Market Briefing For Monday, April 19

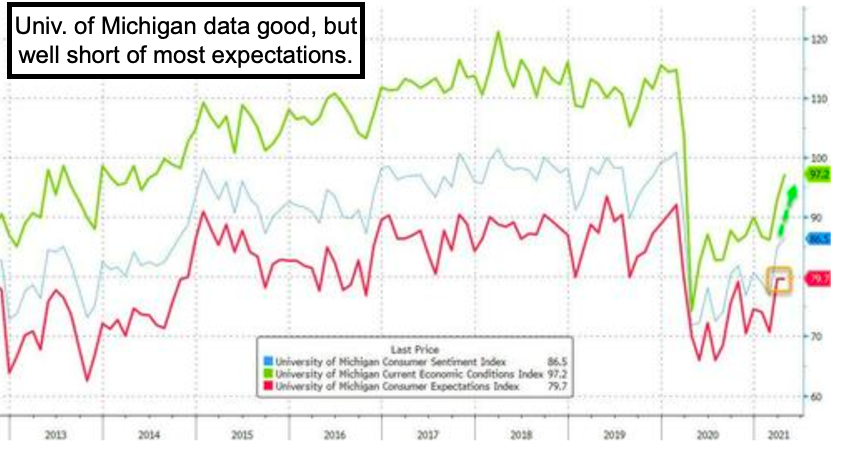

Expiration is behind us and earnings loom - but is that really probing the heart of market concerns? Especially since everyone expects good profits and what might throw them for a loop would be something to the contrary of that.

I'm focused beyond good corporate results in the wake of a stellar S&P clearly anticipating good reports. Rather I'm thinking not just currency (and not crypto either) is at the heart of the next focus; but geopolitics, trade tensions, and for that matter the 'truth' about prospects of opening society fully during Covid.

Most states are open while the majority see an increase in cases and while it is reported by media, they tend to soft-pedal the implications. This time WHO actually has it right, especially on the worldwide scene; and that's where trade and other economic issues might contribute concerns as well. Notice how few countries Americans can fly to this Summer so far; and a clue as to how tough it really is becomes more evident (Mexico is the number 1 destination now as Delta, American and even SouthWest have added flights to beach resorts).

As to 'why' fewer will listen to Dr. Fauci (he's right and wrong at times), we're an impatient society; and Government can only dam up the economy for so long before people first rebel or are exasperated, and then start getting creative (of course a more productive approach). With Covid variants and hospitalizations rising among younger people, along with lackluster performance of vaccines (a huge issue) ....what else is the government going to do? We need testing in a more accurate (tracking) way; and we need therapeutics. Merck, Lilly and of course Sorrento, are all working in various aspects toward this need. While frustrating to see round-robin SRNE moves; it likely basing for another rise, at the same time it needs an approved EUA (or another approval) to really jump.

Covid itself is already igniting a so-called 4th surge; while media speculates if it's coming. Yes it's selective in certain areas, and countries, but it's there and they say half the domestic cases are from variants. Covid fatigue sure set in.

Vaccines are being pushed; but are failing to deal adequately with the variants popping-up globally. The CEO of Moderna was frequently on TV this week, in a sense acknowledging this by talking of 'booster' shots, which really will more likely be a 'next generation' vaccine, which I think was logical to anticipate.

Medical experts are also sometimes speaking out about the harm vaccines do and that's not only the J&J clot issue (though it's most significant and as most often affects the brain, really might be taken off-market... is money involved?). I suspect Governments don't want to panic people (understandable); as word is spreading that the vaccine path is not the only answer (even if eventually it is an annual shot as Moderna suggests). I have contended all along that we'll need 'pills', 'nasal spray', 'injectable lower-dose monoclonal antibodies', and a faster affordable testing and tracking regimen to get a real handle on Covid. I realize Sorrento's innovative Covid solutions could play roles; but sluggish or absent reports that should be available (Brazil, Philadelphia etc.) are troubling at the same time as they keep expanding their deals and probably find current depressed prices for shares are setting-up the next upside romp (with news).

In sum: We suspect politicians will continues trying to ram as much as they're able to in terms of fiscal stimulus; even if later this Summer (if problems arise related to Covid) they may blame significant un-vaccinated citizens. It's also a reason we desperately need 'treatments' not just vaccines, to combat Covid.

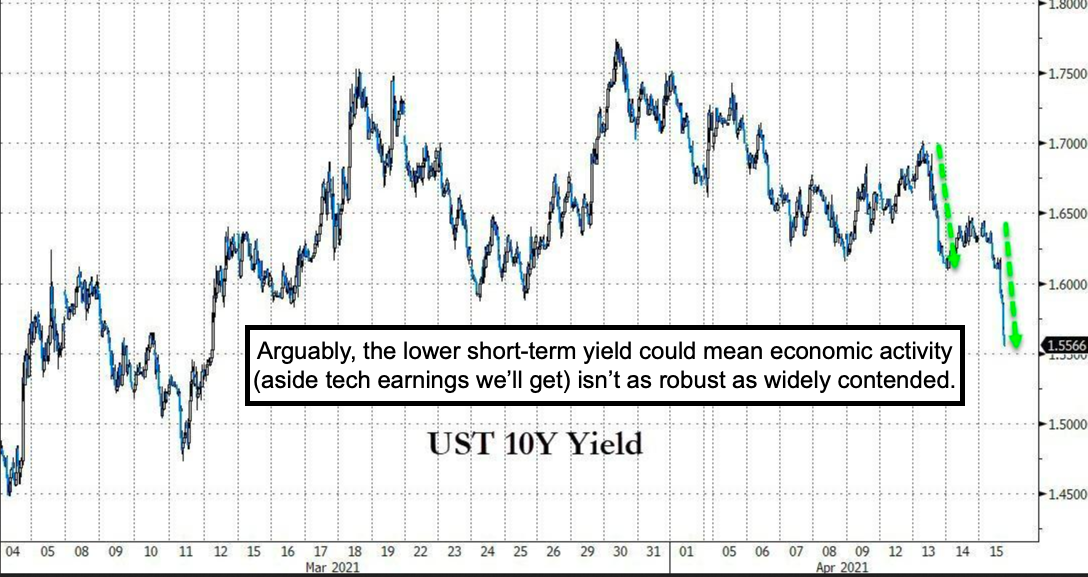

Speaking of funding; the Fed's framework is untested longer-term so remains a problem down the road. Investors are not getting compensated for locking a large portion of monies in Treasuries; so they seek out dividend stocks (that's part of the appeal of something as basic as AT&T yielding around 7%).

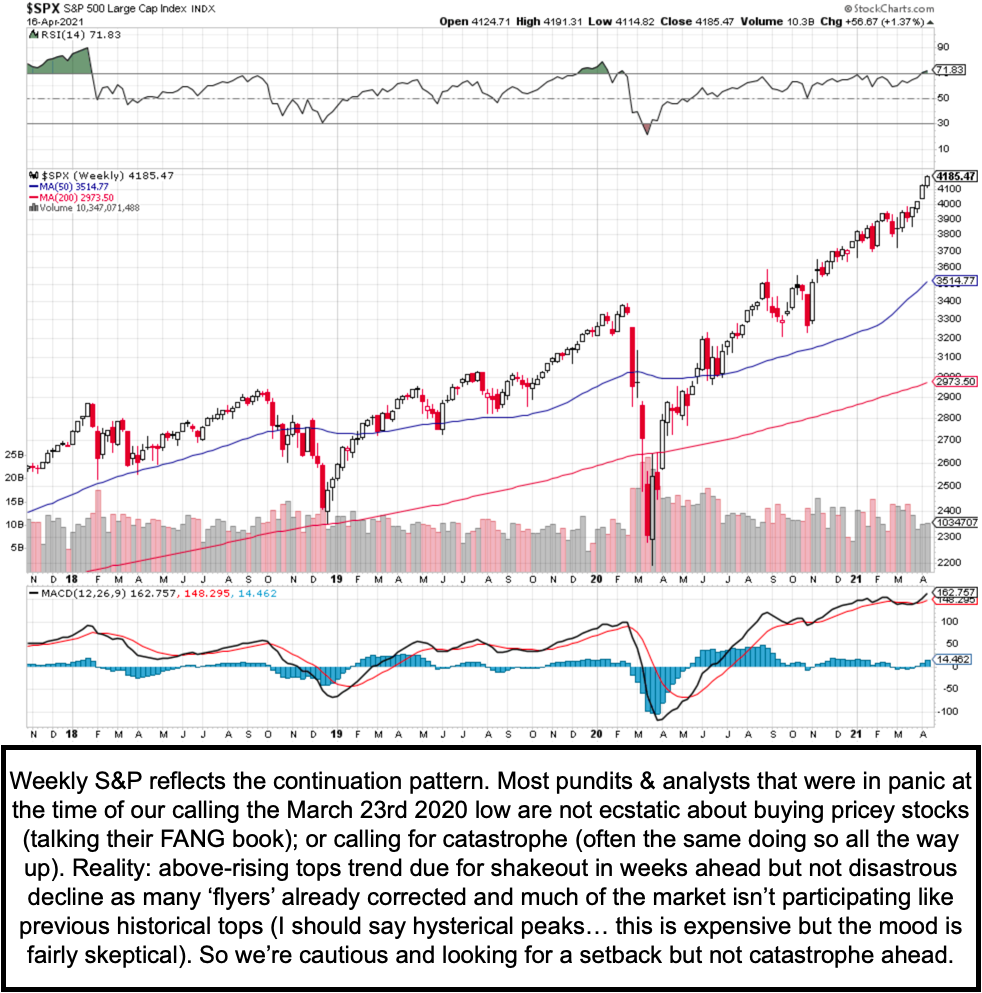

Next week should see consolidation and upside and then correction risk rises; but again many stocks that are the heavy lifters have rotationally corrected.

Again I appreciate the encouraging support; even my physical therapist says I am gaining strength and walking better (persisting wound issues aside) than he might have expected (even as it is a bit penguin-like..hah). It takes time.