Market Briefing For May 11, 2020

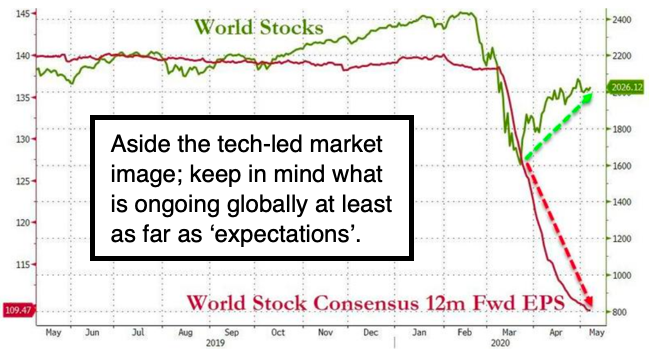

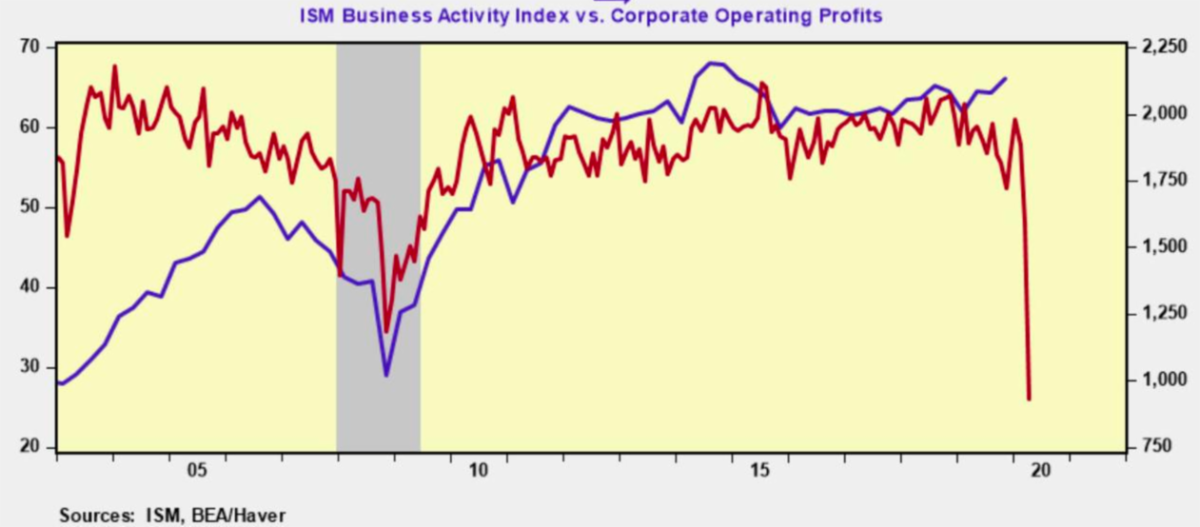

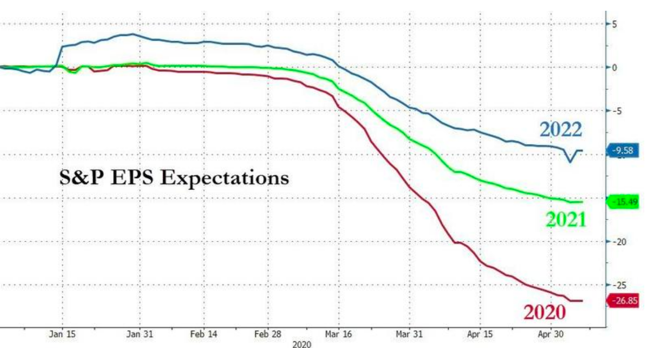

Economic 'fragility' - across so many sectors, and emphasized both by a series of heavy earnings losses and employment plunges, have surprised any manager or investor who failed to assume such concerns were offset, not across the Board, but by virtue of big-cap leadership taking S&P up.

Of course there is suffering; and the S&P recovery is viewed by some as insulting; because economic dismay is staggering, along with Job losses; but that's usually because they failed to view 'the crash' in late February and early March essentially discounting that. Actual numbers typically only appear after-the-fact; when markets already look towards 'what's next'.

For sure the market can be wrong; but in this case it's mostly technology in the leadership role. As that's the single 'must hold' sector (and has been of course), even though now it's again pricey; if we were to have a '2nd wave' of Covid (and we probably will depending on regional vulnerability; besides some areas opening without the 1st wave even being controlled or limited), I would suspect technology would hold reasonable corrections; because it's so clear how more reliance on online telecommuting or similar behavior is relied-on, the more tech is sustained. It's part of why I'd suggested the S&P likely heads to a correction soon; but not debacle.

As to the projected (from March) upside behavior: lately it spread a bit into a broader context, generally indicative of views about a probable 'bridge' to recovery later in the year or next year; valid or not. Sure, it's not so simple; so investors shouldn't be overly complacent to the obvious ability of S&P to both remain in our upside target range now for 3 weeks, shuffling between the 20-DMA and 200-DMA, as outlined every day.

Aside this running-in short-sellers (or defeating their every attempt to 'fade' this market for more than hours or a day on-occasion), not that much that's particularly bullish has been displayed. In fact information available is very mixed, with regard to the distribution of 'Covid' concerns and cases around the Country; helped by optimism surrounding a number of promising drug and vaccine trials; though the slight relaxation is mostly 'hope-based'.

So sure, there is a bit of complacency as 'more cases' are reported given a rise in testing, along with more people presenting with symptoms. Pundits may speculate that the United States situation is trying to emulate Sweden; but it's not so impressive if you compare Stockholm 'morbidity & mortality', with that of New York City. So yes they have an educated compliant fairly healthier population to start with, and are tolerating things pretty well. But I would not take much solace from that with respect to rapid re-opening here as regards expectation to somehow avoid problems, other than seasonally better prospects 'if' rising temperatures help diminish spread (unproven).

Summary points this weekend (first directly about the markets):

- S&P remains extended; but weeks of range-bound trading allowed it to ease a previously overbought status; which combined with broadening of participation somewhat, allowed this higher level range to persist;

- It's hard to say this high-level stability is a plateau from which S&P can launch a further advance; but the advance fights ample skepticism and oddly enough that assists it holding together, for the moment;

- Much of this isn't just market-based, but relies on TINA (there is no real alternative), for now; and that's essentially what's-called a 'Fed Put';

- And while investors have trouble not expecting more pain; the prospect of getting through this while failing to provide an entry opportunity even remotely near the one associated with (what I call) 'The Inger Bottom' of March 22-23, probably contributes to an absorption (likely by funds);

- Some nibbling on minor dips and again helped by a spreading-out of prospects for more sectors; has definitely contribute to S&P stability;

- The pain-trade (as it's called) may be even-higher for the moment; as trader tendencies remain skewed to 'fighting the Fed' and the trend;

- We're not going to get to substantially higher level just due to low rates but at the moment the market is ignoring economic waves and thinking about economic stabilization and recovery (realistic or not);

- A real bullish alternative would be if there were a home-run therapeutic pill to take for Covid; then many other sectors would kick-in too);

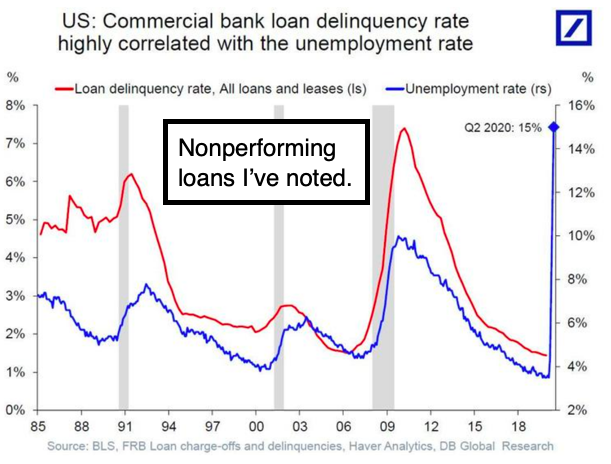

- If business doesn't improve, the layoffs will expand into managerial or white-collar levels, as have mostly been minimally impacted so far;

- One member quipped at my including a chart showing higher Savings Rates; yes he's right; that reflects not just business split in sectors, but social bifurcation we're dealing with now; those that can reduce debt;

- The idea is that 'average' citizens are said not to have any emergency money of significance (the $400 level is typically cited); while indeed a 13% savings rate for Americans who still have income; while reducing debt or credit card expenditures, is a sign of financial responsibility; at the same time that's not what our consumerist society counts on;

- So it will be interesting to see if a variation of 'Depression Mentality', which prevailed for years after the Great Depression in the 1930's, is going to somehow presage an era of fiscal responsibility by people if not Government(?); and we see 'spending patterns' drastically shift;

- As I hear of postponed 'trade shows', and Boat Shows in particular (I've had several boats in younger years so know they're unessential 'money pits'), ponder if recovery will feature more responsible spending, aside pivoting physical office presence to online working where feasible;

- However, let's reflect again on the 'Roaring 20's'; propriety or 'wisdom' prevail for awhile, and then gradually return to having fun; maybe for all the great events and memories, but also returns to building-up debt (it will be challenging as low interest rates make debt too easy);

- Corporate bond facilities effectively create a Floor under stocks; with debt sort of protected from liquidating; and that assurance has not cost taxpayers anything yet; but could leave the Fed as a bagholder (so it's in their interest to continue to be the wind behind the optimism);

- That's even as the idea of the Fed buying High-Yields (HYG, an ETF, already surged on ideas of the Fed entering this realm) is controversial; so actually this might compress, rather than increase, volatility;

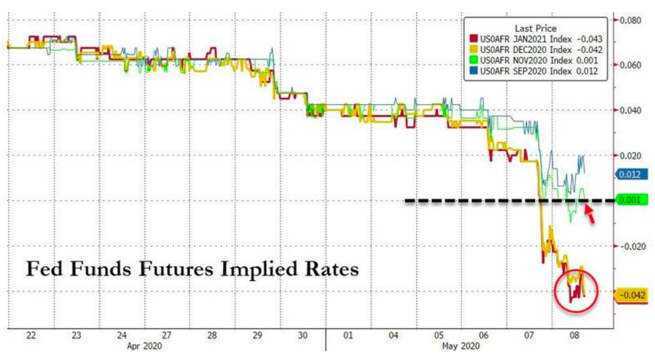

- NIRP (Negative Interest Rate policies) are not favored and won't be by our Fed (hence the Richmond Fed's warning about it this week);

- Nevertheless there is another wave of economic dislocations coming; and that may contribute to more pressure on the Fed to be supportive;

- There is no change in our view of 'some degree' of retrenching coming at any time; while we are not fading or shorting the market, recognizing the excessive negativity and frustration the Bears are experiencing;

- Sooner or later (probably this month) we'll get a bit of a decline; while it has been comforting to not only have called the low but avoided being too negative, beyond realizing that after a sizable move some backing and filling is perfectly sane; despite insane economic backdrops;

- This is not a normal time, and won't be; but the resilience of America to cope with it has been underestimated by many, while sectors (retail is the most glaring, as is travel and leisure) certainly are bifurcated; with a continued view of technology being strongest as the core of the rally.

Less-direct (not totally indirect) market, economic or virus factors:

- Worker safety is a continuing issue; and definitely remains a concern in the real world (more than stocks, but does impact individual firms, as may be impacted or even face litigation or protests) where 'commands' to re-open are irresponsible if disease, or facility infection, is evident;

- Wider reopening may backfire (or not); and the economy (and yes the market in this situation) is sensitive, starting now, to how this goes;

- This week's 'revelation' that 'Rona has visited The White House; first with the President's valet; and now with the Vice President's 'presser', is concerning, and reflects what happens with a cavalier non-masking approach, aside setting a poor example by those giving guidelines;

- Expansion of viral side-effects to children is terribly concerning; and for sure contributes to resisting sending kids to Summer camps or trips; as it also reminds us that ideas of 'zero' effects to young people has been discredited, but keeps getting promoted 'as if' they have no concerns if they're not coming near the 'elderly' or immunocompromised;

- In general there is awareness that recovery from Covid does not leave a lot of patients in normal health; with possible lingering or later effects; and that may contribute to greater reticence to engage socially, given more understanding that Covid may have mutated considerably;

- Shanghai Disney is going beyond test phases, to open more widely; with ticket demand high (sold-out at 30% occupancy); setting-the-bar for U.S. theme park re-openings, likely coming later this month;

- Shanghai has been one of the best-managed Chinese cities, in-terms of coping with coronavirus from the start (and the City that I'd first had personal information about, as I mentioned; both visitors to a seminar I gave in early February and before when a friend returning to the Bay Area from Shanghai in January alerted me, and I shared concerns);

- Theme Parks are over 40% of Disney total revenue; and were growing profit-centers; foreign parks are owned-in-partnership; while domestic parks are wholly-owned; Universal (Comcast) has yet to announce;

- Disney (along with AT&T, Netflix and others) have a common problem as relates to entertainment at all levels but animation; as Covid stymied forward film and television production for studios (streaming included); with significant concern being those reliant on revenues from 'sports';

- Any companies with direct ownership of sporting venues or teams are seriously concerned about seasonal and revenue aspects; although at this time it looks like most training schedules 'assume' an NFL season (of course revenue for media and teams heavily relies on broadcasting revenues, with how this evolves still in-flux; since team training is what they have to do whether the schedule is playable later or not);

- Notice sharp price declines in upscale New York City properties; this was projected for a year before 'Rona visited; and has accelerated;

- NY originally viewed as topping due to poor Canadian exchange rates, and many Middle Eastern, Latins, or wealthy Russians, who stopped seeking to buy units in the U.S.; (some Chinese did buy, but mostly focused on the West Coast or Vancouver and Toronto);

- Property concerns continue valid; we've commented about companies preferring not to expand or even locate in NYC; which combined with retail issues everywhere, leaves commercial property or nonperforming loans a continuing issue for a few sectors;

- On the residential side; while it's true there's a trend by many who have second homes or the ability to work remotely, to avoid the City, at least for the time-being; the residential markets outside impacted cities aren't particularly weak, or even firm in some small low-tax high-tech areas;

- Hard to say if this is a sustainable trend away from 'moving back' to city life that dominated millennial and even some empty-nester trends; but may tend so (as suburbanites revert to 'weekends in the City' for new shows and restaurants and so on, but otherwise reside elsewhere);

- Combine the unfavorable tax-situation and the trend continues; while at the same time there is a concern about advanced medical services for many conditions, once people move away from established metros;

- Energy (Oil) has been firming; suggesting a view of bridging-the-gap to better, if not normal, economic activity; and supports our preferred S&P idea of the market not revisiting the lows, at all, if things go fairly well;

- It is a tough call; but ultimately the better prospect looking-out a year; although there are plenty of bank-and-lender-related oil issues pending and possibly a merger or two among fairly large oil operators looming (a rumor swirls about OXY; because they are struggling so much; but we haven't delved into it, nor are we speculating in Airlines yet);

- A quest for 'normality' is the theme for now; with Apple Stores opening (just in six US states, for now); already open in China; the test market for this; so too Disney opening Disney Springs restaurants and shops (May 20); but not theme parks yet.

Bottom line: we've summed-up where things stand; holding together with a degree of confidence that may not be justified; but optimism is America's nature; and it's been ours since identifying the 'max-fear' panic low back in March. We continue to lean towards intervening corrections, but not lower lows; barring failure of things to somehow galvanize toward recovery.