Market Briefing For Monday, Aug. 17

Push-back time tends to appear in August's second-half as a seasonal retreat or a calm time at least; so it's not at all unusual (especially on-top of our long uptrend off the identified March capitulation 'max-fear' 'Inger Bottom' low) to be cautious now.

That 'push-back' is coming or already upon us in so many ways. The virus itself now is pushing back; with no substantive recovery; and that's even occurring in countries unlike us, that enforced guidelines with an iron fist almost; where outbreaks emerge.

So rocky recoveries are the best that can be hoped for. While many will comment we could reopen more schools, have all normal sports (including football) this Fall, had we managed things properly as a Nation. Well the answer is 'perhaps'. That's a clear message conveyed by countries that did arrest the virus and now it's resurgent. And now you have a lot of cheering about the just-authorized Yale saliva test; mostly as it will help sports screen an entire team; so aside lower cost is similar to others. Really though it's not just testing, but a prophylactic and/or treatment that's sorely needed.

Executive summary:

- S&P continues its slow grind; with debates about bullish and bearish outlooks;

- Goldman Sachs comes out with an S&P 3600 call for 'this' year; which might be curious to many; but probably will squelch some bearishness growing yet again;

- Incidentally Goldman, though often followed by others, often provides outlooks late in a trend; hence the idea some suggest of leaning against their forecasts;

- We do understand 'how' the S&P can move up; as I've said for nearly 6 months; it's a broadening-out of participation, and stability in Oil and Banks (you'll not get that yet in Banks, which have been among our least preferred areas);

- Strength persisting in Industrials, basic materials etc., requires anticipation of a real economic revival; not numbers that are 'spun' based on relativity to the nadir a few months back;

- That real revival can occur if we get a 'phophylactic' or early-sign treatment 'Pill' for Covid; as we have outlined for many months the best way to live with all this;

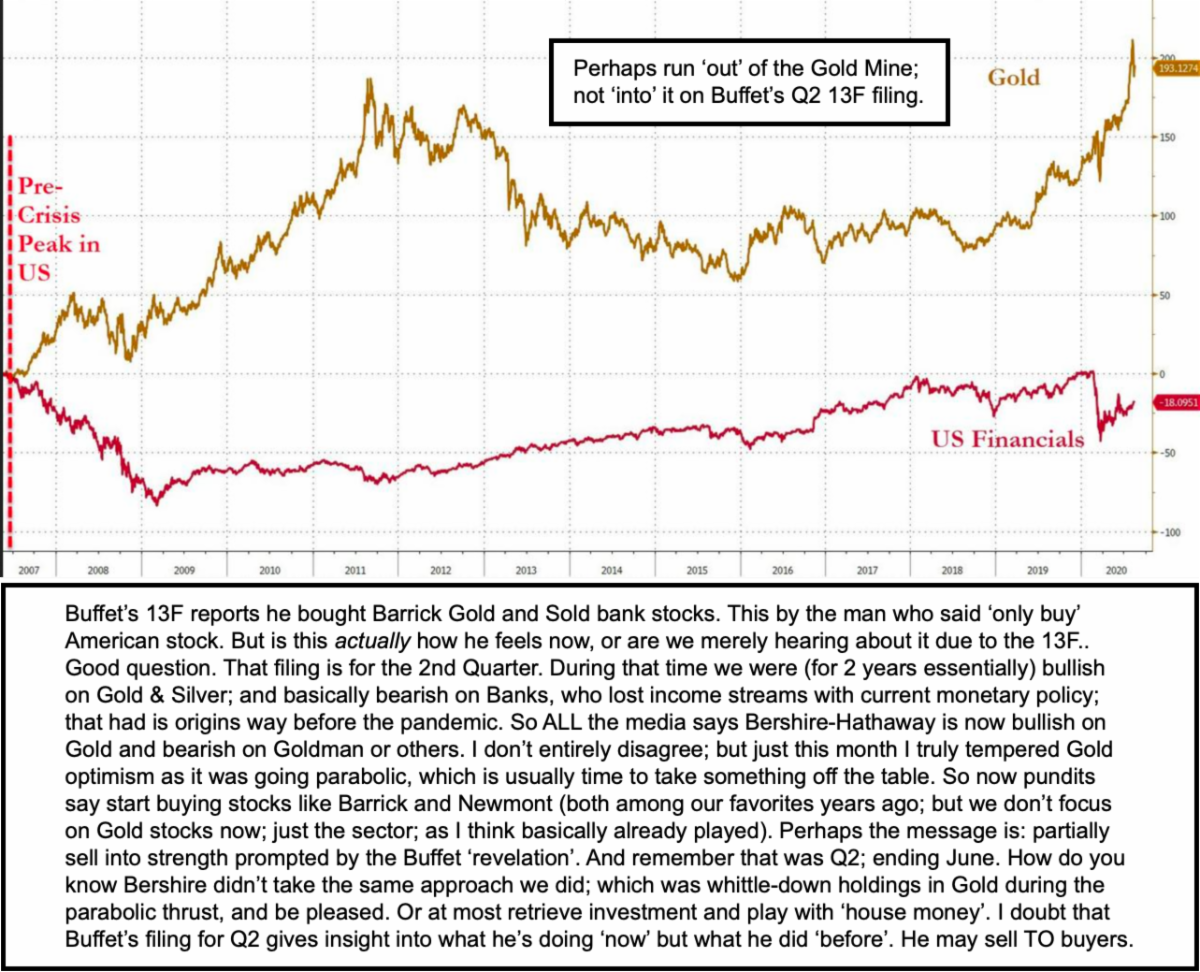

- As to Warren Buffet; I mention that in video and the embedded remark; one does not know that Berkshire is 'actually' still bullish on Gold or bearish on Banks;

- One only sees in a Filing those portfolio holdings at 'end' 2nd Quarter; hence sufficient time to both enter (March / April) and exit (perhaps in Q3 since both Gold and Banks have been weaker more recently;

- Hence implications by pundits to follow Buffet and buy those areas are merely a form of linear thinking; instead taking gains not entering, might be the approach;

- Catching the best thrust higher in Gold especially, is behind, I've thought lately; that's not to say that if Covid and politics collapse-in on each other in a period of time (not right this moment), that you don't have a very nasty mess looming (if so it will be my plan to attack that, as we've been on-guard for setbacks for awhile);

- On the Covid front there's more angst; and realization that Congress adjourning sends the wrong signal (of despair) to those suffering the most; meanwhile there is no slowdown in evaluating new tests and treatments by FDA that we know of;

- The greater concern technically, fundamentally, monetarily; even geopolitically (as trade talks were postponed again, Iranian-fuel-carrying tankers are seized, as well as China's military positioning opposite Taiwan) .. all are variable and tend to distract from the only three issues the market really focuses on;

- Those issues remain: Covid-19; Federal economic stimulus (without invites even more social instability); and 'actual' economic revival beyond statistics (that look better because so much relates to online activity);

- The politics of the day are sad; we'd encourage the President to try the high road; and like Kamala or not (he did donate to her California AG campaign); it's really a silly move to suggest she wasn't born in Oakland;

- That tactic only helps Biden, even in the eyes of voters who like many of Trump's trade or tax policies; and agree changing policies risks a 'future' upheaval; so of course if that happens down the road; contrary positions may be protective;

- The 'heat wave' in the West (and hurricanes in the East) bring economic or social hardships beyond states' ability to contend; and seasonally it's not nearly over;

- Meanwhile the new week will be interesting; a contest between those who think Warren is only now bullish on Gold (might be bearish several months after what has been reported); and somehow Goldman's S&P 3600 play 'now' is notable; plus it's also August Expiration coming up (not a Quarterly; so fairly minor).

In sum: if we don't do something strong, with Congress providing support, there's a more bearish alternative, even for big companies, that has to be contemplated. We'd pushed-back (and still do) on the 'most bearish' possibilities, because of several key things. For the S&P and NDX, the most significant are that the heaviest-weighted of all big-caps tend to be in the very industries that benefit from the increased isolation that has worn-out the best of us; and has others resigned to a deteriorating outlook.

The other aspect, beyond the path of the virus, is pushing back with Fed liquidity (a very key component of keeping things together); the (otherwise ridiculous) buybacks by certain big-caps (Apple comes to mind with their bond issuance for buybacks); a perception that Government won't oppose those for now (even with taxpayer bucks) because it keeps the S&P up, which is so important.

Broad-based support has been absent from the market aside a basing structure that is trying to broaden-out participation in anticipation of bridging the gap toward actual (rather than pretend) recovery. So if that's the case; and seasonal flu is about to just slam into Covid with a complicated season ahead; and with astonishingly high levels of unemployment (better month-over-month but look how depressed it was and is); a sign I've indicated that business cannot endure this kind of situation for long.

So what can we do? Clamp down on the virus; stop push-back from any entities or media that are opposed to both mask wearing (even though some 'surge' is ongoing in countries that have been very compliant on wearing masks) and a focus; and stop the expansion of primarily vaccine development; since that's important; but is really a story for 2021 and 2022 (2nd and 3rd generation vaccines with too much expended it seems on supplies for 1st generation; so citizens already know if possible, to await a better more effective vaccine). Instead focus on antivirals and monoclonal antibodies or any combination 'cocktail' which may include off-the-shelf antiviral components.

Along the way it's imperative not to lose heart and to recognize that extreme political upheaval is also a product of push-back by the impoverished, not merely underclass criminals, although the wretched jobs situation has contributed to hopeless of course. That's where Congress comes in; so that's why it seem unethical for them to adjourn until after Labor Day; even though they can be called back. Visit constituents digitally not physically is what most campaigns will do anyway; so what is this adjourning for; time to go to the Hampton's, Martha's Vineyard, Berkshires or Colorado Springs?

The answer to that is yes; and I'd like to take a break and do that too. But I am not running for office; just give me a fast internet connection and I'm ready (well I would be if not for Covid-19 interceding with all our plans; as it should with politicians too).

In-sum: the President has ordered Treasury and the SBA to help fund matters; and we shall see if he actually can do anything like the CARE Act without Congress. It's all stalled, and the push-back from both sides is mind-boggling; not merely talking in terms of trillions of dollars; and not even how essential pandemic spending is paid for in the long-run; but it will be tougher if we don't address this on the short-run.

If we are successful in an effective antiviral that can be taken as soon as a positive test is known, we can strip those ventilators out of most hospitals (won't be needed), and we can keep most patients from entering a hospital in the first place. Absent a broadly-inoculated population with an efficacious vaccine; this needs to transform a terrible 'acute' disease into a 'chronic' condition that won't be contagious; resides in humans like other viruses they'd rather not think about still do; and life can resume.

Conclusion: push-back against the coronavirus; not against humanity. Push money into antibody and antigen test as well as (similar) prophylactic and early-intervention antiviral (and immune boosting) treatments; and focus less on politics and division.

The stalled Covid-19 agreement has unintended consequences regardless of any political bias. It's inexcusable that Congress adjourns; and as parents send kids back to school and problems inevitably grow (they already have); we don't even have the Congress to come-up with a uniform policy or guidance. Leaving it to the states has a downside, especially where states will (and are) tightening-up guidelines; but often only after the virus has further migrated into the general population.

This Saturday, going into this push-back season without anything to stimulate profits or earnings expectations; there's little reason for big stocks not to have 'opportune' times to shakeout a bit. No catastrophe. And this is a different August (or should be) not just for the rest of us, certainly not for politicians, and part of that is why buybacks are being trotted-out, perhaps even the splits too, to allow upgrades or 'hold-on' calls from Wall Street; as they try to 'push-back' against the coming tendency to retreat.