Market Briefing For Monday, April 16

Technical trading alternates as markets continued to be embattled by a perception that 'issues' (like politics and social media or geopolitical risk alone) are the challenge. Sure, the market has to juggle all these balls on a daily basis. However what's really going on is a market depending itself shy of breakdown levels (again; the important 200-Day Moving Average, for the June S&P), while cheerleaders try to pretend all would be swell if not for the ancillary influences that indeed do shuffle things day-to-day.

Ironically, the Strike on Syria doesn't at this point (Saturday afternoon) change anything; providing there is verbal jockeying and no counterattacks coming from the Syrians. Basically they fired intercepting SAM's (surface-to-air missiles) without guidance; either because they're inept, or perhaps we used electronic countermeasures. I was pleased that it was a tripartite action rather than solo; and the results (which do not change the concern about a Shia Crescent concern at all.)

But for now; because it's impossible to ascertain what might occur prior to Monday's opening (perhaps nothing but chatter) let's focus on the market.

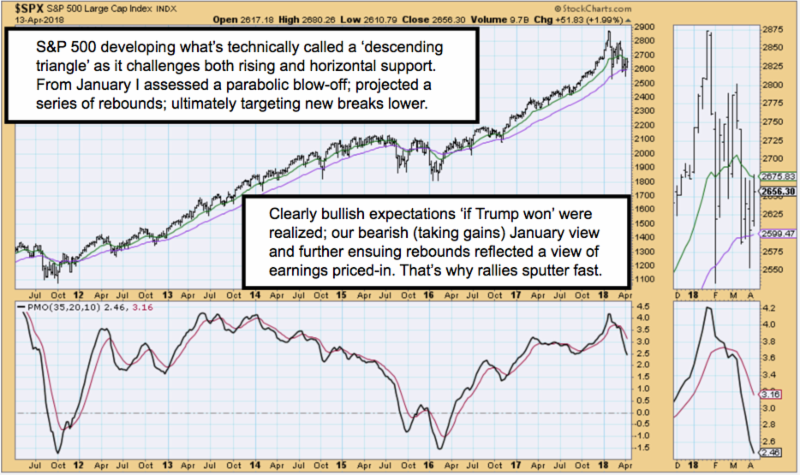

In a sense those talking of the meaning of any break of the 200-DMA, are essentially arguing a tail-wagging-the-dog approach to future movements. That's because amidst all of this, a 'sell signal' for S&P's was generated way back in January when right in the middle of a Caribbean cruise; as of course regular members know, I looked at very limited leadership in an already-parabolic blow-off thrust; to proclaim 'crash alert' conditions (a concern not that the market will 'crash' as such, but that conditions were at that point favorable for greater risk of a breakaway downside move).

The actual forecast was for a 'breakdown' of the S&P no later than early in February; and then some sort of ragged efforts resulting in Spring rally prospects, but ideally no higher highs for some time to come. Incidentally once we got the purge (the February 'flash crash') we called for stability in the form of an 'automatic rally' (a technical term some are familiar with); a series of alternating moves I simply called 'Hail Mary' rebound attempts to forestall reckoning with ultimately lower downside prospects and hence I absolutely departed from the consistent optimism shown since just before the 2016 Election, when I projected 'market to the moon' if Trump won. (I said at the time, even if you hated Trump, hold your nose and buy stocks, as it will be good for business and viewed as a huge regulatory relief too.)

To this day the overall pattern evolution persists. This is just a summary bringing new members to the present time, with a basic snapshot of our ongoing perspective. Plus to emphasize we have not been calling (nor do we now) for awful catastrophes as most permabears or some hedge guys expected. At the same time, analytically there is an overriding concern.

Markets are extended; the Bulls seriously are 'Fighting the Fed', as they'd rather not focus on monetary policy and just view the 10-year yield. More notably they generally ignore the even shorter-duration paper, suggesting what they Fed says they're doing: draining liquidity and letting paper roll off the Balance Sheet. Yet solid Auctions (foreign buyers mostly) dull this a bit and give an illusion of the Fed going the opposite way of markets (it is to a degree); but doesn't mean that will persist. In fact the FOMC has a unanimous view about the trend towards higher rates in their Minutes.

That historically makes this market a decent time to retain 'core' positions but not a good time to be trading with a bullish bias for more than bounce events. The big bulls say this is a great time to buy stocks; and actually it is history that argues vehemently against that (even seasonally); perhaps even in a more favorable backdrop with fewer barbs impacting sentiment.

There are three areas that we have generally been optimistic about or are interested in during the expected declines and/or doldrums this Summer. I have emphasized Oil (more so Oil itself than Oil stocks); but give gains as forecast that sector generally becomes a hold more than a buy now. I was bullish every time time dropped into the 40's; precise opposite most of the commodity-crowd, who tended to talk it lower or dismiss the future due to changing power evolution; to which I said nonsense for now. I did have a projected 'cap' of the rally from the 40's / 50's (per bbl. of WTI) as you know; and lifted that ahead of a potential conflict-related spike higher (with realization if it were to suddenly thrust up we might be a seller).

Another area favored looking forward is selected telecom. You know our assessment of AT&T as more than a relatively safe (with dividend being important to many) holding; and that we've liked it in the low 30's while at 40 it was not seen as a buy. So now if the market tanks and it erodes to a lower level as we'll outline in future reports or videos, that's going to be a relatively safe (primarily domestic) investment again (new or to add as we have said in the past). What's of interest are the new Government related 'security' contracts that don't seem considered by analysts; as well as the prospect of being the front-runner to establish a solid USA 5G foothold in the coming year. Unlike Verizon and T-Mobile, they are better-able to put a combined super-fast internet, wireless, and DirecTV bundle together.

It will increasing be appealing as (or where) AT&T offers gigabit fiber, and as a transformative 'in the Cloud' version of DirecTV Now launched in the months just ahead. It will combine satellite with high-speed broadband. So, sure, there are competitors; but AT&T doesn't carry the multiple they do, which leaves room for a PE expansion-based gain later this year and next, especially if T commands a multiple recognizing business changes.

Bottom line: the outcome of this can (in theory) hold S&P together until it doesn't of course. But as I mentioned last week; I'll be surprised, if by May's end, we're not 100 handles lower in the S&P, if not considerably below that. Should it depart from that expectation I'll surely acknowledge (perhaps anticipate); but at this point there's nothing to change my view.

Now, working-in the domestic politics is tricky; but there's not much from a bullish perspective. Should there be (and most advise against) any sort of 'Saturday Night Massacre', then of course you get great implosion risk. In such an occurrence, the market cheerleaders probably will fall-back on that as the 'causation' of the drive down; rather that the correlation with a technical pattern that correlates anyway with downside prospects. (With the focus on the Syrian attack's aftermath... more sound than fury... new political shakeups in the midst of the weekend are less likely.)