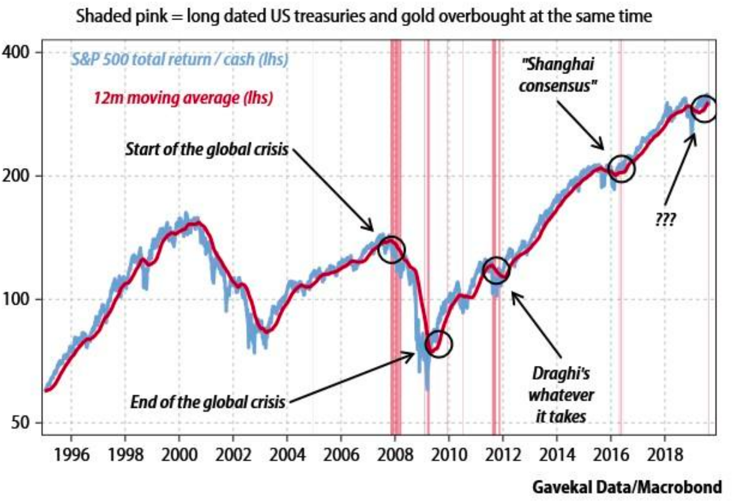

Oscillating S&P moves are not merely confounding swings responding to news regarding China, tweets from President Trump, or even interest rates; although all of those do and will trigger fast-paced immediate reverberations that are challenging to traders, and confusing to many investors.

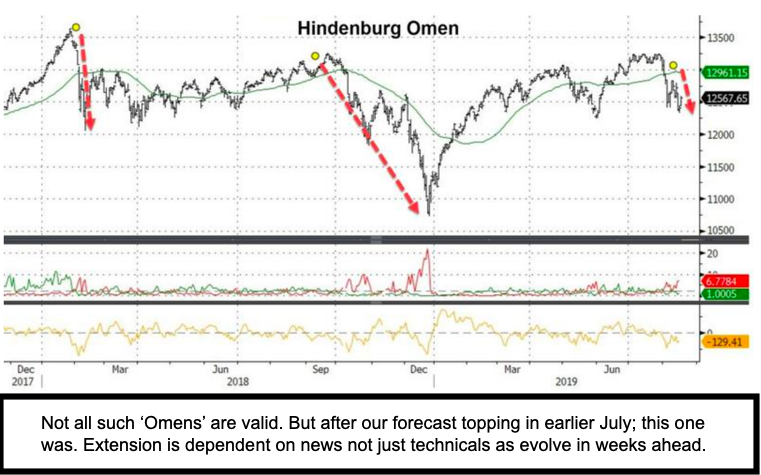

So despite having anticipated this rolling series of alternating moves; we've tried to convey a serious technical aspect to this past week's (next week as well) roller-coaster ride, which is really clear (that's why we focused on S&P recent low points, as traders worked to create 'a cushion' above danger).

What that reflects is fairly determined efforts not just to run-in short-sellers, but to hold-the-line (and there is a lateral line) represented by the intraday lows of the S&P during the past two weeks. Friday's levitation aimed, more than anything I suspect, to create some trading room to allow swings.

What I mean by that is the ability for markets to absorb good or bad stories, especially as relate to China trade or interest rate nominal moves at these absurdly low levels, without triggering 'algorithmic' cathartic moves that sort of 'force' the market into defining what passive-investing managers (there's that risk again, of non-thinking dumping or buying of baskets of stocks).

Having what I call a flexible 'cushion' of space, allows this news-sensitive or low-liquidity thin market, to oscillate in response to developments which are not definitive, without immediately compelling major portfolio changes by the very managers who were (as forewarned) so obliviously complacent both in the Spring's 'distribution under-cover of a strong DJIA and S&P'; and then in similar fashion during a projected despite reprieve rally into early-mid July.

Presuming we have a couple weeks without definitive resolution to either a Fed quandary; or the trade negotiations (with speculation about the Meeting a couple weeks hence); some of the pressure off determining the next huge move (or primary trend impact) from the next sharp 'daily basis' swing has a good shot not to 'force' a trend breakdown or breakout prematurely.

Sure, it doesn't mean the headline risk is reduced; it won't prevent stocks in meandering irresolute individual patterns. In fact the broad list is battered in many areas, with shareholders licking wounds for various time-frames over many months preceding. Meanwhile FANG+ games roiled without relevance beyond those stocks; but with relevance to overall market psychology when periodically hit hard. It's part of the bifurcated 'Tale of Two Cities' market.

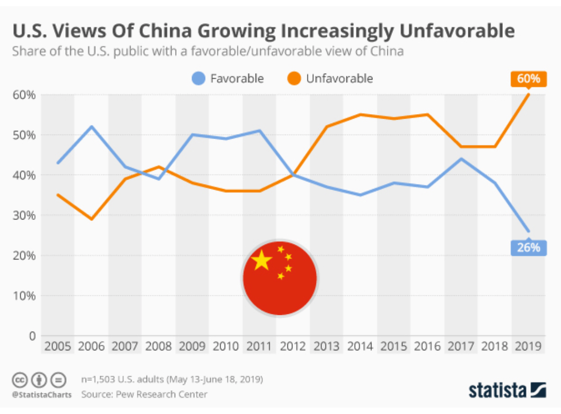

And heaven forbid, the market starts to ponder 'whether' Trump counters a slew of diatribes suggesting he 'can't win' in 2020; with more bullying. We'd like to think all this presses him to take-home a serious 'win' (superficial or not in terms of IP with China or some structural aspects) to buoy prospects and deny the 'anyone-but-Trump' undertone out there.

This does not reflect any viewpoint of my own, 'other than' how the markets will view this issue. It's a potentially destabilizing aspect of forward market expectations. So yes, questioning whether a Trump victory, or a defeat, or even withdrawal from the campaign (his ego will never allow that), possibly impacts markets, is going to creep-into forward outlooks. Perhaps equally if not more important, will be if his opponent is 'market-friendly'; because then the market might even be relieved; with the contest a bit less pivotal. If that becomes clear as we get into the primaries, it can mitigate this 'wild card' of addition risk, so that stocks can focus more on more traditional factors.

In-sum: you have a stock market that's relatively firm in the big Averages, at the same time overseas angina (and political pressure) inappropriately has the Fed being assumed (we again say they should not succumb because it is not the Fed's job to only respond to global factors OR to support the U.S. stock market; except when it actually behaves in dangerous fashion.

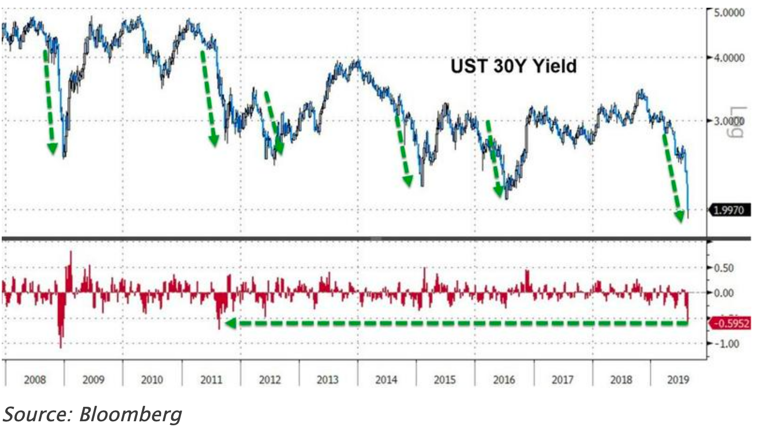

Really the very short-term Treasury rates have been inverted for nearly half a year; while the financial mainstream focus has only been 10's vs. 2's more recently. During the earlier phase (distribution under Index cover) the broad market already declined, which is part of why they now only meander or just erode (or firm) slightly; while risk transferred to the big-cap 'Grand Dames'.

The Grand Dames (FANG and a few others) get the 'press' so are featured during the 'race to the bottom' by rates, which as I've argued before others, as they mostly say now, becomes an ineffective 'pushing on a string' by Fed efforts; and in-fact increases risks by eroding confidence as it creates great curiosity as to 'what in the world is going on' among citizens in-general.

Stimulative actions (especially such as Blackrock and others calling for big 50 Basis Point declines next) are actually counterproductive. Since getting it with the economy not broadly weak (but slugglish and slipping nuances for over a year) with negatively impact confidence and reduce the Fed's ability to actually intervene effectively, should be actually get a meltdown (and that risk is still there, especially if no China deal is forthcoming next month).

Bottom line: this work-in-progress attempts to be an effort to 'immunize' a fairly healthy patient, who is coughing a bit (as am I); but isn't officially sick. That may help; but it's preferable to keep strong antibiotics 'in-reserve', just in case the patient gets really sick.

To wit: don't hit a cough with what really is an 'elephant gun' too soon. And especially when that elephant gun only has a small amount of ammunition remaining. You have negative rates all around the world; and we're reacting to that (some like most on Wall Street and the President think it appropriate) perhaps because almost all of them are fully invested or relying on holding the market together at extremely high S&P levels for their own reasons.

For sure I understand their perspective. While they temper business cycle behavior (in this case an expected trade-sensitive technology transition year as well as a needed normal market correction); they are not advocating any sort of responsible behavior; which would have the Fed primarily responsive to domestic stability and retaining relative strength to our paper, which does attract funds, and holds the Dollar stable. Those calling for a weaker Dollar generally must not grasp that our currency tends to stay firm in a low-rate environment, and that there is an economic downside to weakening it too.

Conclusion: this can become episodic over time if too much fiddling occurs especially as the consumer is not that weak; and business is slow but not in freefall. They can push it over the cliff if they continue to panic Americans.

Meanwhile the behavior of the S&P is 'mid-stream' in a projected correction from our early-mid-July highs; and is trying to hold the past two weeks lows in-hopes that it can stabilize all the way into the upcoming trade Meetings. If it fails after that (or if it's cancelled); then there's even more pressure for the Fed to cut (ill-advised) and greater risk of the S&P breaking to lower levels, probably as all the 'race to the bottom' cheerleaders gaze aghast at that.

The corollary of course is that price-stability in this anticipated roller-coaster time of year, can be solidified a bit if there 'is' a China deal and if the Fed in their ultimate wisdom, resists some pressures to waste all their ammunition; since it won't prevent, and might even precipitate, a further liquidation.

I am glad the President was 'receptive' to the arguments in a conversation, a couple days ago, with CEOs Dimon, Moynihan, and others; regarding the need to sort out some of these issues. It's not up to the President alone but it sure would help if he'd get on-board the idea of enhancing stability, rather than oscillating so much that it stokes uncertainty; which markets of course not only disdain; but make resolutions inherently tricky.