Market Briefing For Monday, April 12

Tactics employed -by the Federal Reserve and Congress to offset the very real economic effects of the pandemic, were discussed with the Chairman on Wednesday with the full interview on '60 Minutes' (CBS) Sunday evening. Of course Powell says the U.S. economy is set to make a turnaround (it's already underway), with increased growth that should provide more jobs.

This is really a global phenomenon, as relates to our 'Roaring 20's' call before others embraced the term; and I suspect also relates to outflanking efforts by China to consolidate trade moves particularly in Asia. The downside is doing all this gets the Fed to a 'pushing on a string' posture on actual rate policies; a phenomenon 'in itself' that historically leads to significant trouble (but not yet).

During my prolonged (fight for life) and recovery (which is ongoing at home at last) the market generally remained bifurcated and led by big-cap stocks. Not much has changed within the general backdrop regarding monetary policies, the Congress and the rigid policies on both sides during this entire time. The S&P has managed to work higher, and I suggested something like 4150 might be a reasonable spike peak.

The contrast of Bull and Bear opinions has also not changed much for a while now. The bearish catastrophe calls almost ensure that does not happen 'yet', baring an exogenous fiasco. There are challenges out there, as the US tries to tame Iran, even as we will probably surrender some leverage to construct what this administration wants to see with Iran. Maybe not the best approach but that's what we've got. When you have the threat against Taiwan which is always simmering in the background.

Armed conflict with China really needs to be avoided; I won't say at all costs, but I will say if you want global economic vitality to really persist; it's essential. It's not a perfect world and we can challenge policy a lot, but we have to trade and invest within what exists, not how we might perceive it 'should' exist.

Meanwhile - there are few stories that aren't in the news impacting individual stocks; with analysts oscillating between whether semiconductors are capable of moving higher or vulnerable (it depends on which you look at or daily mood or upgrade or downgrade, none of which really move stocks out of this range).

Perhaps one interesting story is an old favorite of years ago: Nuance. Turns out that Microsoft is reportedly about to make an offer equating to $56/share. I know we don't actively follow this, but every now and then a members asks so I'll comment. We were long as I recall around $5 and the company in time did well (this was well after earlier controversy) because they provided unique software that formed the basis of 'Hello Siri' for Apple.

The software dictation feature on my iMac is based on Nuance and will never work properly (constant errors); so it's definitely not flawless. Worth noting as Microsoft is interested in the ability to transcribe doctor visits 'live' patients (all patients ideally are alive) eliminating need to later enter it in medical records.

Nuance is active in telehealth and other remote voice/text systems; and this deal could still far apart. What's curious is 'why' Apple didn't buy them; and of course what the relationship will be for 'Siri' if Microsoft does buy Nuance.

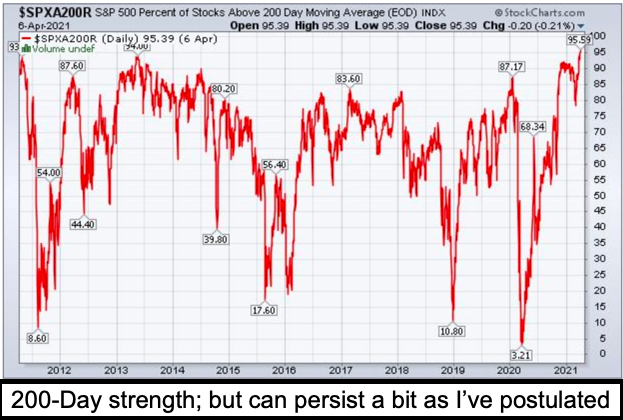

In sum- the lofty market grinds higher as you know... Senior Index S&P charts reflect the proximity to 50 and 200-Day Moving Averages, which merely notes it's expensive, not that it has to imminently come crashing down. Antenna will be up looking for risk; along with questioning the sanity of those buying into a group of incredibly expensive stocks, long after basic gains were achieved.

I include the last few comments below; and I will try to resume more reports in the week ahead. I will likely do primarily videos; with sitting for any protracted time being painful; as I deal with the hospital-acquired wound which should not be inevitable for a patient spending over 2 weeks in the ICU. 'Yin & Yang' situation: respiratory/pulmonary saved my life but now I am dealing with either neglect, fatigue, incompetence or just inadequate care, by the ICU staff. Aside being tethered to a 'wound vac', I continue recovery with physical therapist on almost every day scheduled to visit my home to help with basic exercises. My thanks again for the many expressions of support and good wishes; and if I've not responded to any, my apologies; I've been sifting thru long-term email too.

Presuming Chairman Powell has no surprises; stocks consolidate and just try to eke out further gains; everyone knows it's a bit ridiculous to hear forecasts of 8000 S&P and numbers like that; which sounds like marketing not reality. I think Powell's comments about the virus having another surge are realistic; at the same time I discount assessments of the current vaccines as being totally adequate to cover the 'variant' strains that are now dominant. And I'm slightly disappointed that the J&J vaccine has problems; as that is what considered in my own case once I'm cleared to get vaccinated next month.